- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

The Bull Case For Microchip Technology (MCHP) Could Change Following Launch of SkyWire Timing Solutions—Learn Why

Reviewed by Sasha Jovanovic

- In recent weeks, Microchip Technology unveiled several innovations, including its SkyWire timing tool for critical infrastructure, next-generation Switchtec Gen 6 PCIe switches for AI and data centers, and demonstrated multi-vendor automotive connectivity with AVIVA Links, signaling ongoing advancement in high-performance semiconductor solutions.

- These developments, coinciding with the company's upcoming fiscal second-quarter earnings and ongoing restructuring efforts, highlight Microchip's push into high-growth markets despite operational headwinds and inventory challenges.

- We'll examine how the launch of the SkyWire timing technology shapes Microchip's investment narrative in the context of its recent restructuring.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Microchip Technology Investment Narrative Recap

To own shares of Microchip Technology, an investor needs confidence in the company’s ability to overcome persistent inventory headwinds and factory underutilization, while capitalizing on secular demand for advanced semiconductor solutions in infrastructure, AI, and automotive. Recent product launches, such as the SkyWire timing tool and next-generation PCIe switches, bolster Microchip’s position in high-growth markets, but they do not immediately address the most significant short-term catalyst, normalization of elevated inventory levels or the material risk of ongoing gross margin pressure from excess inventory and underutilized assets.

Of the recent announcements, the SkyWire timing solution stands out for its relevance to Microchip’s core strengths in critical infrastructure and distinguishing capabilities within increasingly competitive industrial and networking markets. While this technology reinforces the company’s long-term value proposition, the most immediate driver for share price and earnings outlook remains the pace at which inventory and operational efficiency normalize in coming quarters.

However, investors should also keep in mind that prolonged excess inventory levels can have implications for future gross margins and capital flexibility...

Read the full narrative on Microchip Technology (it's free!)

Microchip Technology's narrative projects $6.6 billion revenue and $1.4 billion earnings by 2028. This requires 15.9% yearly revenue growth and an earnings increase of $1.578 billion from -$178.4 million today.

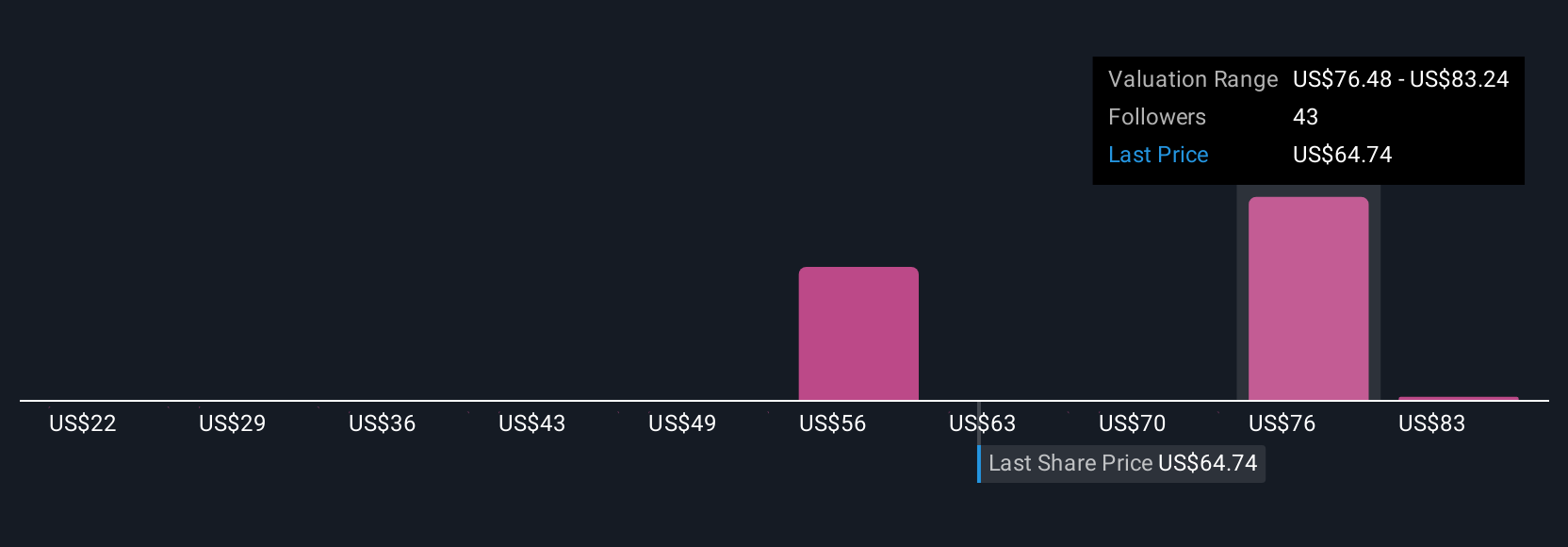

Uncover how Microchip Technology's forecasts yield a $76.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published five fair value estimates for Microchip Technology ranging from US$22.39 to US$90 per share. While some focus on operational recovery, elevated inventory and margin pressures remain a central concern that could affect performance well beyond the current period, inviting you to compare various outlooks for a fuller picture of the stock.

Explore 5 other fair value estimates on Microchip Technology - why the stock might be worth as much as 38% more than the current price!

Build Your Own Microchip Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microchip Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Microchip Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microchip Technology's overall financial health at a glance.

No Opportunity In Microchip Technology?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives