- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA): Is the Current Valuation Justified After Strong Shareholder Returns?

Reviewed by Simply Wall St

Nvidia (NVDA) shares have grabbed attention following their recent performance in the stock market, as the company continues its momentum in AI and semiconductor innovation. Investors are closely watching how Nvidia's positioning influences its valuation and outlook.

See our latest analysis for NVIDIA.

Momentum is clearly building for Nvidia, with the stock’s share price up 49.6% year-to-date and a massive three-year total shareholder return of over 1,300%. This sustained performance reflects both excitement around AI-driven growth and strong investor confidence in Nvidia’s long-term prospects.

If you're interested in seeing what other innovators are making waves in tech and AI right now, check out the opportunities in our handpicked list in the following resource: See the full list for free.

With such remarkable gains fueling investor enthusiasm, the key question becomes whether Nvidia's current stock price accurately reflects its true potential, or if there is still a window for buyers before markets fully price in future growth.

Most Popular Narrative: 12% Undervalued

According to restinglion, the most widely cited narrative pegs Nvidia’s fair value above its last close, suggesting the stock isn’t fully priced for future dominance. This narrative anchors its appraisal in Nvidia’s strategic grip on the AI chip and software markets, hinting that recent momentum might only be the beginning.

Most stockholders don't understand how NVIDIA makes its money: not only is NVIDIA an AI chip company, NVIDIA sells their top tier software with their hardware called CUDA. CUDA is the software all companies are turning to due to its advanced integration with AI and its end-to-end software stack. This software is sold on a subscription basis, generating high earnings even after the sale of their chips. Thus, NVIDIA has positioned themselves in a way to dominate the future of AI, and with their high earnings, they will be able to continue to invest a high amount of their funds into innovation to maintain their lead over the global AI market.

Curious what bold assumptions push Nvidia’s fair value higher? One key projection in the narrative is a rate of growth that rivals the company’s most explosive years. But which financial forecast tips the balance? Find out what makes the story impossible to ignore. There is a financial lever at play that could change how investors see Nvidia’s future.

Result: Fair Value of $235 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower growth or intensifying competition from rivals in AI chips could quickly challenge even the most optimistic outlook for Nvidia’s continued dominance.

Find out about the key risks to this NVIDIA narrative.

Another View: DCF Valuation Raises Caution

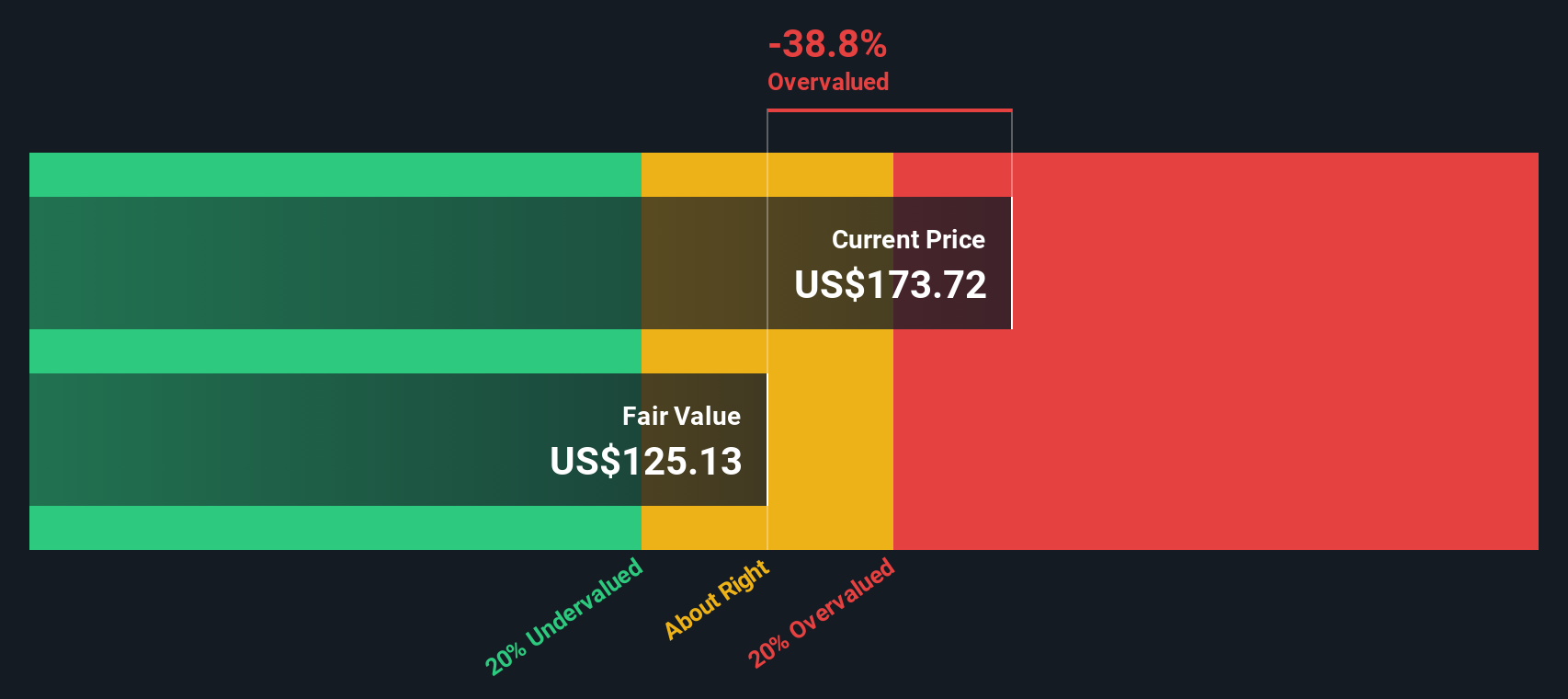

While narrative-driven and peer-based valuations see Nvidia as undervalued, the SWS DCF model takes a more conservative approach. According to its cash flow assumptions, Nvidia’s fair value is estimated at $141.12, which is noticeably below the current share price. This framework suggests the market may already reflect a significant amount of anticipated future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVIDIA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVIDIA Narrative

If you’d rather make your own call or want to run the numbers your way, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit yourself to just one opportunity. Many investors are already acting on fresh trends and new market movers with the Simply Wall Street Screener. You could be missing out on strong growth or reliable returns by sticking to the usual picks. See what else is moving right now.

- Capitalize on tech disruption and stay ahead of the curve by tapping into these 26 AI penny stocks pushing boundaries in artificial intelligence.

- Amplify your passive income plan by targeting these 18 dividend stocks with yields > 3% delivering yields above 3%, built for investors who value steady cash flows.

- Get in early on trending companies shaking up finance with these 82 cryptocurrency and blockchain stocks incorporating blockchain innovation into real-world use cases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives