- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

Navitas Semiconductor (NasdaqGM:NVTS) Collaborates With NVIDIA For Efficient 800 V HVDC Architecture

Reviewed by Simply Wall St

In May 2025, Navitas Semiconductor (NasdaqGM:NVTS) experienced a remarkable price surge of 149%, likely buoyed by several significant developments. The company announced a collaboration with NVIDIA to innovate an efficient 800 V HVDC architecture, aligning with growing trends in AI applications and power efficiency. This partnership potentially contributed to heightened market interest amidst positive broader stock market conditions. Additionally, the launch of advanced power solutions, including the 12 kW Power Supply Unit for AI data centers, may have bolstered investor confidence. Meanwhile, overall market trends remained favorable, and despite Navitas's recent earnings challenges, its strategic moves in high-demand sectors likely enhanced investor optimism.

You should learn about the 3 weaknesses we've spotted with Navitas Semiconductor.

The collaboration between Navitas Semiconductor and NVIDIA to develop efficient power solutions presents a potentially transformative impact on the company’s revenue narrative. With the emphasis on AI applications and power efficiency, this partnership aligns with the rising demand for advanced technology solutions. The introduction of the 12 kW Power Supply Unit for AI data centers could further boost the company's outlook, enhancing its position in high-demand sectors. Looking at the long-term performance, Navitas Semiconductor's shares have seen a 24.09% return over the past year, reflecting investor optimism despite the company's current profitability challenges.

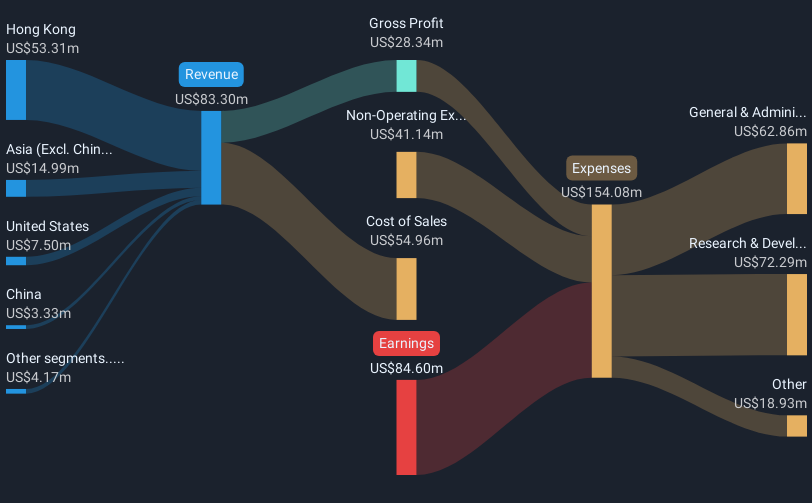

Over the last year, Navitas outperformed both the US semiconductor industry and the broader market, which returned 9.8% and 11.5%, respectively. This strong performance could be partly attributed to the company's $450 million backlog of design wins, which signifies substantial future revenue potential. Additionally, despite a share price currently trading at a discount to the analyst consensus price target of US$3.41, the recent surge in May suggests an optimistic market sentiment. Nevertheless, given the forecasted challenges in achieving profitability within the next few years, the company's earnings and revenue growth remains a critical area of focus. Investors will need to closely monitor whether the anticipated improvements in net margins and cost-reduction initiatives materialize, which could either validate or challenge the existing price targets and growth assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)