- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

A Look at PDF Solutions (PDFS) Valuation Following Exensio Studio AI Launch and Partnerships

Reviewed by Kshitija Bhandaru

PDF Solutions (PDFS) is making headlines after announcing the launch of its next-gen Exensio Studio AI platform, a move enabled by a technology partnership with Intel, as well as a collaboration with Lavorro Inc. focused on smarter, AI-driven fab operations.

See our latest analysis for PDF Solutions.

Investors are watching PDF Solutions closely following its AI platform launch and Intel partnership, especially after a dramatic 29.85% share price return over the past month. Despite this recent momentum, the one-year total shareholder return of -19.2% highlights the volatility that still surrounds the stock. New business wins and product rollouts continue to spotlight its long-term growth potential.

If you’re curious how other technology and AI-focused companies are performing in this fast-changing landscape, it’s worth checking out See the full list for free.

With shares rebounding sharply yet still down year-over-year, is PDF Solutions now trading below its true worth, or are investors already factoring in all the potential upside from its new AI initiatives?

Most Popular Narrative: 16% Undervalued

With PDF Solutions closing at $25.10 and the most-followed narrative putting fair value at $30.00, there is a significant gap that could catch investors’ attention. This set-up raises key questions about whether the market is fully appreciating the company’s earnings potential and sector trends.

Accelerated enterprise adoption of PDF's secure, cloud-based supply chain orchestration and analytics solutions, including secureWISE, Sapience Manufacturing Hub, and Exensio, positions the company to capitalize on the industry's growing need for integrated data traceability and resilient manufacturing networks. This supports robust recurring revenue growth and higher earnings stability.

Want to know which bold growth projections drive that fair value? This narrative is not only about tech buzzwords. It is built on assumptions of surging recurring revenues, bigger earnings, and expanding profit margins. Discover the impressive roadmap behind this valuation.

Result: Fair Value of $30.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued heavy R&D spending or any disruption in key customer relationships could quickly undermine PDF Solutions' ambitious growth outlook.

Find out about the key risks to this PDF Solutions narrative.

Another View: Are Multiples Telling the Whole Story?

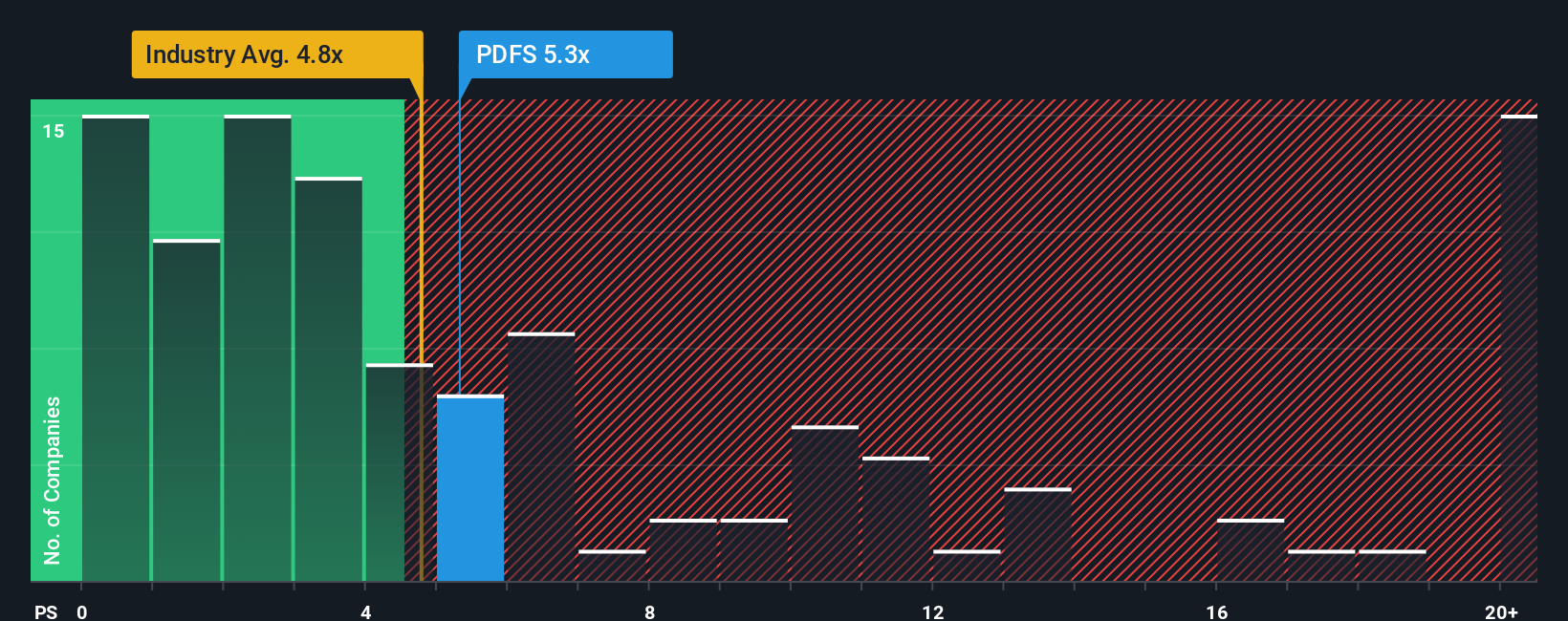

Looking at the company’s price-to-sales ratio, PDF Solutions trades at 5.1x, which is higher than both the semiconductor industry average of 4.8x and the peer average of 4.2x. Still, the fair ratio stands at 6x, indicating the market could re-rate the stock higher if growth continues. However, does paying up for growth offer the reward investors expect, or could it increase the risk if momentum cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PDF Solutions Narrative

If you have a different perspective or want to dive into the numbers yourself, you can shape your own story in just a few minutes with Do it your way.

A great starting point for your PDF Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep an edge by staying alert to new opportunities. Don’t let today’s trends pass you by. It’s time to uncover what’s next in the market.

- Spot rising potential with these 3582 penny stocks with strong financials, featuring robust financials and early growth momentum before they make headlines.

- Unlock future game-changers by checking out these 26 quantum computing stocks, where innovative companies are setting new standards in quantum technology.

- Boost your passive income strategy by searching through these 19 dividend stocks with yields > 3%, offering reliable yields above 3% for stable, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion