- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Did Microchip’s (MCHP) Launch of SkyWire and Time Provider 4500 v3 Redefine Its Investment Narrative?

Reviewed by Sasha Jovanovic

- In October 2025, Microchip Technology launched the Time Provider 4500 v3 grandmaster clock and introduced its SkyWire technology, both delivering industry-leading sub-nanosecond timing accuracy and reliability for critical infrastructure over long-haul optical networks.

- These advancements provide terrestrial, standards-based alternatives to GNSS timing, addressing urgent needs for resilient time synchronization in sectors such as telecom, utilities, government, and defense.

- We’ll examine how Microchip’s push into high-precision, GNSS-independent timing solutions could reshape its investment narrative and growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Microchip Technology Investment Narrative Recap

To be a shareholder in Microchip Technology today, you have to believe that the company’s push into resilient, mission-critical timing solutions will drive renewed demand and bolster its position in strategic markets. While the launch of the Time Provider 4500 and SkyWire technology adds differentiation and technical credibility, these innovations are unlikely to quickly change the short-term catalysts, such as inventory normalization or factory utilization pressures, or address the company’s elevated financial leverage risk at this stage.

Among recent developments, the release of SkyWire technology is especially relevant. This product directly supports the new grandmaster clock by enabling nanosecond-accurate clock verification across long distances, potentially strengthening Microchip’s value proposition to sectors dependent on resilient, GNSS-independent timing, a theme central to the long-term catalyst of industrial and infrastructure recovery.

By contrast, something investors should be aware of is the ongoing impact of high inventory levels on margins and near-term results...

Read the full narrative on Microchip Technology (it's free!)

Microchip Technology's narrative projects $6.6 billion revenue and $1.4 billion earnings by 2028. This requires 15.9% yearly revenue growth and a $1.58 billion earnings increase from current earnings of -$178.4 million.

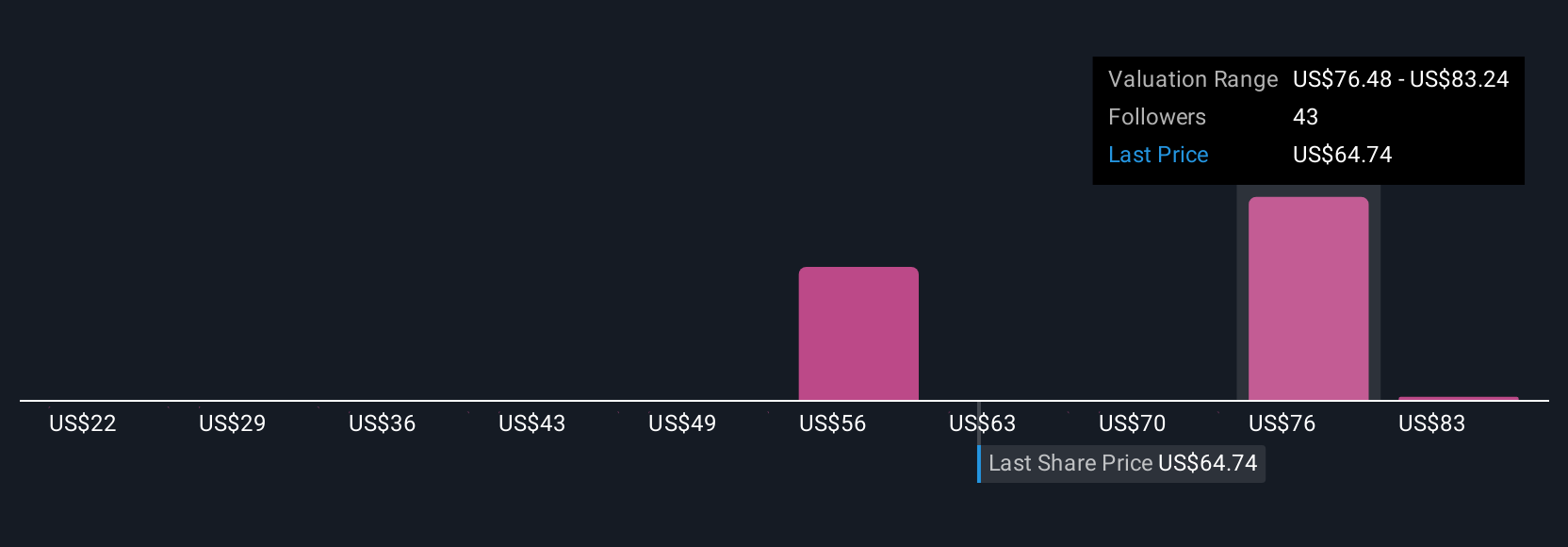

Uncover how Microchip Technology's forecasts yield a $76.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Six individual fair value estimates from the Simply Wall St Community range from US$22.39 to US$90 per share. While community forecasts diverge widely, Microchip’s persistent high inventory levels and margin pressures may weigh on performance and should be top of mind as you explore alternate views on value.

Explore 6 other fair value estimates on Microchip Technology - why the stock might be worth less than half the current price!

Build Your Own Microchip Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Microchip Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Microchip Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Microchip Technology's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives