- United States

- /

- Semiconductors

- /

- NasdaqGS:OLED

Universal Display (OLED): Exploring Whether Recent Momentum Shifts Signal an Undervalued Opportunity

Reviewed by Simply Wall St

See our latest analysis for Universal Display.

Universal Display’s shares have drifted lower recently, with a 4.2% slide over the past week and a 1-year total shareholder return of negative 20.5%. However, the three-year total return still stands at a robust 42%, showing that long-term momentum, while recently faded, has not fully disappeared.

If Universal Display’s shifting momentum has you rethinking your own watchlist, now is a good time to expand your view and discover fast growing stocks with high insider ownership

With shares lingering well below analyst price targets despite ongoing double-digit growth, investors are left to wonder whether Universal Display’s current slump reveals a genuine buying opportunity or if the market has already priced in all future gains.

Most Popular Narrative: 21.9% Undervalued

Universal Display’s most widely followed narrative points to a fair value significantly above the last close, amplifying debate about whether the market is missing something big. Today’s share price paints a discount story, but the narrative hinges on upcoming catalysts in OLED adoption and technology.

The rapid proliferation of connected, intelligent consumer devices (AI, 5G, always-on connectivity) is fueling global demand for high-efficiency, premium displays. This directly benefits Universal Display's energy-saving OLED materials portfolio, which is expected to underpin further licensing and material sales growth. Universal Display's successful commercialization of phosphorescent blue OLED technology, verified at mass production scale, is poised to unlock a major leap in display energy efficiency. This could increase OLED adoption in mobile and IT segments and expand both revenue and high-margin royalty streams.

Want to know what bold projections justify this price outlook? Behind the scenes: aggressive sales growth, margin resilience, and a future profit multiple that splits from typical sector norms. Click in to uncover the surprising numbers and narrative tensions driving Universal Display’s current valuation debate.

Result: Fair Value of $181.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and erratic customer ordering patterns could disrupt Universal Display’s expected growth if demand volatility continues.

Find out about the key risks to this Universal Display narrative.

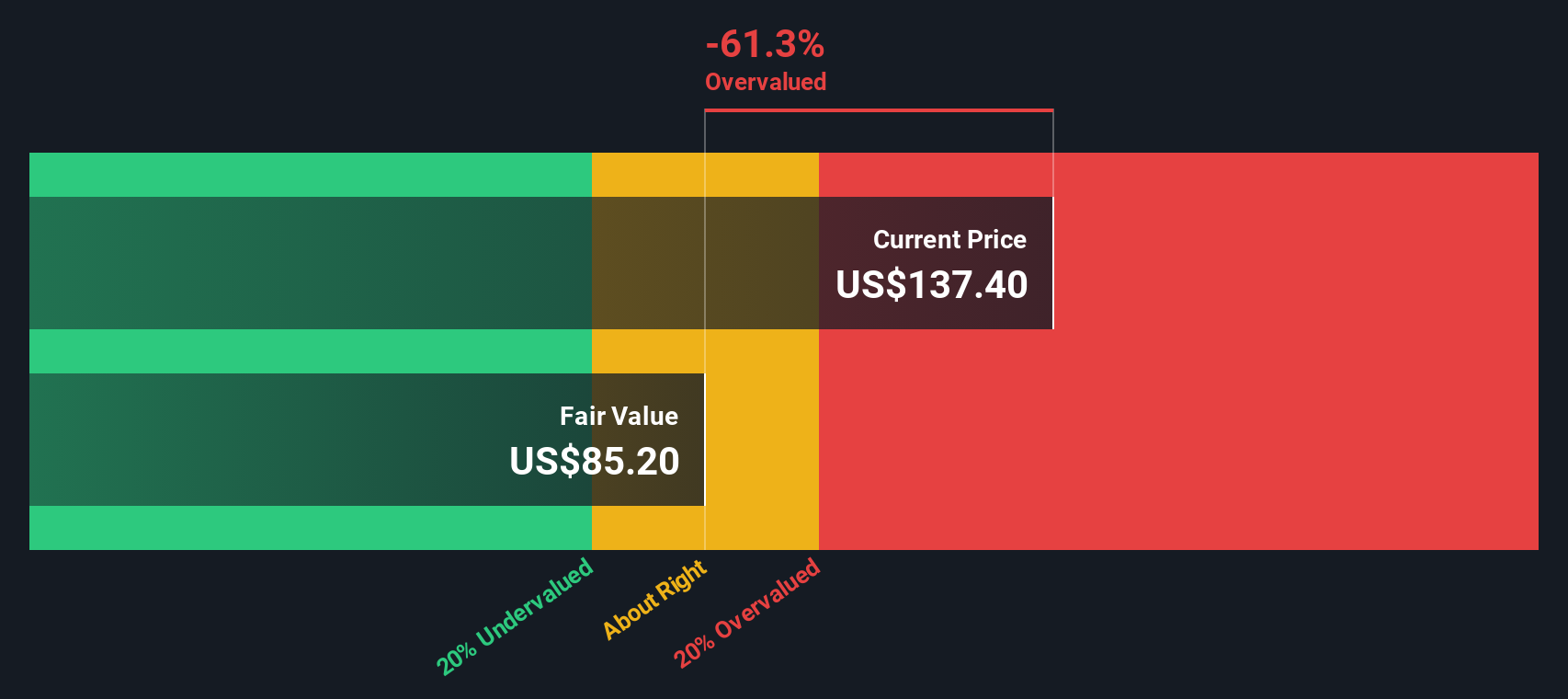

Another View: SWS DCF Model Challenges the Undervaluation Story

While analysts see Universal Display as markedly undervalued on future earnings potential, our SWS DCF model presents a far more cautious outlook. According to the DCF, the stock is actually trading above its calculated fair value, which suggests possible overvaluation if long-term cash flows fall short of projections. Which method will prove more accurate as new data emerges?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Universal Display Narrative

If you think there’s more to the story or want to take a hands-on approach, you can create your own Universal Display narrative in under three minutes, your way Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Universal Display.

Looking for More Compelling Investment Ideas?

Expand your opportunities by checking out some of the most exciting and high-potential stocks you might be missing on Simply Wall Street right now.

- Grow your income with these 20 dividend stocks with yields > 3%, which offers attractive yields above 3% and a track record of rewarding shareholders.

- Discover breakthroughs in digital assets and follow market leaders among these 82 cryptocurrency and blockchain stocks focused on blockchain and cryptocurrency innovation.

- Explore undervalued opportunities before the crowd by browsing these 840 undervalued stocks based on cash flows, identified based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OLED

Universal Display

Engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives