- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Monolithic Power Systems (MPWR): Valuation in Focus After Strong Earnings, Record Revenue, and Post-Report Share Drop

Reviewed by Simply Wall St

Monolithic Power Systems (MPWR) just delivered its fifth straight quarterly earnings beat, posting record revenue along with strong growth across enterprise data, automotive, and industrial markets. Yet after these solid numbers, shares pulled back substantially.

See our latest analysis for Monolithic Power Systems.

Despite delivering upbeat third-quarter numbers and setting revenue guidance slightly above consensus, Monolithic Power Systems' recent 1-day share price drop of 7.6% underscores how investor expectations sometimes outpace even solid execution. Still, the 32% one-year total shareholder return and nearly 2x gains over three years signal that long-term momentum and belief in MPWR's transformation story are very much intact.

If top-tier performance in power management caught your attention, now is a perfect moment to discover See the full list for free.

With stellar performance and ambitious growth plans, the question remains whether Monolithic Power Systems’ recent dip has opened a window for long-term investors, or if the current valuation already reflects all that future promise.

Most Popular Narrative: 13.4% Undervalued

With the narrative’s fair value estimate of $1,161 per share outpacing the recent close at $1,005, Monolithic Power Systems is seen as offering notable upside compared to where the market currently values it. This prominent valuation is driven by expectations of continued strength and expansion in key growth areas, backed by bullish analyst sentiment.

The company's transformation from a chip-only semiconductor supplier to a full-service silicon-based solutions provider, along with its focus on vertical, module-based, and system-level solutions, allows it to capture higher value, increase customer stickiness, and drive gross and operating margin expansion critical for long-term earnings growth.

What is powering this ambitious price tag? The key could be in the growth forecasts for new business segments and a future profit multiple normally reserved for top-tier industry names. Want to learn which bold revenue and margin projections back up this narrative’s optimism? You’ll need to dig deeper into the full story.

Result: Fair Value of $1,161 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company's lofty valuation could face headwinds if segments like Enterprise slow unexpectedly, or if macro uncertainty challenges its expansion momentum.

Find out about the key risks to this Monolithic Power Systems narrative.

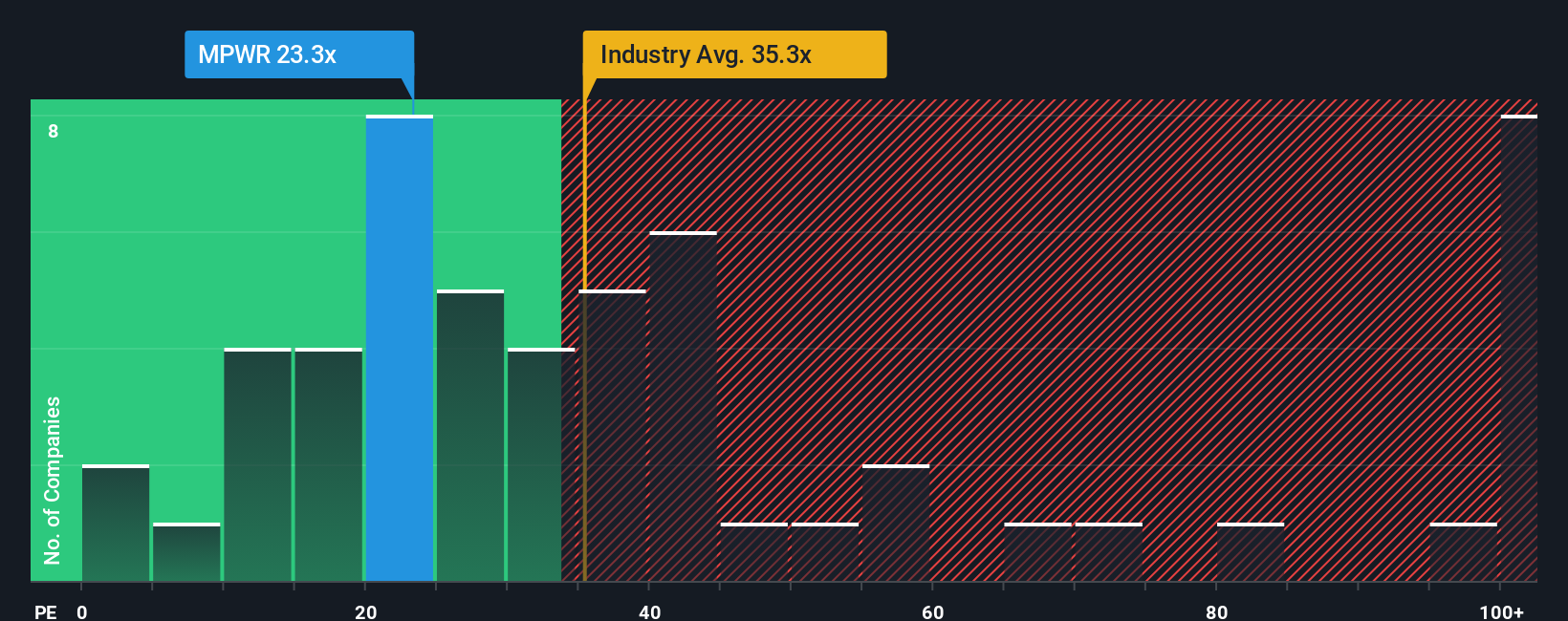

Another View: Sizing Up Valuation Using Ratios

While some see Monolithic Power Systems as undervalued, a look at its price-to-earnings ratio tells a more complex story. At 25.4x, it is cheaper than the US semiconductor industry average of 36.1x or peers at 37.2x. It still trades above its fair ratio of 23.2x, which could mean there is less room for upside if expectations cool. Does the market believe profits can keep pace with the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Monolithic Power Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Monolithic Power Systems Narrative

If you see things differently, or want to dig into the data yourself, it takes less than three minutes to shape your own story, so why not Do it your way

A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Unlock More Smart Investment Opportunities?

Take your next step toward smarter investing by handpicking stocks with exceptional growth or value potential. Your next top idea could be just a click away.

- Capture strong passive income streams and gain an edge with these 20 dividend stocks with yields > 3% offering yields higher than the market average.

- Capitalize on technological breakthroughs and lead the AI surge by evaluating these 27 AI penny stocks built for the future of intelligent innovation.

- Turn market volatility to your advantage by scouting these 3587 penny stocks with strong financials with solid fundamentals and powerful growth potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives