- China

- /

- Consumer Durables

- /

- SZSE:301004

Top Chinese Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As Chinese stocks faced weekly declines amidst a light economic calendar and cautious sentiment ahead of Fed Chair Powell’s Jackson Hole speech, the market remains a focal point for investors seeking growth opportunities. In such an environment, companies with high insider ownership often signal strong confidence from those closest to the business, making them intriguing prospects for growth-focused portfolios.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Shandong Longhua New Material (SZSE:301149) | 34.4% | 42.5% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 26.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.7% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 42.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 85.3% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

Let's review some notable picks from our screened stocks.

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥11.72 billion.

Operations: Offcn Education Technology Co., Ltd. generates revenue through various vocational education services in China.

Insider Ownership: 25.1%

Offcn Education Technology has a high forecasted Return on Equity of 40.6% in three years and is expected to become profitable within the same period, surpassing market growth. Despite its revenue growing at 19.4% per year, which is faster than the Chinese market average, it remains highly volatile with debt not well covered by operating cash flow. Recent earnings showed net income rising to ¥115.9 million from ¥81.98 million year-over-year despite a decline in sales to ¥1.45 billion from ¥1.73 billion.

- Unlock comprehensive insights into our analysis of Offcn Education Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that Offcn Education Technology is trading beyond its estimated value.

Intco Medical Technology (SZSE:300677)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Intco Medical Technology Co., Ltd. engages in the research, development, production, and marketing of medical consumables, health care equipment, and physiotherapy care products for use in medical and elderly care institutions as well as household daily use both in China and internationally; it has a market cap of CN¥17.47 billion.

Operations: Revenue segments include medical consumables, health care equipment, and physiotherapy care products used in various sectors such as medical and elderly care institutions, household daily use, and other related industries in China and internationally.

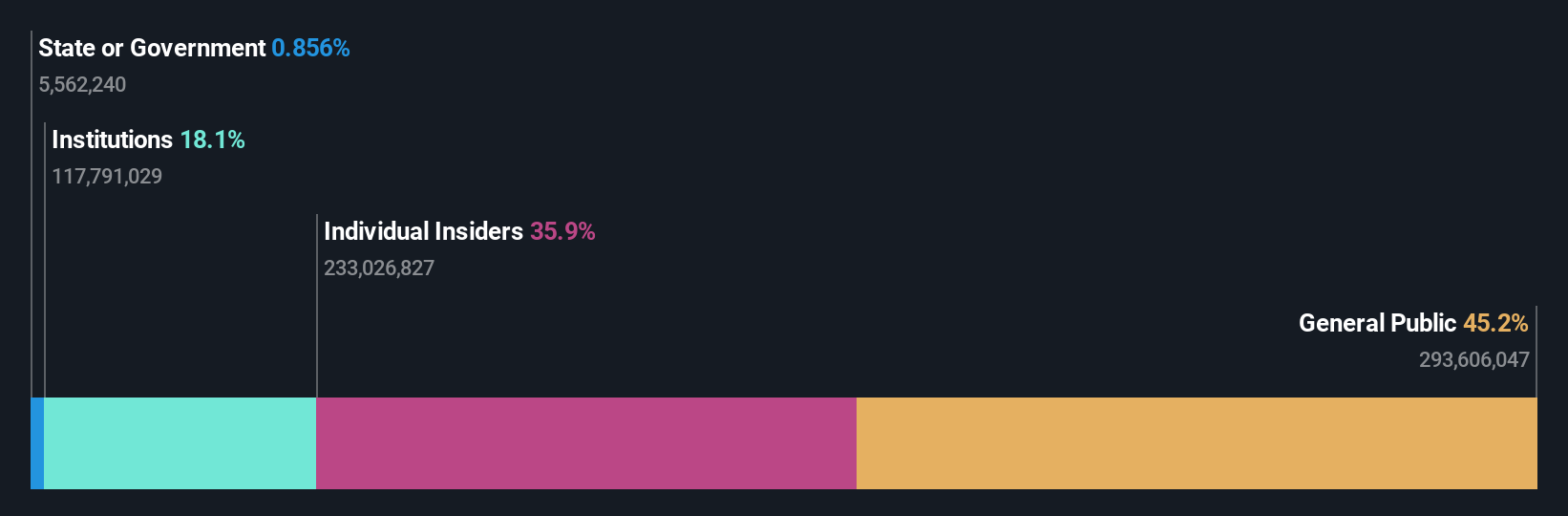

Insider Ownership: 36%

Intco Medical Technology's revenue is forecast to grow at 21.8% per year, outpacing the Chinese market average of 10.4%. Earnings are expected to rise significantly by 46.05% annually, well above the market's 16.8%. Recent earnings reported a net income of ¥587.03 million for H1 2024, doubling from ¥293.16 million a year ago, with sales increasing to ¥4.50 billion from ¥3.28 billion in the same period despite large one-off items impacting results and recent buybacks totaling ¥100 million under its repurchase plan.

- Dive into the specifics of Intco Medical Technology here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Intco Medical Technology is priced lower than what may be justified by its financials.

Zhejiang Cayi Vacuum Container (SZSE:301004)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Cayi Vacuum Container Co., Ltd. engages in the research, development, design, production, and sale of beverage and food containers of various materials in China and has a market cap of CN¥9.06 billion.

Operations: The company's revenue segments include the research, development, design, production, and sale of beverage and food containers made from various materials within China.

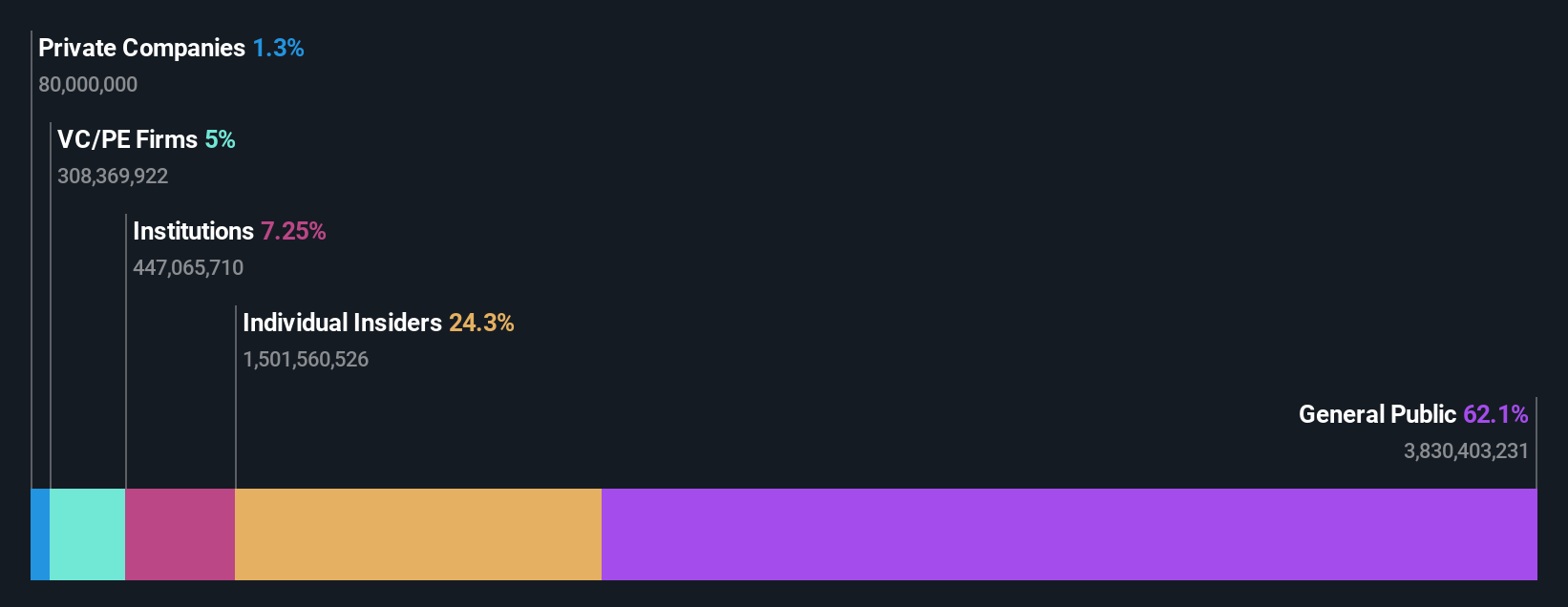

Insider Ownership: 16.8%

Zhejiang Cayi Vacuum Container has demonstrated strong growth, with H1 2024 earnings nearly doubling to ¥317.24 million from ¥163.05 million a year ago and sales rising to ¥1.13 billion from ¥631.38 million. Despite an unstable dividend track record, the company trades at 69.7% below its estimated fair value and is expected to grow earnings by 17.71% annually, outpacing the Chinese market's average of 16.8%.

- Click here and access our complete growth analysis report to understand the dynamics of Zhejiang Cayi Vacuum Container.

- Our expertly prepared valuation report Zhejiang Cayi Vacuum Container implies its share price may be lower than expected.

Seize The Opportunity

- Click here to access our complete index of 453 Fast Growing Chinese Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Cayi Vacuum Container might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301004

Zhejiang Cayi Vacuum Container

Engages in the research, development, design, production, and sale of beverage and food containers of various materials in China.

Undervalued with solid track record.