- United States

- /

- Semiconductors

- /

- NasdaqGM:MRAM

Introducing Everspin Technologies (NASDAQ:MRAM), A Stock That Climbed 21% In The Last Year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. For example, the Everspin Technologies, Inc. (NASDAQ:MRAM) share price is up 21% in the last year, clearly besting than the market return of around 6.3% (not including dividends). That's a solid performance by our standards! Note that businesses generally develop over the long term, so it the returns over the last year might not reflect a long term trend.

View our latest analysis for Everspin Technologies

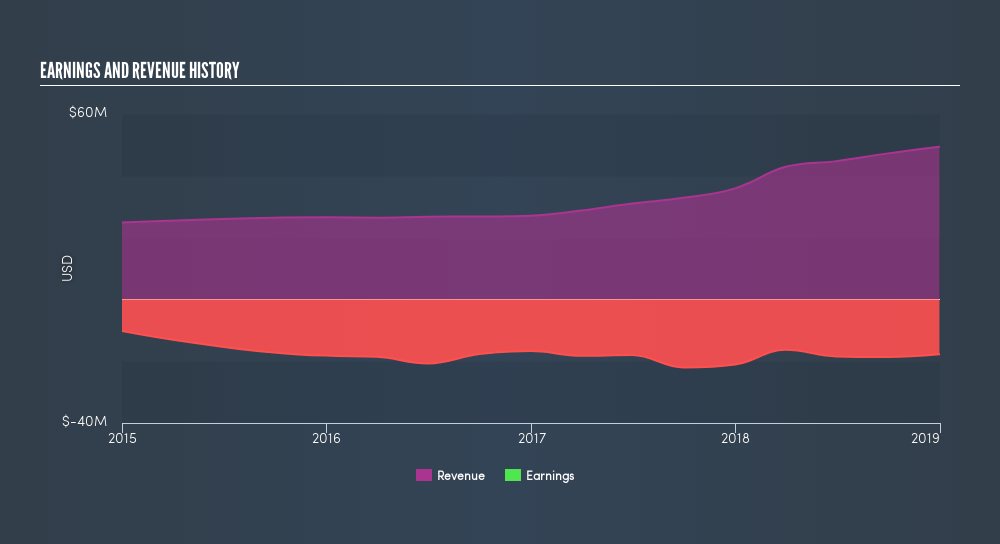

Given that Everspin Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Everspin Technologies grew its revenue by 38% last year. That's a fairly respectable growth rate. Buyers pushed the share price 21% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

This free interactive report on Everspin Technologies's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Everspin Technologies shareholders have gained 21% over the last year. And the share price momentum remains respectable, with a gain of 41% in the last three months. This suggests the company is continuing to win over new investors. Before spending more time on Everspin Technologies it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:MRAM

Everspin Technologies

Manufactures and sells magnetoresistive random access memory (MRAM) technologies in the United States, Japan, Hong Kong, Germany, Singapore, China, Canada, and internationally.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives