- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (MRVL): Evaluating Valuation as Analyst Views Diverge Ahead of Earnings and Data Center Growth Focus

Reviewed by Simply Wall St

Marvell Technology (MRVL) is getting extra attention from investors after JPMorgan reiterated its Buy rating, while Barclays issued a downgrade. Both actions come just ahead of the company’s next earnings report and have sparked debate about its data center strategy and growth potential.

See our latest analysis for Marvell Technology.

Marvell’s share price has swung sharply this year. After jumping 14.2% over the past 90 days, the stock is still down 28.4% year-to-date, with a 1-year total shareholder return of -9.2%. Recent dips likely reflect shifting sentiment on its AI prospects and market share ambitions. However, the company’s long-term track record remains impressive, with total shareholder returns of 88% over three years and 86% over five.

If you’re watching how leadership in AI and data center chips is shaking up the semiconductor space, this could be a good time to discover See the full list for free.

With shares still off their highs, a mixed analyst outlook, and fresh earnings on the horizon, the real question is whether Marvell is undervalued at current levels or if the market has already considered future growth potential.

Most Popular Narrative: 9.7% Undervalued

With a fair value set at $90.07, the narrative suggests Marvell shares have a meaningful gap to close from the latest $81.32 close. The narrative brings together bullish and bearish forces, but leans toward a more optimistic outcome for valuation if company execution stays on track.

Marvell's significant growth in custom data center silicon and interconnect (AI/Cloud) design wins highlights growing industry demand as AI, cloud computing, and data proliferation accelerate, supporting future revenue expansion and sustained top-line growth.

Curious about what’s fueling this target? The narrative relies on aggressive revenue growth and a margin turnaround rarely seen in this sector. One bold financial leap stands out as the backbone of the fair value math. Think you know what it is? Don’t miss out on the rest of the story inside the narrative.

Result: Fair Value of $90.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in data center orders or unexpected supply chain challenges could quickly reshape Marvell's outlook and put its current growth story at risk.

Find out about the key risks to this Marvell Technology narrative.

Another View: Multiples Signal a Different Story

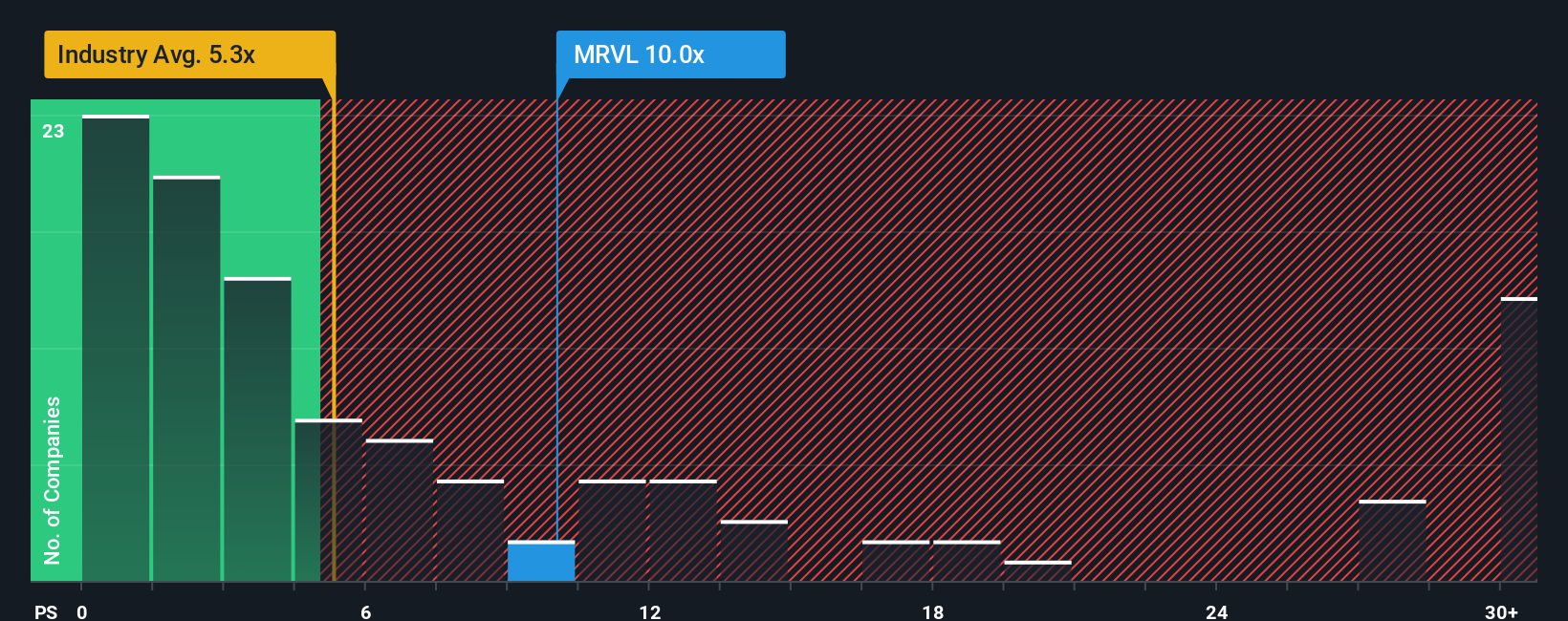

While narrative-driven fair value points to upside, Marvell’s current valuation tells a more cautious tale. The stock trades at 9.7x sales, which is over double the US semiconductor industry average of 4.2x and remains well below peer averages of 16x. Still, the fair ratio sits even higher at 11.3x, which challenges the idea of real undervaluation. Could the premium be justified, or does it signal more risk than reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marvell Technology Narrative

Feel like the numbers might tell a different story, or want to dig into Marvell's fundamentals on your own terms? You can quickly build your own view of the company in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Marvell Technology.

Looking for more investment ideas?

Don’t sit on the sidelines while smarter investors spot emerging opportunities and sharpen their portfolios. Uncover fresh ways to grow your wealth starting today.

- Unlock income potential and boost your portfolio with steady-yielding opportunities by checking out these 15 dividend stocks with yields > 3%, offering reliable returns above 3%.

- Get ahead of the curve and power your strategy with these 27 AI penny stocks, pushing the boundaries of artificial intelligence innovation.

- Spot value before the crowd by screening for these 896 undervalued stocks based on cash flows, which are flying under Wall Street’s radar but showing promising fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives