- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA): Exploring Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Nvidia (NVDA) shares have delivered solid growth over the past month, up 8%. Investors might be curious about what is driving this momentum and whether it signals more strength ahead for the chipmaker.

See our latest analysis for NVIDIA.

Looking beyond the past month, Nvidia's share price momentum is part of a much bigger story. The stock has surged over 32% year-to-date, with a remarkable three-year total shareholder return topping 1,370%. This combination of recent acceleration and long-term outperformance has investors watching for what is next, as excitement around AI and Nvidia’s new product launches continue to drive sentiment.

If you’re interested in what else is fueling tech sector gains lately, now is an ideal moment to check out the full list of cutting-edge opportunities with See the full list for free.

But with shares near all-time highs, the key question is whether Nvidia’s current valuation still offers room for upside, or if the market is already accounting for all its projected growth. Could there still be a buying opportunity here?

Most Popular Narrative: 20% Overvalued

Nvidia’s share price of $183.22 stands well above the narrative’s fair value estimate of $152.63. This gap creates a tension between high market optimism and what is justified by projected fundamentals according to Investingwilly’s perspective.

Despite Nvidia's outstanding performance, its valuation has understandably increased, reflecting investor optimism about its future. The company’s leadership in AI and high-performance computing markets has driven its stock to new heights, and many analysts continue to view Nvidia as a strong long-term growth opportunity.

What is really driving this price premium? The narrative here is built on expected innovation in AI, an enviable market leadership position, and confident growth assumptions for both profits and revenue. Ready to find out which financial levers such as growth rates, margins, and big technology bets are behind this ambitious valuation? The answers will surprise you.

Result: Fair Value of $152.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain constraints or trade tensions could trigger shifts in Nvidia’s valuation narrative if they intensify or persist unexpectedly.

Find out about the key risks to this NVIDIA narrative.

Another View: What Do Earnings Multiples Say?

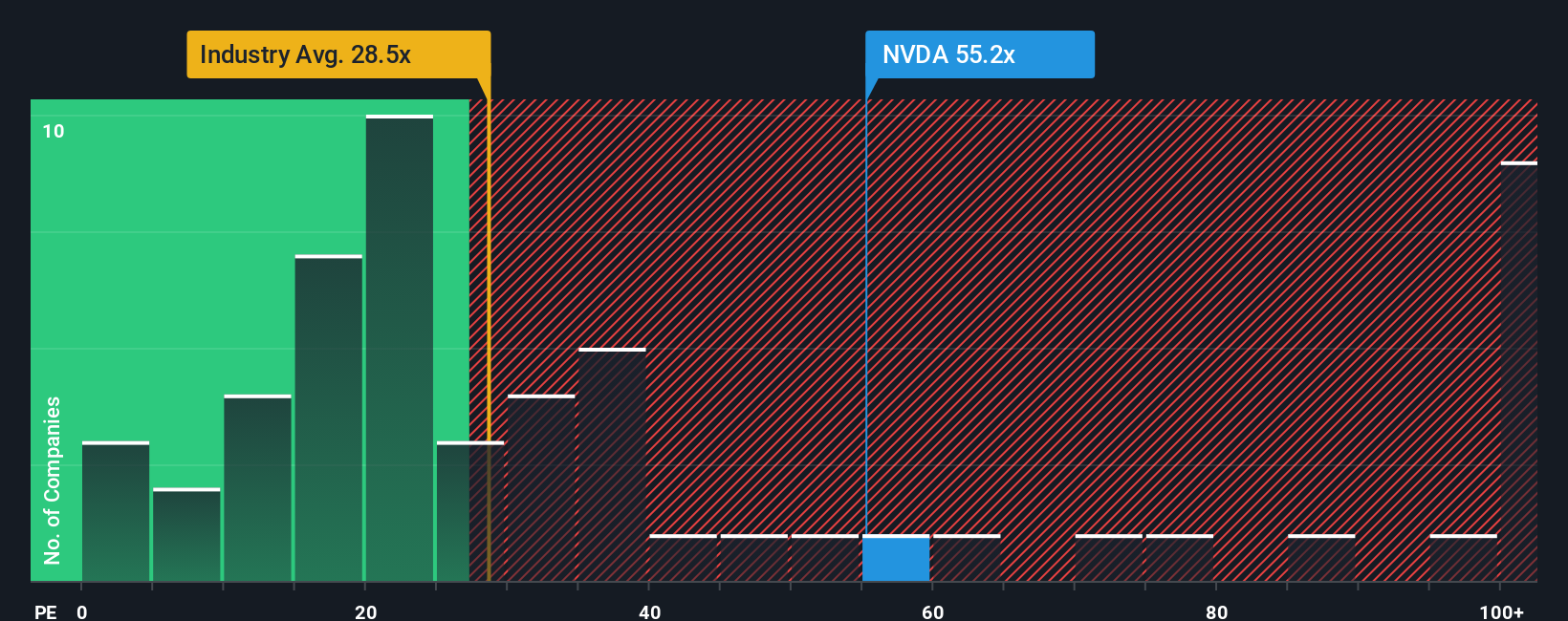

Switching gears to a different lens, Nvidia's price-to-earnings ratio stands at 51.4 times, noticeably higher than the U.S. semiconductor industry average of 35.9 times and its peers’ 67 times. While above the sector, it is below peers and the market’s fair ratio of 58 times, highlighting both a valuation risk and a potential window if the market’s optimism endures. Could patience pay off, or does the premium signal caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NVIDIA Narrative

If you want to dig into the numbers yourself or would rather shape your perspective firsthand, you can chart your own take in minutes with Do it your way

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now is the perfect moment to energize your investment strategy by examining opportunities beyond Nvidia. The best investors always keep their options open and seize what's next.

- Tap into tomorrow’s mega-trends by scanning these 24 AI penny stocks, which are harnessing artificial intelligence to drive real growth in a fast-changing market.

- Lock in potential for reliable income and capital appreciation by searching for these 18 dividend stocks with yields > 3% with attractive yields above 3% and resilient fundamentals.

- Step ahead of the market by reviewing these 79 cryptocurrency and blockchain stocks, leading in blockchain innovation and digital payment solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives