- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Penguin Solutions (PENG): Assessing Valuation After New High-Density DDR5 Module Launch

Reviewed by Simply Wall St

Penguin Solutions (PENG) just expanded its DDR5 lineup with new SMART 64GB DDR5 6400 ECC CSODIMM modules, targeting high performance computing, telecom, and industrial systems that need dense, reliable memory in tight spaces.

See our latest analysis for Penguin Solutions.

The new DDR5 launch comes after a choppy stretch for Penguin Solutions, with the share price at $19.67 and a recent 30 day share price return of almost 12 percent, but a much weaker 90 day share price return. The three year total shareholder return still points to solid long term momentum rather than a clear breakout story.

If this kind of infrastructure play interests you, it could be worth exploring other chip and hardware names using our screener for high growth tech and AI stocks.

Yet with revenue still growing, shares trading well below analyst targets, and only modest long term returns, investors now face a key question: is Penguin undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 30.4% Undervalued

With the narrative fair value sitting well above Penguin Solutions latest close, the story leans toward upside potential grounded in long range cash generation.

Expansion of recurring software and managed services (e.g., Penguin ICE ClusterWare and post-deployment operations) is raising earnings stability and aggregate profitability, as services revenue is recognized steadily over time and attached to each new customer win.

Want to see what powers that optimism? The narrative leans on rising margins, faster revenue compounding, and a future earnings multiple that might surprise you.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue lumpiness and tariff exposure, particularly in hardware and LEDs, could compress margins and derail the current undervaluation thesis.

Find out about the key risks to this Penguin Solutions narrative.

Another View: Rich on Earnings Multiples

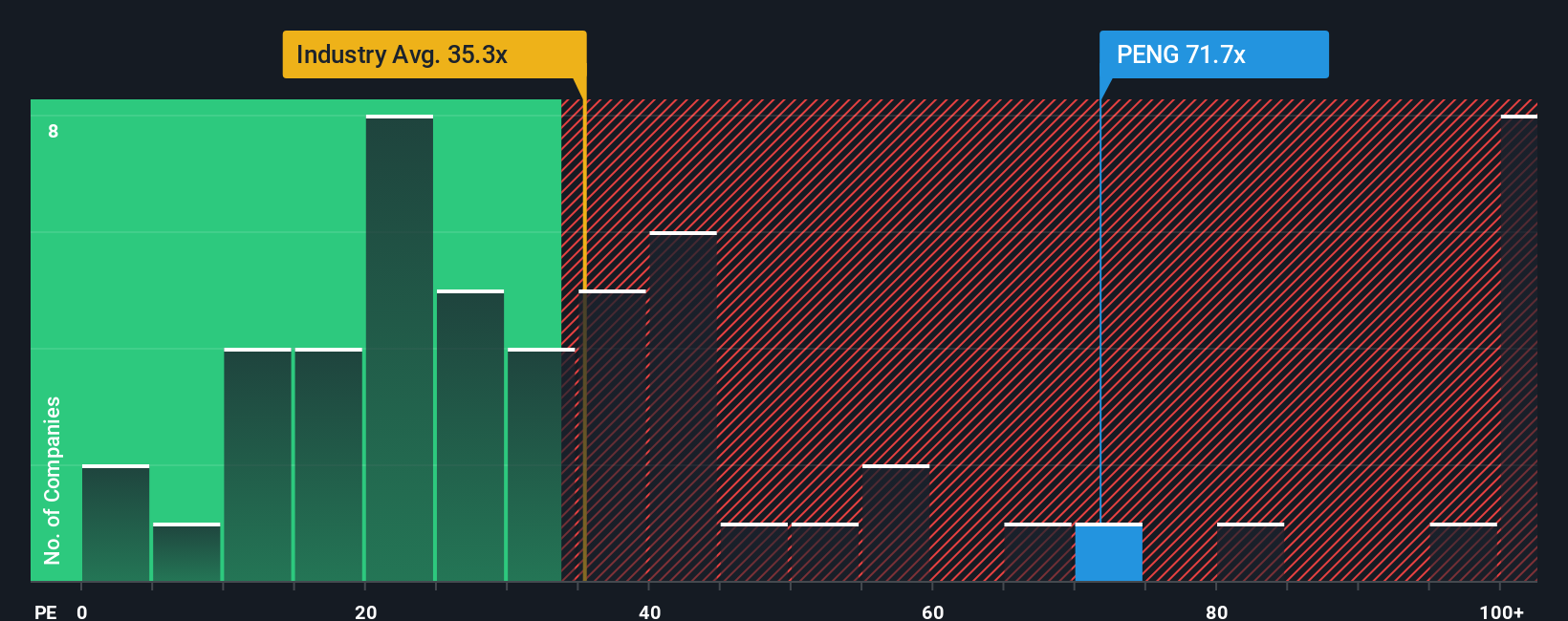

While our narrative points to 23.8 percent upside versus fair value, the earnings multiple tells a more demanding story. Penguin trades on a P/E of 67.2 times, above both peers at 60.9 times and the US Semiconductor average at 36.8 times. This leaves less room for disappointment if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penguin Solutions Narrative

If you would rather dig into the numbers yourself and reach your own conclusions, you can shape a complete Penguin story in minutes, Do it your way.

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put momentum on your side by using the Simply Wall Street Screener to uncover fresh opportunities before everyone else chases the same crowded trades.

- Tap into potential multi-baggers early by scanning these 3633 penny stocks with strong financials that already show solid financial underpinnings.

- Seek structural growth by targeting these 29 healthcare AI stocks that are transforming diagnostics, treatment, and hospital efficiency worldwide.

- Strengthen your income stream with these 12 dividend stocks with yields > 3% that combine attractive yields with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion