- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Should Microchip Technology's (MCHP) Launch of Advanced Networking Solutions Require Action From Investors?

Reviewed by Sasha Jovanovic

- Microchip Technology recently announced the launch of advanced Optical Ethernet PHY transceivers with up to 25 Gbps speeds and the Time Provider 4500 v3 grandmaster clock, delivering sub-nanosecond timing accuracy for critical infrastructure applications worldwide.

- These products highlight the company’s efforts to address growing industry demand for secure, high-speed networking and resilient, precise time synchronization across sectors such as industrial automation, telecommunications, and data centers.

- We'll examine how Microchip Technology's focus on secure, high-speed networking solutions could influence its future outlook and growth narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Microchip Technology Investment Narrative Recap

Microchip Technology’s investment story is tied to belief in the company’s ability to capitalize on secular trends toward automation, secure networking, and industrial connectivity, despite recent headwinds such as ongoing inventory challenges and pressure on margins. The latest product launches in optical networking and precision timing show a meaningful push to address rising demand in industrial and data center markets, though these developments may not provide a near-term offset to the main risk: persistent elevated inventories that continue to weigh on profitability. Among recent announcements, the introduction of the new Optical Ethernet PHY transceivers stands out for its immediate relevance, reflecting Microchip’s response to the need for secure, high-speed data transmission over long distances in demanding environments. This launch directly aligns with one of the company’s core growth catalysts, expanding presence in data-intensive and industrial sectors, potentially supporting incremental revenue opportunities as markets recover. Yet, in contrast, investors should be aware that Microchip’s elevated inventories and potential margin pressure remain a...

Read the full narrative on Microchip Technology (it's free!)

Microchip Technology's narrative projects $6.6 billion revenue and $1.4 billion earnings by 2028. This requires 15.9% yearly revenue growth and a $1.58 billion increase in earnings from the current -$178.4 million.

Uncover how Microchip Technology's forecasts yield a $76.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

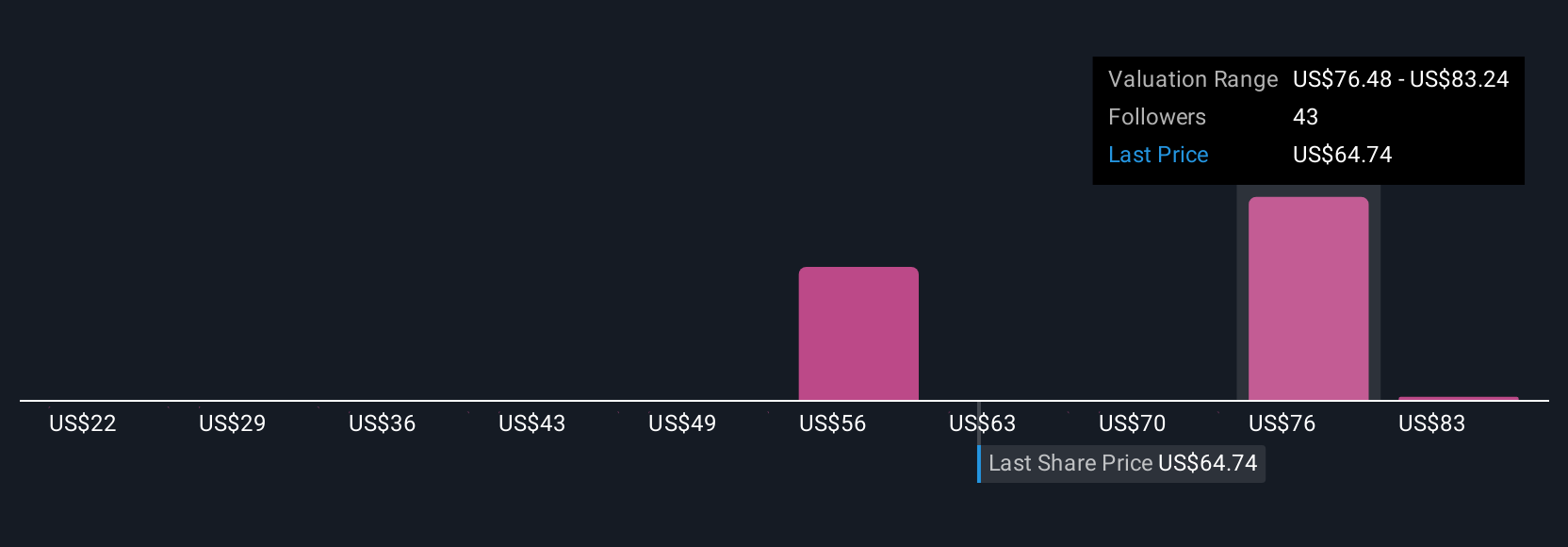

Six individual fair value estimates from the Simply Wall St Community range from US$22.39 to US$90, reflecting broad variance in growth expectations. This diversity stands beside Microchip’s ongoing effort to reduce high inventories which could impact near-term margins and operating performance, explore several viewpoints to see how opinions differ.

Explore 6 other fair value estimates on Microchip Technology - why the stock might be worth less than half the current price!

Build Your Own Microchip Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microchip Technology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Microchip Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microchip Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives