- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Shareholders have faith in loss-making Penguin Solutions (NASDAQ:PENG) as stock climbs 7.3% in past week, taking five-year gain to 39%

It hasn't been the best quarter for Penguin Solutions, Inc. (NASDAQ:PENG) shareholders, since the share price has fallen 12% in that time. On the bright side the share price is up over the last half decade. However we are not very impressed because the share price is only up 39%, less than the market return of 105%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

We check all companies for important risks. See what we found for Penguin Solutions in our free report.There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Penguin Solutions has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So it might be better to look at other metrics to try to understand the share price.

We are not particularly impressed by the annual compound revenue growth of 1.2% over five years. So why is the share price up? It's not immediately obvious to us, but a closer look at the company's progress over time might yield answers.

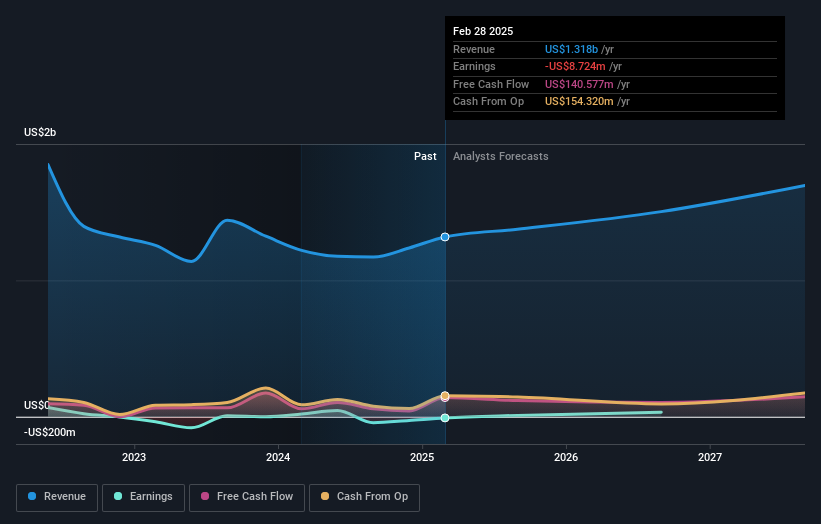

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Penguin Solutions' financial health with this free report on its balance sheet.

A Different Perspective

Investors in Penguin Solutions had a tough year, with a total loss of 7.3%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of Penguin Solutions' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Penguin Solutions may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PENG

Penguin Solutions

Engages in the designing and development of enterprise solutions worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives