- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Penguin Solutions (PENG): Assessing Valuation After Profit Turnaround and Strategic Shift Toward AI

Reviewed by Simply Wall St

Penguin Solutions (PENG) shares drew attention following the company's latest 10-K filing. The filing revealed a shift from net losses to net income and highlighted progress in operational efficiency and strategic business realignment.

See our latest analysis for Penguin Solutions.

As Penguin Solutions pivots toward AI and high-performance computing, investor optimism appears to be building. Strategic acquisitions, divestitures, and new AI offerings have coincided with a 15.9% year-to-date share price gain and an impressive 46.3% one-year total shareholder return. This signals renewed momentum for both the business and its stock.

If recent momentum has you thinking bigger, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

Yet with the recent rally and robust financial recovery, the question remains: is Penguin Solutions undervalued at current levels, or is all that future growth already priced in?

Most Popular Narrative: 20.7% Undervalued

With Penguin Solutions’ fair value calculated at $28.25 per share and a last close of $22.40, the prevailing narrative suggests there is meaningful upside left if the ambitious growth outlook is realized.

Ongoing digital transformation is expanding the addressable IT infrastructure market, with Penguin's expertise in large-scale, complex deployments and growing channel partnerships (including recent wins and new distribution agreements) positioning the company to capture additional market share and drive topline growth.

What hidden assumptions are fueling this rally call? The narrative is built on robust sales growth, margin expansion, and a future profit multiple that may surprise even optimistic tech investors. Uncover which bold projections underpin this fair value. These numbers could rewrite Penguin’s financial future.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing revenue unpredictability and margin risk from large project-based deals and tariff exposure could quickly undermine this upbeat outlook.

Find out about the key risks to this Penguin Solutions narrative.

Another View: Looking at Multiples

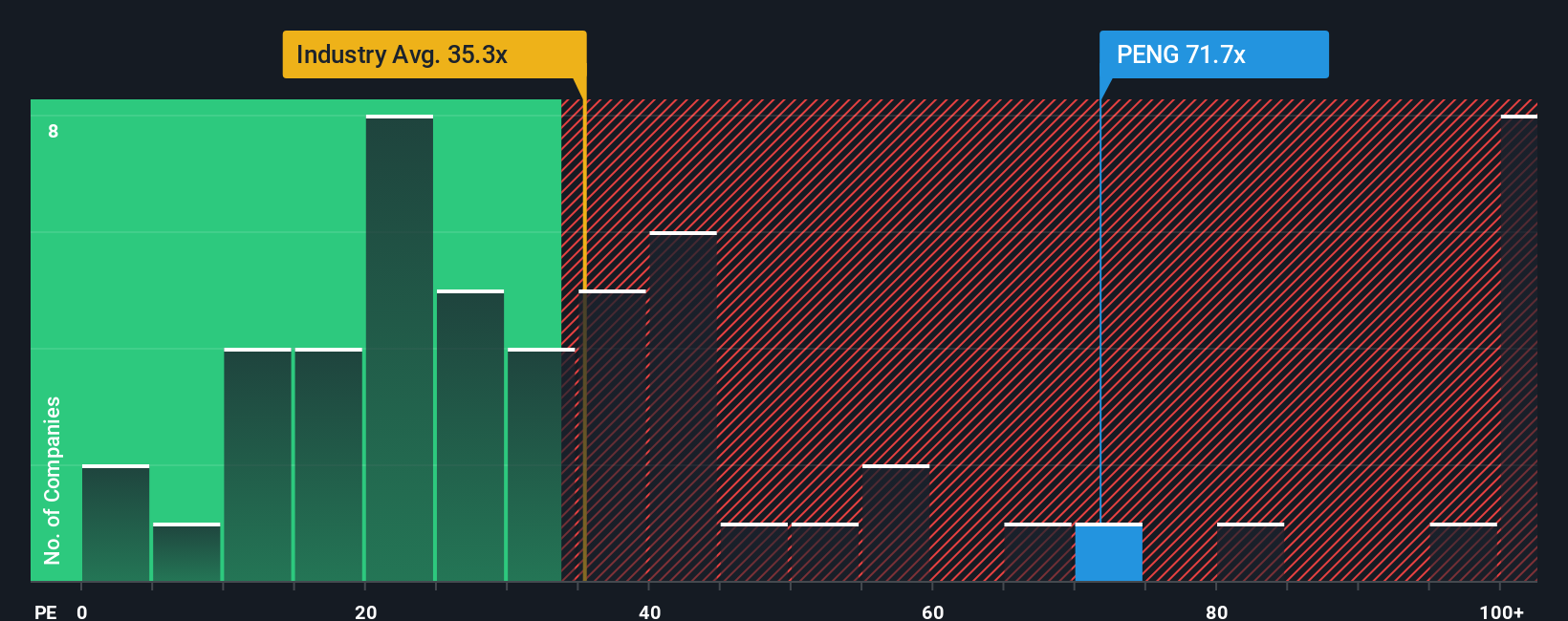

While one approach points to Penguin Solutions being undervalued, a quick look at its price-to-earnings measure tells a starkly different story. With a P/E ratio of 76.6x, which is almost double both its peer average (44.6x) and the US Semiconductor sector (39.5x), the shares look expensive by traditional standards. Does that mean optimism has run ahead of fundamentals, or could recent profit growth justify the premium? Investors must weigh which narrative seems more likely to play out.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penguin Solutions Narrative

If you think the story looks different for Penguin Solutions or want to draw your own conclusions from the data, it takes just a few minutes to put your own view together. Do it your way

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Ideas?

Don’t get left behind. Use the Simply Wall Street Screener to pinpoint other stocks with breakout potential and stay ahead of market trends.

- Capitalize on rapid technological change by targeting these 27 AI penny stocks that are fueling the future of automation, data science, and next-gen computing.

- Unlock powerful income streams with these 17 dividend stocks with yields > 3% featuring strong yields and consistent payouts, helping to elevate your portfolio’s cash flow.

- Catch high-upside opportunities before the crowd with these 876 undervalued stocks based on cash flows identified as trading below their real worth based on cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion