- China

- /

- Electronic Equipment and Components

- /

- SZSE:002475

3 Stocks That Might Be Trading Up To 27.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets react positively to the Federal Reserve's announcement of potential interest rate cuts, investors are seeing major indices like the Dow Jones Industrial Average and S&P 500 Index nearing record highs. Amidst this optimistic climate, identifying undervalued stocks becomes crucial for maximizing potential returns. A good stock in the current market conditions is one that trades below its intrinsic value, offering a margin of safety and room for growth as broader economic sentiments improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥38.86 | CN¥77.63 | 49.9% |

| Nilörngruppen (OM:NIL B) | SEK68.00 | SEK135.98 | 50% |

| Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957) | CN¥42.05 | CN¥83.93 | 49.9% |

| Lindab International (OM:LIAB) | SEK262.00 | SEK523.56 | 50% |

| EnomotoLtd (TSE:6928) | ¥1473.00 | ¥2941.44 | 49.9% |

| Tencent Holdings (SEHK:700) | HK$382.00 | HK$761.79 | 49.9% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹292.95 | ₹585.86 | 50% |

| TORIDOLL Holdings (TSE:3397) | ¥3696.00 | ¥7379.78 | 49.9% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹498.10 | ₹994.53 | 49.9% |

| Cavotec (OM:CCC) | SEK20.80 | SEK41.56 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Marvell Technology (NasdaqGS:MRVL)

Overview: Marvell Technology, Inc., along with its subsidiaries, provides data infrastructure semiconductor solutions from the data center core to the network edge and has a market cap of $59.24 billion.

Operations: The company generates $5.35 billion from the design, development, and sale of integrated circuits.

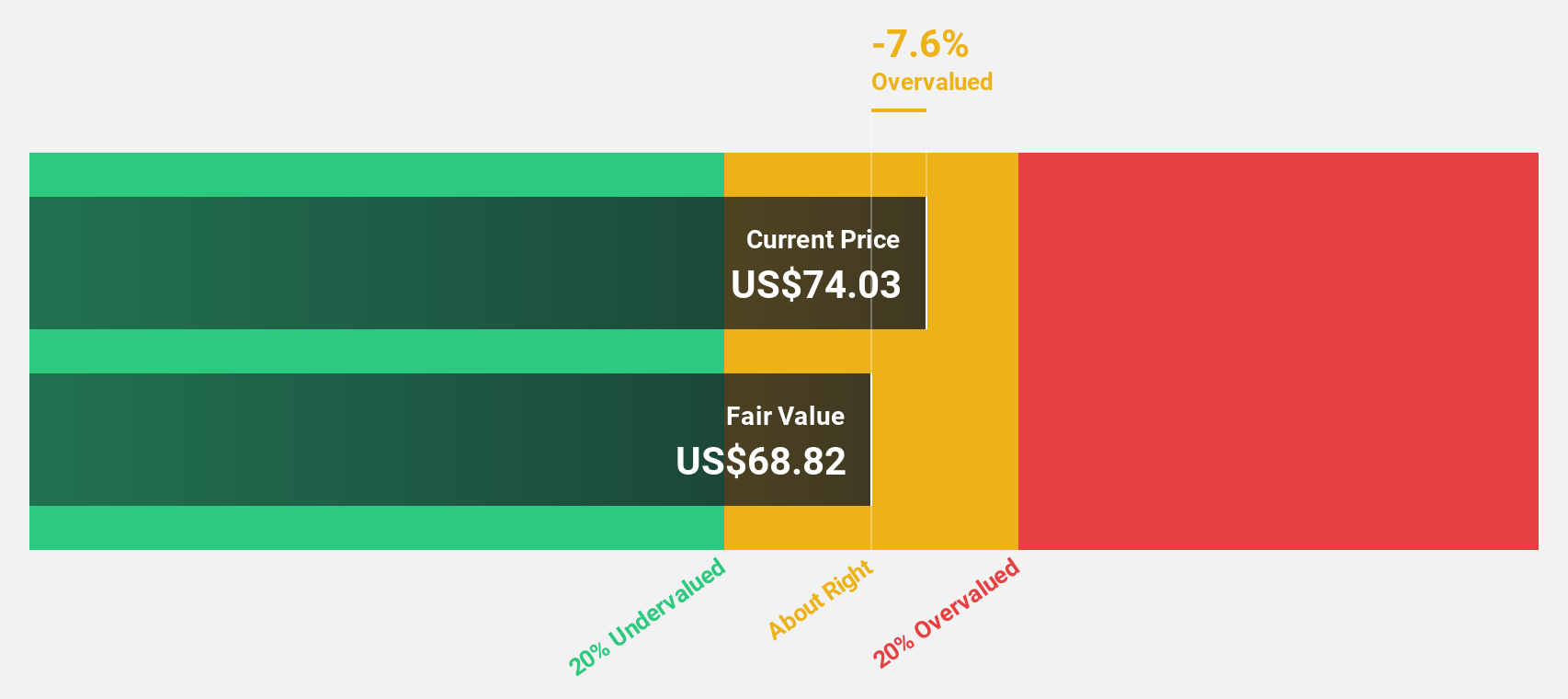

Estimated Discount To Fair Value: 27.5%

Marvell Technology appears undervalued based on discounted cash flow analysis, trading at US$69.84 compared to an estimated fair value of US$96.32. Despite recent earnings showing a net loss of US$193.3 million for Q2 2024, the company is expected to become profitable within three years and grow its revenue faster than the overall market at 16.7% annually. Analysts also project a significant stock price increase of 29.3%.

- Our growth report here indicates Marvell Technology may be poised for an improving outlook.

- Take a closer look at Marvell Technology's balance sheet health here in our report.

Block (NYSE:SQ)

Overview: Block, Inc., with a market cap of $39.82 billion, develops ecosystems centered around commerce and financial products and services both in the United States and internationally.

Operations: Block generates revenue primarily from two segments: Square, which contributes $7.38 billion, and Cash App, which brings in $15.93 billion.

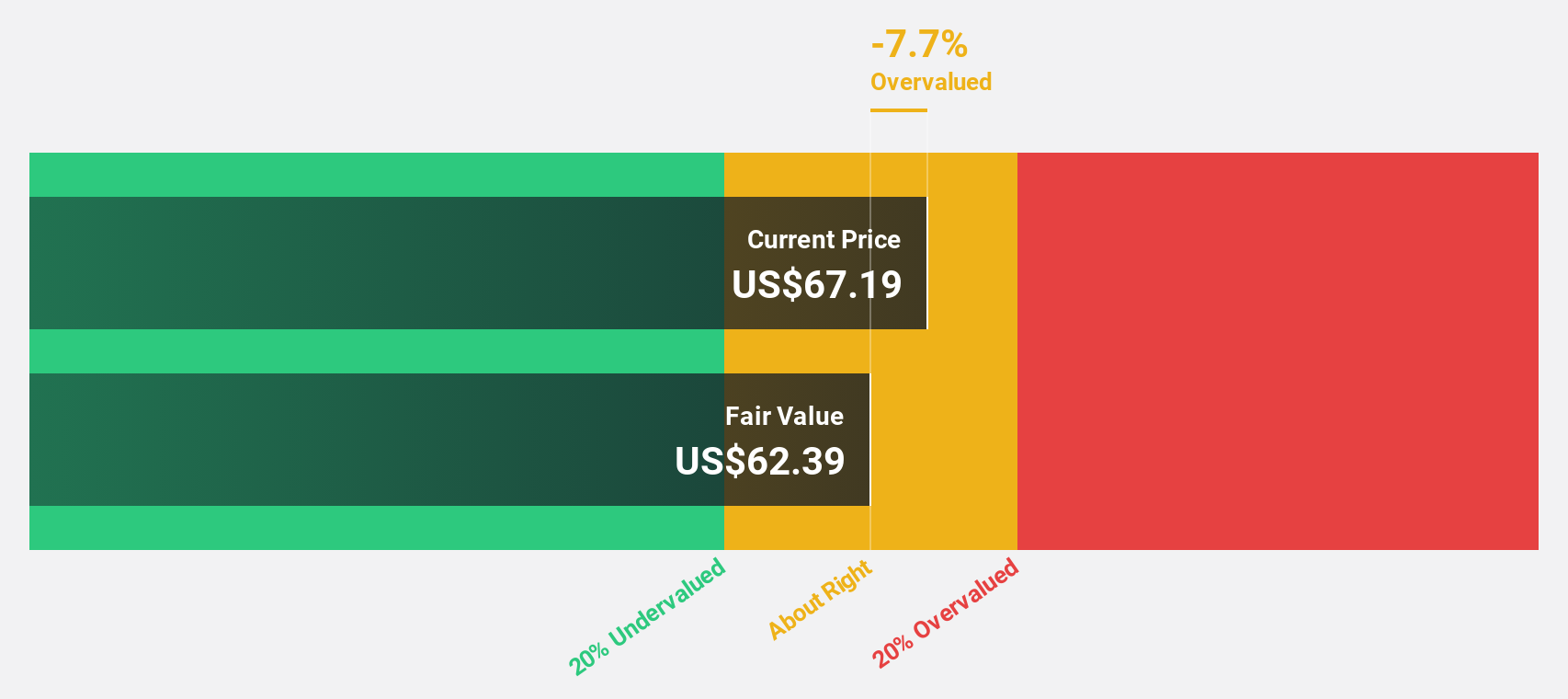

Estimated Discount To Fair Value: 10.1%

Block, Inc. reported strong second-quarter earnings with revenue of US$6.16 billion and net income of US$195.27 million, a significant turnaround from last year's loss. The company also repurchased shares worth US$389.45 million and increased its equity buyback plan to US$4 billion. Analysts forecast Block's earnings to grow 32.65% annually, outpacing the market, while the stock trades at 10% below its estimated fair value of US$73.90 based on discounted cash flow analysis.

- According our earnings growth report, there's an indication that Block might be ready to expand.

- Click to explore a detailed breakdown of our findings in Block's balance sheet health report.

Luxshare Precision Industry (SZSE:002475)

Overview: Luxshare Precision Industry Co., Ltd., along with its subsidiaries, designs, manufactures, and sells cable assembly and connector system solutions globally, with a market cap of CN¥268.18 billion.

Operations: The company's revenue segments include Consumer Electronics (CN¥199.87 billion), Automotive Internet Products and Precision Components (CN¥10.80 billion), Communication Interconnection Products and Precision Components (CN¥15.87 billion), Computer Interconnection Products and Precision Components (CN¥7.68 billion), and Other Connectors and Other (CN¥3.31 billion).

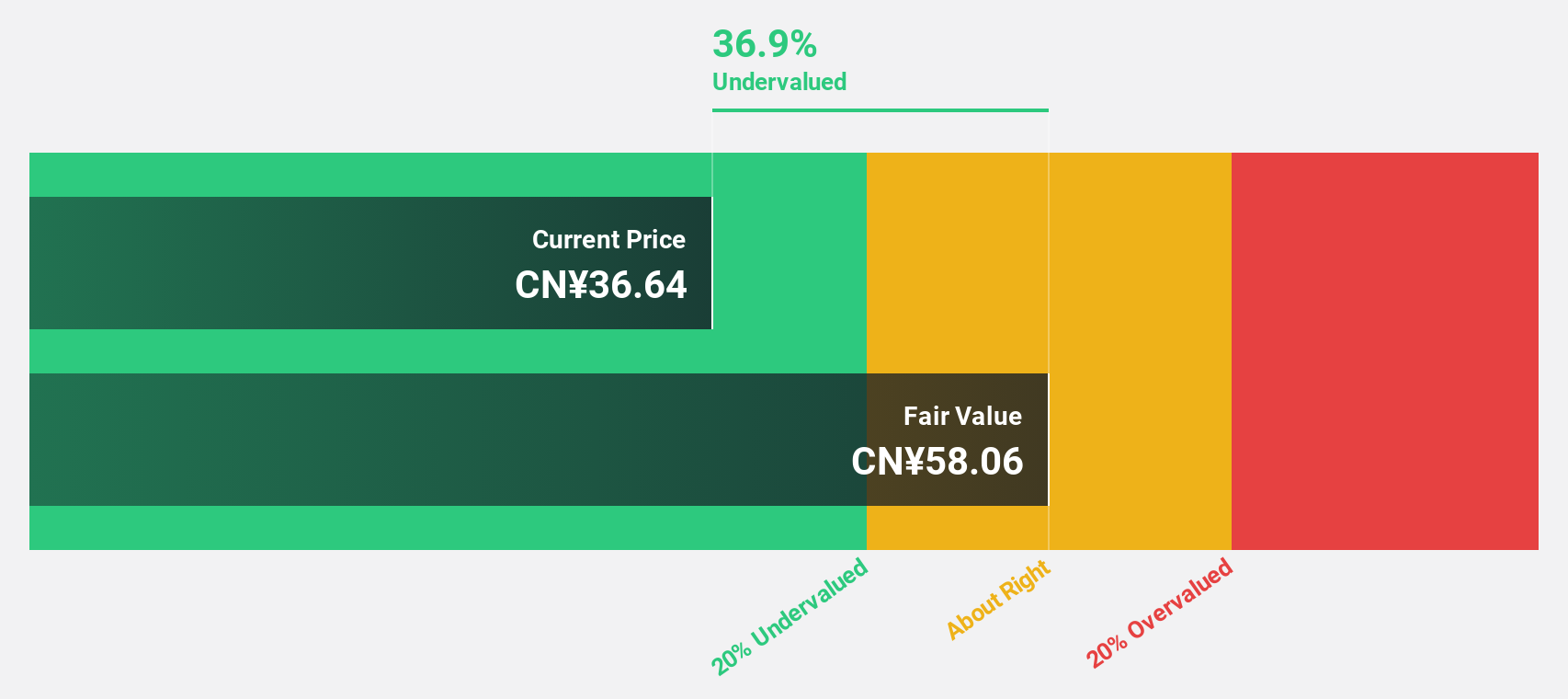

Estimated Discount To Fair Value: 16.3%

Luxshare Precision Industry's recent earnings report shows strong performance, with half-year sales reaching CNY 102.78 billion and net income at CNY 5.40 billion, up from CNY 4.36 billion a year ago. The company is trading below its estimated fair value of CN¥47.08 at CN¥39.42, indicating it may be undervalued based on discounted cash flow analysis. Additionally, Luxshare has revised its annual cap agreements significantly upwards for 2024 and 2025, reflecting strong future demand expectations.

- The analysis detailed in our Luxshare Precision Industry growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Luxshare Precision Industry.

Seize The Opportunity

- Reveal the 1001 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002475

Luxshare Precision Industry

Designs, manufactures, and sells cable assembly and connector system solutions worldwide.

Undervalued with solid track record and pays a dividend.