- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Does Amazon's Trainium2 Surge Redefine the AI Opportunity for Marvell Technology (MRVL)?

Reviewed by Sasha Jovanovic

- Amazon recently announced strong demand for its Trainium processors, manufactured by Marvell Technology, highlighting Trainium2's rapid adoption and escalating its status into a multibillion-dollar business.

- This surge in demand underscores Marvell's expanding role in the AI infrastructure market, fueled by partnerships with leading industry players and increased cloud capital spending.

- We'll explore how the growing demand for Marvell's AI-focused chips, highlighted by Amazon's announcement, could influence the company's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Marvell Technology Investment Narrative Recap

To be a Marvell shareholder today means believing in the company's ability to maintain and grow its data center market share, particularly as demand for AI-focused chips accelerates. Amazon's recent announcement of robust Trainium2 adoption is a clear positive for Marvell's short-term growth catalyst in AI infrastructure, but it also heightens the company's exposure to volatile cloud orders, a key risk that remains front and center.

Of Marvell's recent announcements, the launch of new 800G and 1.6T active copper cable linear equalizers stands out, aligning directly with the surging demand for AI data center interconnects spurred by hyperscaler investments. As cloud operators ramp AI infrastructure spending, this product expansion may help reinforce Marvell's competitive position for data center wins.

However, even as AI-driven demand grows, investors should be aware that a sudden reduction in hyperscale cloud spending could threaten...

Read the full narrative on Marvell Technology (it's free!)

Marvell Technology's narrative projects $12.1 billion revenue and $2.9 billion earnings by 2028. This requires 18.7% yearly revenue growth and an earnings increase of about $3 billion from current earnings of -$103.4 million.

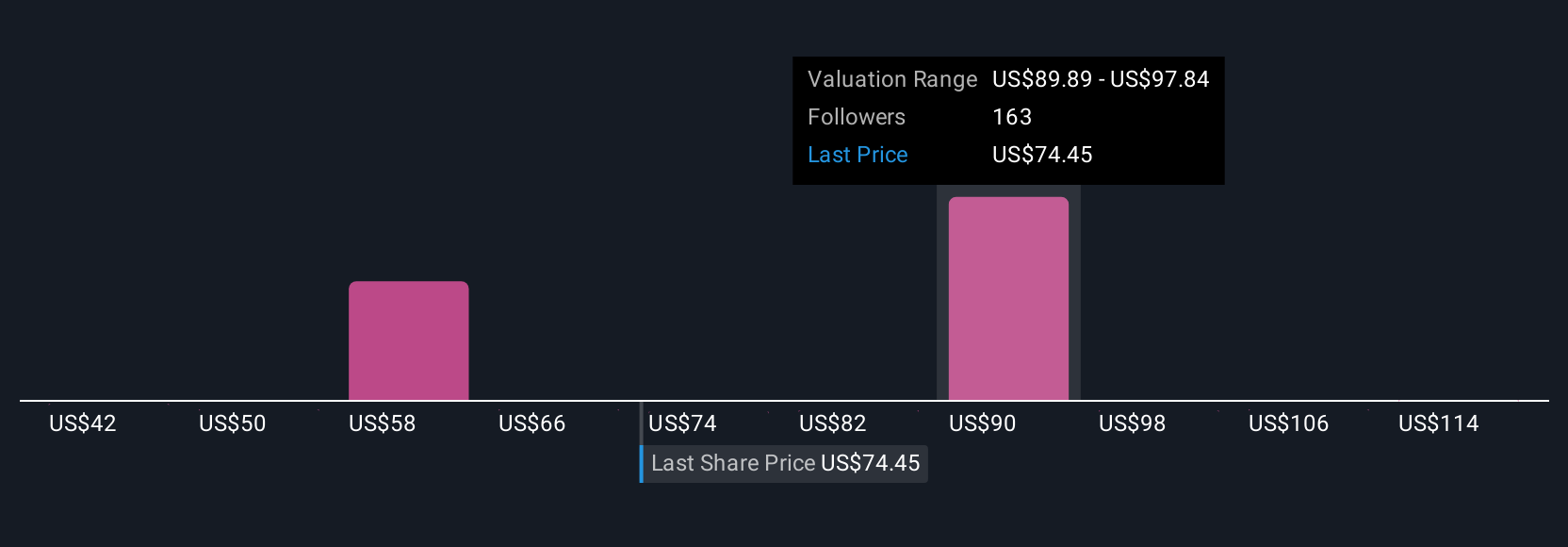

Uncover how Marvell Technology's forecasts yield a $90.07 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 24 fair value estimates for Marvell, spanning from US$48.74 to US$112.78 per share. While AI infrastructure demand is a current catalyst, differences in outlooks highlight how future data center market shifts could shape Marvell's performance; explore the full range of perspectives to inform your own view.

Explore 24 other fair value estimates on Marvell Technology - why the stock might be worth 46% less than the current price!

Build Your Own Marvell Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marvell Technology research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marvell Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marvell Technology's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives