- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Should NVIDIA’s (NVDA) Record Q3 Earnings and New AI Partnerships Reshape Investor Expectations?

Reviewed by Sasha Jovanovic

- NVIDIA reported third quarter earnings for the period ended October 26, 2025, with revenue rising to US$57.01 billion and net income increasing to US$31.91 billion, while also issuing strong fourth-quarter revenue guidance and revealing a wave of new AI infrastructure partnerships including collaborations with HUMAIN, Microsoft, Anthropic, and Brookfield Asset Management.

- These announcements highlight a period of accelerated investment and adoption of NVIDIA’s AI platforms across cloud, sovereign, municipal, and industrial sectors, underscoring how NVIDIA’s hardware and software ecosystems are becoming central to next-generation computing infrastructure worldwide.

- We'll assess how this combination of robust financial results and expanding AI partnerships strengthens NVIDIA's investment narrative, particularly as global AI infrastructure builds intensify.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

NVIDIA Investment Narrative Recap

To own NVIDIA stock, you need to believe in the company’s ability to maintain leadership in advanced AI infrastructure amid surging global demand and rapid innovation cycles. The latest results, highlighting soaring Q3 revenues, record net income, and another quarter of strong guidance, reinforce AI infrastructure as NVIDIA’s main short-term catalyst. However, these developments do not materially offset the persistent risk posed by US-China regulatory uncertainty, which threatens a significant portion of NVIDIA’s addressable market.

Among several new deals, the expanded partnership with HUMAIN stands out: plans to deploy up to 600,000 advanced NVIDIA AI platforms over three years aim to meet ballooning global demand for sovereign, secure AI infrastructure. Anchored by large-scale data centers in both Saudi Arabia and the US, and coupled with next-gen platform rollouts, such efforts directly support NVIDIA’s growth narrative while highlighting the scale, and supply chain pressures, of the ongoing global AI buildout.

Yet, in contrast, investors should be aware that decisions on US export controls and licensing for NVIDIA’s latest AI chips in China could suddenly reshape revenue expectations for...

Read the full narrative on NVIDIA (it's free!)

NVIDIA's outlook anticipates $337.2 billion in revenue and $187.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 26.8% and an increase in earnings of $101.3 billion from the current $86.6 billion.

Uncover how NVIDIA's forecasts yield a $232.79 fair value, a 25% upside to its current price.

Exploring Other Perspectives

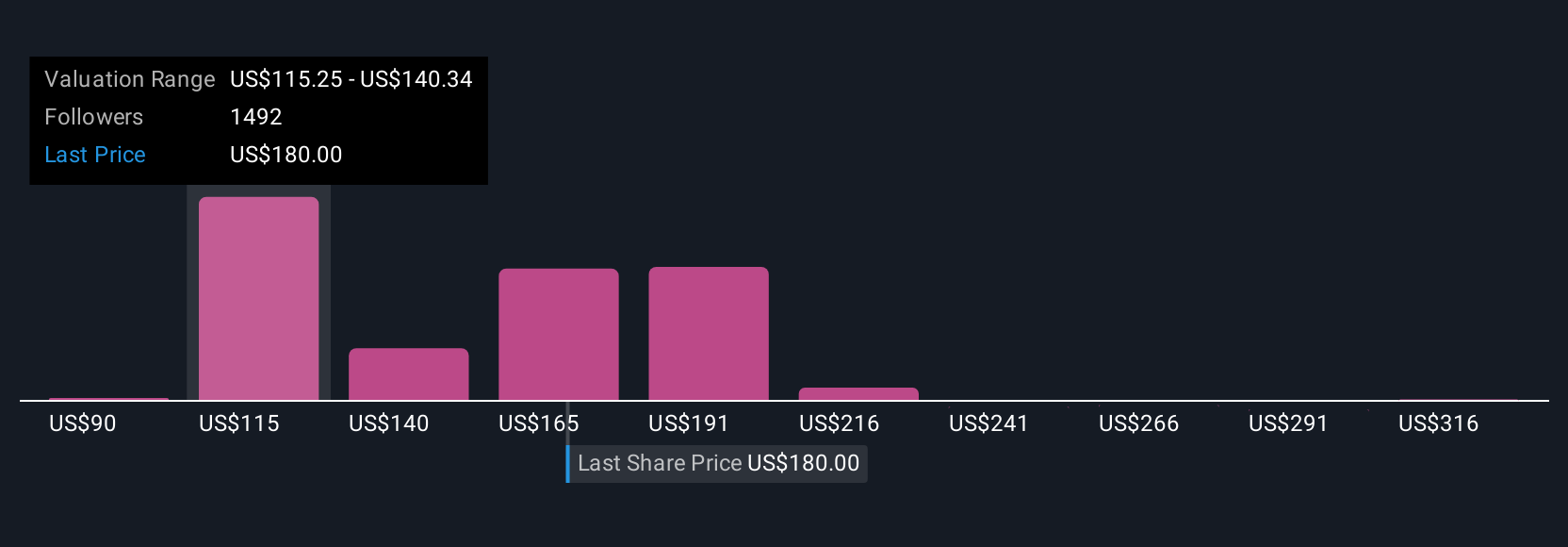

Across 425 estimates from the Simply Wall St Community, fair values for NVIDIA range from US$90.15 to US$341.12 per share. While many expect AI-driven expansion to support earnings and revenue growth, unresolved China export risks remain a key factor for future performance.

Explore 425 other fair value estimates on NVIDIA - why the stock might be worth less than half the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives