- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (MU): Revisiting Valuation as AI Data Center Demand Drives Strong Growth and Upgrades

Reviewed by Simply Wall St

Micron Technology (MU) recently ramped up momentum in the AI data center space by unveiling its advanced 192GB SOCAMM2 memory module. The company’s strong fiscal 2025 results and tight DRAM supply are fueling expectations for continued expansion.

See our latest analysis for Micron Technology.

Micron’s year has been anything but typical, with recent product launches and board changes punctuating a run of outsized gains. The 1-month share price return stands at 19.1%, and the total shareholder return for the past year has soared to nearly 121%. The rapid climb in Micron's stock reflects surging optimism about AI memory demand; yet with the share price now at $223.77 and market momentum running hot, investors should keep in mind that such explosive growth often invites short-term volatility.

If AI memory demand has you curious about tech’s next wave, now’s a great time to explore the possibilities in our See the full list for free..

With so much momentum behind Micron, investors are left wondering if the stock is still undervalued or if recent gains have already priced in all future growth. Could there still be a real buying opportunity here?

Most Popular Narrative: 9.7% Overvalued

According to BlackGoat, the prevailing narrative sets Micron’s fair value at $200 per share, noticeably beneath the current market close of $223.77. This spotlight reveals excitement around AI-fueled memory demand, but the numbers point to a valuation surge that runs ahead of the narrative’s long-term thesis.

The AI Supercycle is the most powerful catalyst. The demand for next-generation HBM is unprecedented. Micron has successfully passed NVIDIA's quality verification for its HBM3E products and has become a key supplier for the next-generation "Blackwell" AI accelerator. The company is now shipping high-volume HBM to four major customers across both GPU and ASIC platforms. With its entire 2025 production capacity already sold out, analysts project the HBM market will grow from roughly $30 billion in 2025 to a staggering $100 billion by 2030, representing a massive runway for growth.

Want to know what financial drivers support this ambitious view? The full narrative lays out core assumptions about Micron’s trajectory, profit margins, and how changing sector dynamics could reshape future earnings. Dive in to unpack the bold projections backing BlackGoat’s call.

Result: Fair Value of $200 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that fierce competition and potential geopolitical headwinds could quickly challenge Micron’s current growth thesis and valuation.

Find out about the key risks to this Micron Technology narrative.

Another View: Looking Through the Lens of Market Multiples

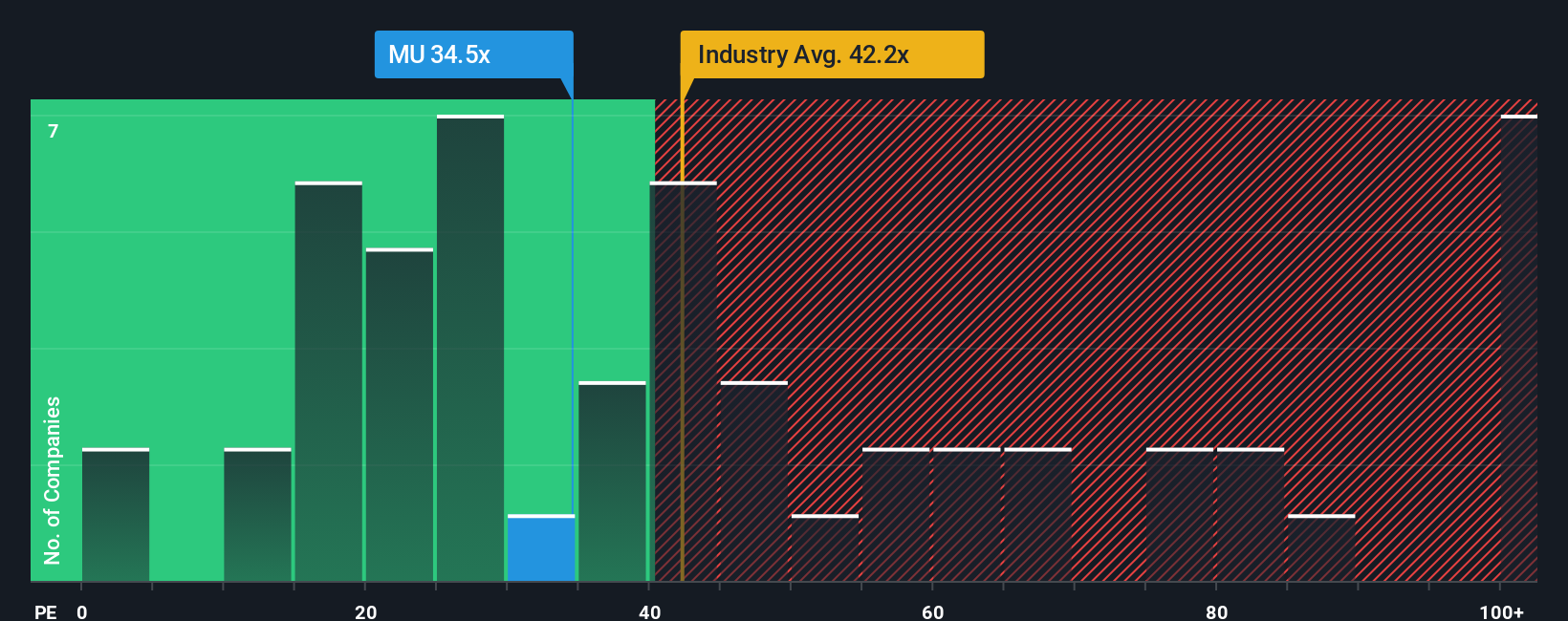

There’s more to the story when you compare Micron’s valuation to other semiconductor companies. With a price-to-earnings ratio of 29.4x, Micron trades at a much lower level than the industry average of 36.1x and peer group average of 64.3x. The fair ratio, calculated at 42.4x, suggests the market could eventually lift Micron closer to this level. Does this relative value open the door for further upside, or does it highlight risks if growth slows unexpectedly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Micron Technology Narrative

If these perspectives do not align with your own, or you value building your own investment case from the data, it takes just a few minutes to create your own narrative: Do it your way.

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not limit your investing journey to just one stock surge. Make your next move by tapping into new sectors and trends getting attention right now.

- Target higher yields by checking out these 20 dividend stocks with yields > 3% with reliable payouts above 3% to strengthen your portfolio’s income potential.

- Go after tomorrow’s tech leaders by starting your search with these 27 AI penny stocks, featuring standout AI companies shaping the intelligent future.

- Position yourself for growth with these 845 undervalued stocks based on cash flows to spot stocks that could be trading below their real worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives