- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Examining Microchip Technology Stock After Supply Chain Headlines and 14% Monthly Drop

- If you have ever wondered whether Microchip Technology is a hidden gem or just another semiconductor stock, you are not alone. Let's dig into what the numbers say about its value.

- After gaining 3.1% in the past week, the stock has rebounded a bit, but the 30-day return is still a sharp -14.4%, pointing to increased volatility and shifting sentiment lately.

- Recent headlines have centered on Microchip’s ongoing investments in automotive and industrial applications and the broader market’s reactions to global chip supply chain developments. These stories have been moving the stock and shaping investor expectations, especially as the industry keeps evolving.

- Currently, Microchip Technology scores a 3 out of 6 on our value checklist, a mixed result that calls for a closer look. We are about to dig into what traditional valuation models say about the company and discuss a smarter approach to understanding value later on.

Find out why Microchip Technology's -15.7% return over the last year is lagging behind its peers.

Approach 1: Microchip Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its anticipated future cash flows and then discounting them back to today's dollars. This approach helps investors understand whether the stock’s price reflects these expected future earnings.

For Microchip Technology, the current Free Cash Flow stands at $678.6 Million. Analyst estimates extend up to five years, and then Simply Wall St extrapolates further. By 2030, Free Cash Flow is forecast to reach $2.62 Billion, which highlights the company’s strong expected earnings growth.

Based on all these projections and using a 2-Stage Free Cash Flow to Equity model, the estimated intrinsic value of Microchip Technology is $56.13 per share. Compared to the recent trading price, this suggests the stock is priced at a 4.8% discount to its calculated fair value.

In summary, while there is a slight undervaluation on paper, the margin is narrow and within a typical valuation range.

Result: ABOUT RIGHT

Microchip Technology is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Microchip Technology Price vs Sales

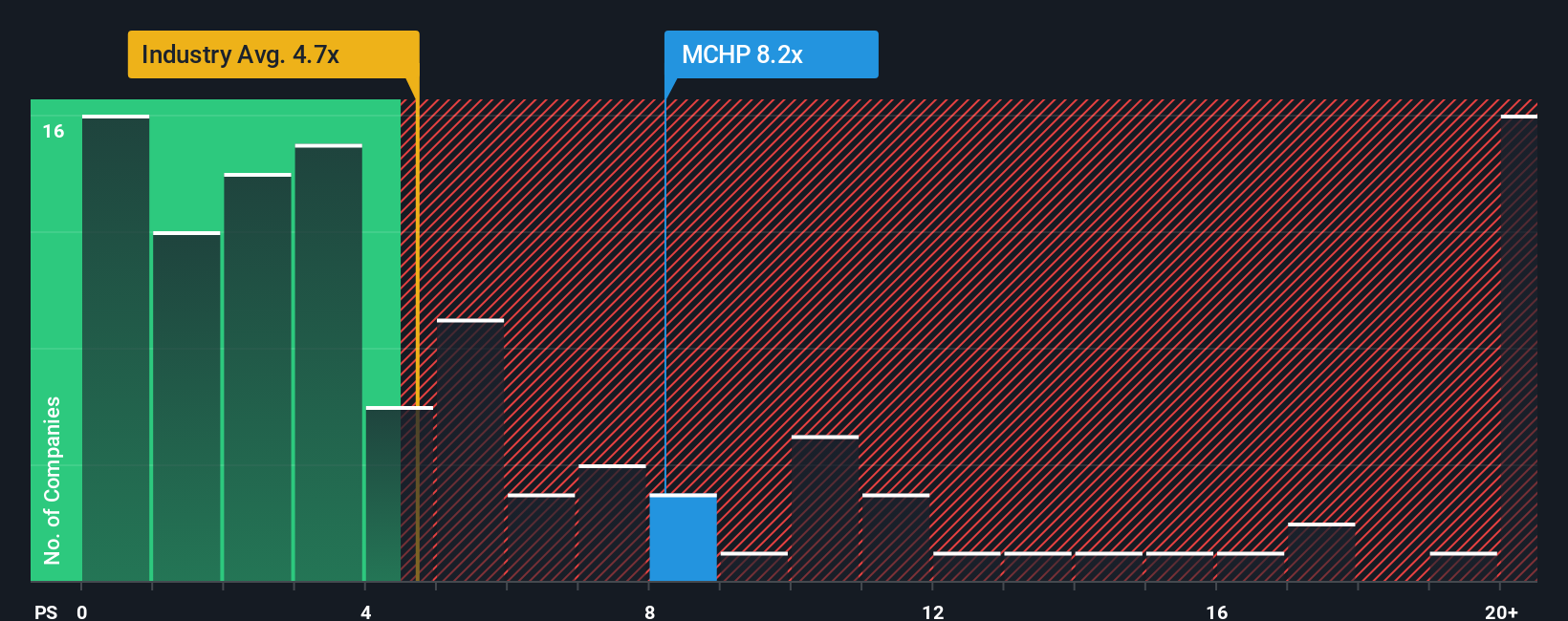

When valuing a technology company like Microchip Technology, the Price-to-Sales (P/S) ratio is often preferred, especially for firms with consistent revenue streams and where profits can fluctuate due to industry cycles. The P/S ratio is effective because it focuses on sales, which are less volatile and less affected by accounting policies than earnings, and provides a direct insight into how the market values each dollar of revenue.

Microchip Technology currently trades at a P/S ratio of 6.86x. For comparison, the average P/S ratio among its semiconductor industry peers is 4.00x, while the broader semiconductor industry average sits at 4.73x. This means Microchip is trading at a noticeable premium to both its direct competitors and the sector as a whole.

However, Simply Wall St's proprietary “Fair Ratio” model suggests a fair P/S ratio of 7.76x for Microchip Technology. This model stands out by factoring in not just industry averages but also the company’s unique position, expected growth, profitability, market capitalization, and risks. By combining these factors, the Fair Ratio aims to better reflect what an informed, long-term investor should expect rather than relying solely on broad comparisons.

Comparing the current P/S ratio of 6.86x to the Fair Ratio of 7.76x shows that Microchip Technology is valued just below what would be considered fair, once its fundamentals and outlook are fully accounted for.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Microchip Technology Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives, a dynamic, user-driven approach that connects the company’s story to its financial forecast and fair value in a clear, approachable way.

A Narrative gives you the opportunity to craft and share your outlook on Microchip Technology by stating your expectations for future revenue, margins, and the factors you believe will shape the business. This allows you to put your assumptions side by side with your fair value and forecast numbers.

On Simply Wall St’s Community page, millions of investors use Narratives to easily map their reasoning to financial outcomes. This makes it far simpler to decide when a stock is undervalued or overvalued by comparing its Fair Value (based on their expectations) to the current Price.

Because Narratives update automatically with new news, earnings releases, or price moves, your view stays current and reflects the latest developments without manual recalculations.

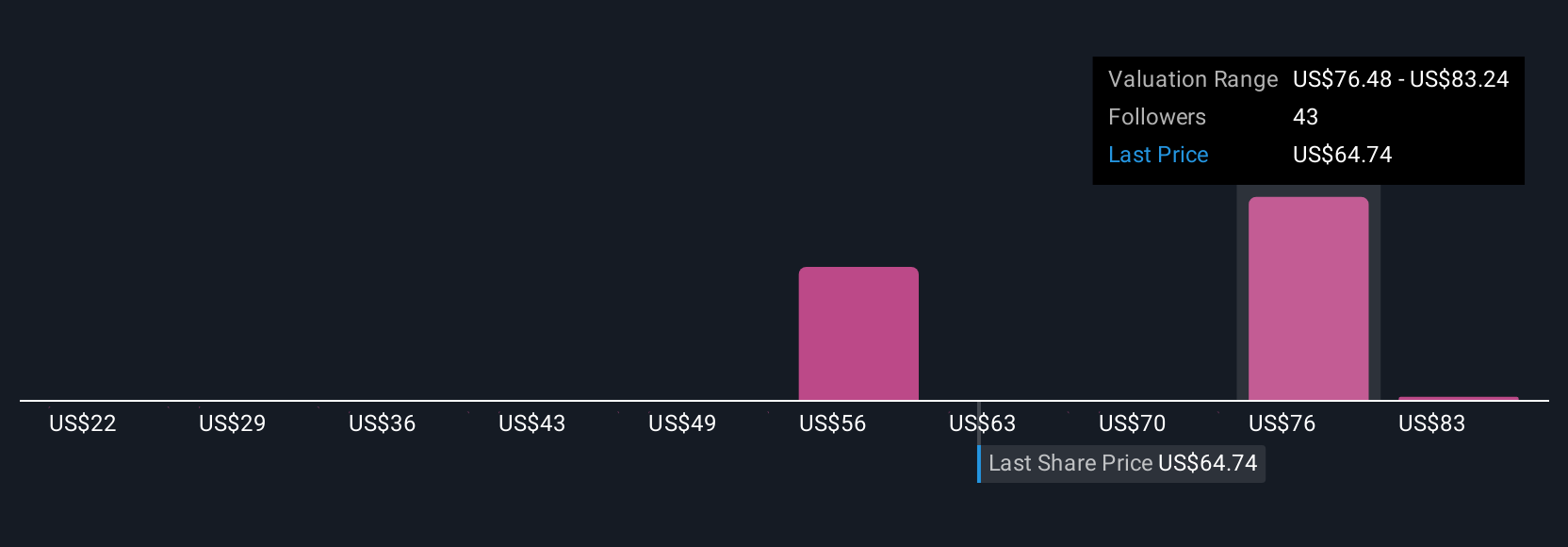

For instance, when it comes to Microchip Technology, bullish investors may expect a future fair value as high as $90 per share, citing AI adoption and factory expansion. More cautious investors might set their fair value closer to $60, concerned about rising debt and slower automotive recovery. Each Narrative tells a different story, helping you weigh both upside and risks for smarter investment choices.

Do you think there's more to the story for Microchip Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion