- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Monolithic Power Systems (MPWR): Valuation in Focus as New Institutional Stake and Earnings Draw Investor Interest

Reviewed by Simply Wall St

Monolithic Power Systems (MPWR) is drawing fresh interest after Stanley-Laman Group invested $8.5 million in new shares, just ahead of the company's third-quarter earnings report scheduled for October 30. Investors are watching closely as strong demand in AI, automotive, and consumer electronics continues to shape its outlook.

See our latest analysis for Monolithic Power Systems.

Shares of Monolithic Power Systems have rarely looked this energetic, climbing nearly 21% over the past month alone as enthusiasm builds around AI-driven demand and its upcoming earnings report. The company’s long-term momentum is equally striking, delivering an impressive 224% total shareholder return in three years. This is a sign that confidence in its future growth is on the rise.

If major moves like this have you looking for what’s next, it could be the perfect moment to broaden your scope and discover See the full list for free..

With shares currently near all-time highs, investors must now ask whether Monolithic Power Systems is trading at a premium reflecting all future growth, or if the upcoming earnings could reveal a genuine buying opportunity.

Most Popular Narrative: 9.7% Overvalued

The most cited valuation narrative puts Monolithic Power Systems' fair value at $979, which is meaningfully below the latest closing price of $1,074.91. This sets up a debate: are bullish projections already more than baked into the share price, or is there room for further upside?

"The company's transformation from a chip-only semiconductor supplier to a full-service silicon-based solutions provider, and its focus on vertical, module-based, and system-level solutions, allow it to capture higher value, increase customer stickiness, and drive gross and operating margin expansion critical for long-term earnings growth."

Think today's price tag is bold? Behind this headline valuation is a web of strategic pivots and projected growth leaps, fueled by ambitious margin and revenue targets. Curious what number-crunching justifies the market’s confidence? The narrative’s future outlook will surprise you.

Result: Fair Value of $979 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable shifts in automotive demand or a sudden slowdown in data center expansion could quickly challenge the optimistic outlook that supports today's elevated valuation.

Find out about the key risks to this Monolithic Power Systems narrative.

Another View: A Look at Earnings Ratios

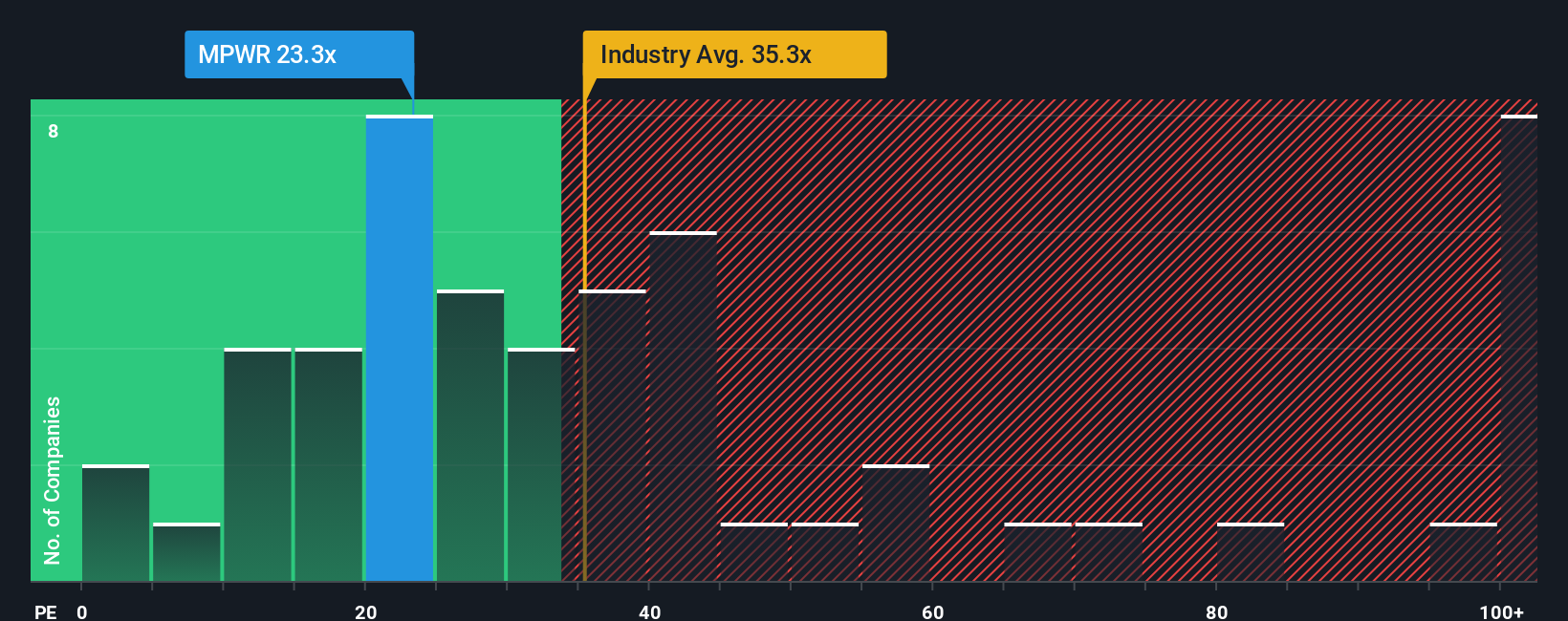

While many debate fair value, earnings multiples tell a different story. Monolithic Power Systems currently trades at 27.7 times its earnings, which is below the US semiconductor industry’s average of 39.5x and its closest peers at 37.7x. However, this is above its fair ratio of 23x, which could indicate some overvaluation risk if the market moves toward that fair level. Does current enthusiasm fully justify this premium, or is there more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Monolithic Power Systems Narrative

If you have a different perspective or enjoy hands-on research, you can dig into the numbers yourself and put together your own story in under three minutes. Do it your way.

A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't settle for the obvious. Expand your investing horizon by tapping into exceptional stock opportunities you might not have noticed. The best picks often hide in plain sight.

- Target profits from cutting-edge tech by checking out these 27 AI penny stocks, which are driving today’s artificial intelligence breakthroughs and tomorrow’s growth.

- Boost your portfolio income with these 17 dividend stocks with yields > 3%, where you’ll find robust companies offering yields above 3% and a track record of reliable payouts.

- Jump ahead of the market with these 80 cryptocurrency and blockchain stocks, which are leading advances in blockchain and digital finance innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives