- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Is Monolithic Power Systems' (MPWR) Modest Buyback Reflecting a Shift in Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Between July and September 2025, Monolithic Power Systems repurchased 2,000 shares for US$2.1 million, bringing the total completed under its February buyback to 5,900 shares for US$4.74 million.

- This buyback is relatively minor and occurred as the company moved in line with sector-wide caution over AI hardware valuations and Federal Reserve policy signals rather than being driven by company-specific actions.

- We'll examine how the technology sector’s AI-driven caution and the modest buyback update feed into Monolithic Power Systems' investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Monolithic Power Systems Investment Narrative Recap

Owning Monolithic Power Systems means believing in the company's ability to capitalize on long-term demand for power management solutions across AI, automotive, and data center markets, even amid recent uncertainty over AI hardware valuations and shifting Federal Reserve signals. The recent minor buyback and share price drop are unlikely to materially affect the company’s key short-term catalyst, which is ongoing AI and data center business momentum, but they do reinforce how exposed MPS is to wider sector sentiment and risk of valuation-driven pullbacks.

Of the company’s recent updates, the October earnings report best connects to current market concerns. MPS posted year-over-year growth in both sales and profitability for the third quarter of 2025, underscoring the underlying business strength that supports ongoing optimism about its AI and auto exposure, but these results may not be enough to offset broader sector caution around high expectations and potential slowdowns.

In contrast, investors should be aware of how quickly short ordering cycles and inventory corrections can introduce near-term volatility to even...

Read the full narrative on Monolithic Power Systems (it's free!)

Monolithic Power Systems' outlook anticipates $3.9 billion in revenue and $1.0 billion in earnings by 2028. This is based on a forecasted 15.5% annual revenue growth rate but represents a decrease of $0.9 billion in earnings from current levels of $1.9 billion.

Uncover how Monolithic Power Systems' forecasts yield a $1181 fair value, a 38% upside to its current price.

Exploring Other Perspectives

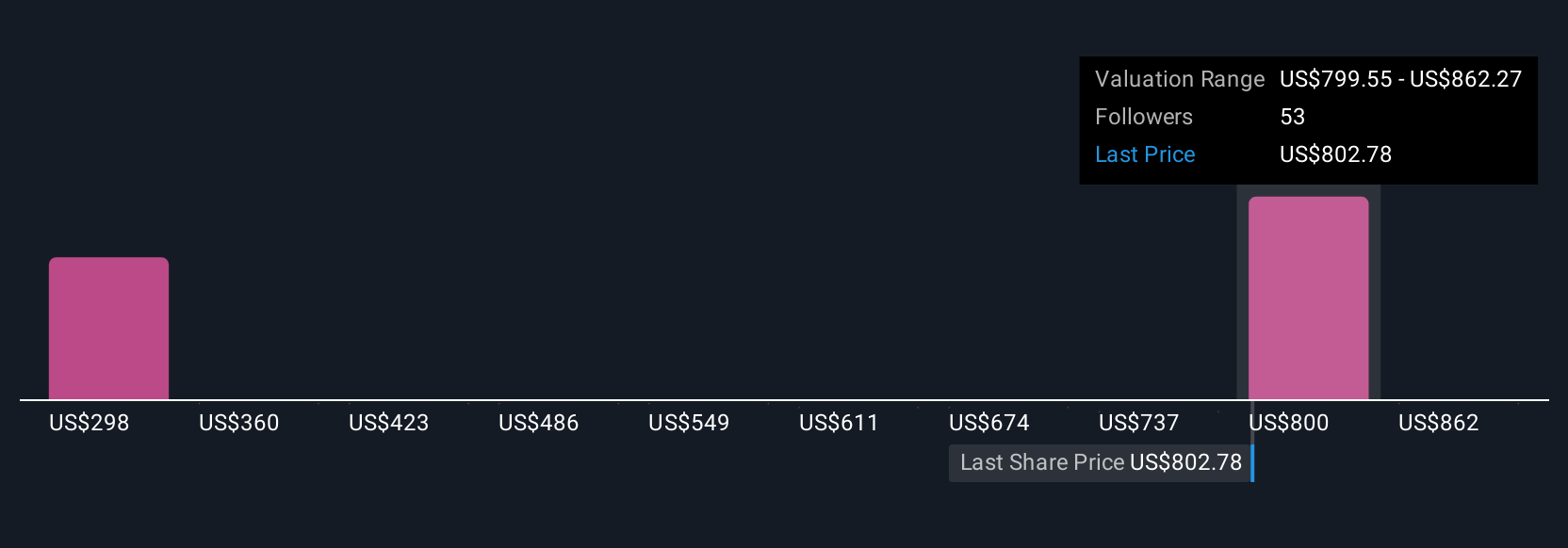

Twelve individual fair value estimates from the Simply Wall St Community cluster between US$338 and US$1,181 per share, highlighting significant differences in retail investor views. With broader sector caution now influencing price action, expectations for sustained revenue growth could face new tests in the quarters ahead.

Explore 12 other fair value estimates on Monolithic Power Systems - why the stock might be worth as much as 38% more than the current price!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives