- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is Lam Research Still a Good Value After 117% Share Price Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if Lam Research offers good value after its huge share price gains? You are not alone, as many investors are looking beyond the headlines to figure out what the stock is really worth.

- The stock has soared 117.4% year to date and 112.7% over the past year, making Lam Research one of the standout performers in the sector.

- Recent news about strong global demand for semiconductor equipment and growing interest in artificial intelligence technologies has helped drive Lam Research’s share price higher. Industry-wide supply chain improvements and positive analyst sentiment have added further momentum to the stock.

- Our valuation check gives Lam Research a score of 2 out of 6. It is a mixed picture. Here is what this score means, a comparison of common valuation methods, and a smarter approach to consider before wrapping up.

Lam Research scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

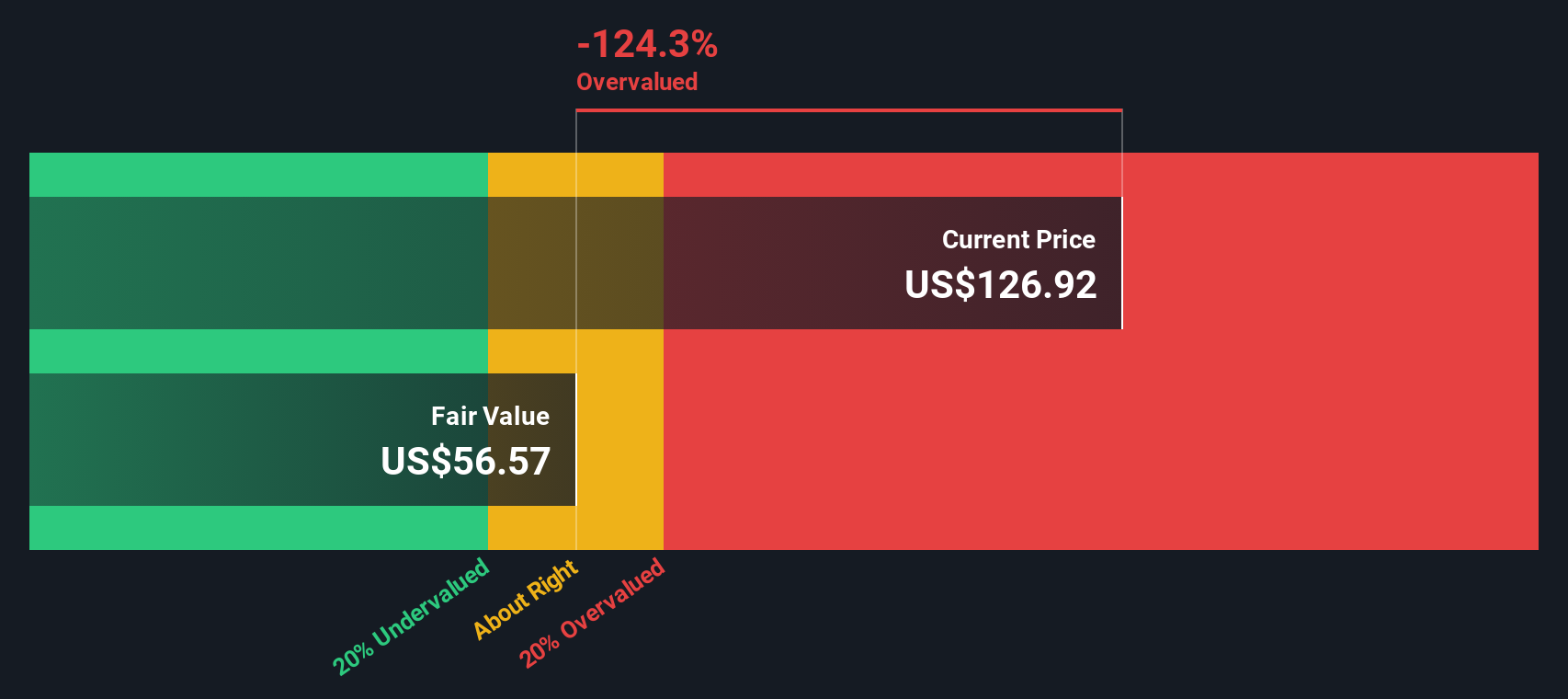

Approach 1: Lam Research Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. This approach is popular among investors who want to understand what a business is fundamentally worth, independent of current market hype.

For Lam Research, the latest reported Free Cash Flow stands at $5.73 billion. Analyst estimates suggest this figure will grow steadily, reaching approximately $7.91 billion by 2030. It is important to note that analyst forecasts only cover the next 5 years, and cash flow projections beyond that are extrapolated to reflect likely business performance over time.

Using these projections and the 2 Stage Free Cash Flow to Equity methodology, the calculation yields an intrinsic value of $65.83 per share. Compared to the current share price, this figure indicates Lam Research is trading at a 139.2% premium to its calculated fair value.

This considerable gap suggests that expectations built into the current price are quite lofty, leaving little margin for error if future growth disappoints.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lam Research may be overvalued by 139.2%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

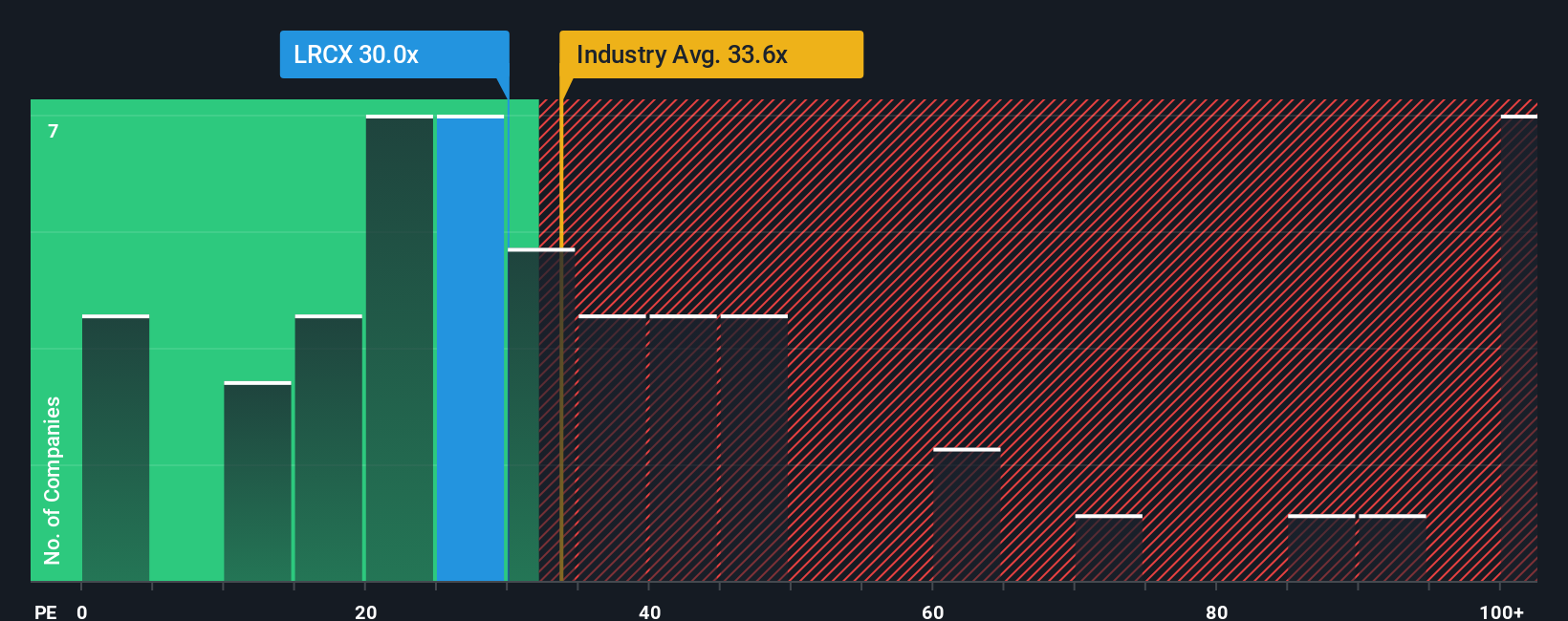

Approach 2: Lam Research Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored tool for valuing profitable businesses like Lam Research, as it directly compares a company's share price to its earnings. For companies that consistently report solid profits, PE gives investors a sense of what the market is willing to pay for a dollar of earnings.

What constitutes a "fair" PE ratio depends on several factors, particularly growth expectations and risk. Companies expected to deliver faster earnings growth or those deemed less risky tend to deserve higher PE multiples. Conversely, slower-growing or riskier businesses are often valued at lower PE levels.

Currently, Lam Research trades at a PE ratio of 34.0x. This is below both the semiconductor industry average of 36.1x and the broader peer group average of 44.5x. However, headline multiples only tell part of the story, as they do not fully adjust for the uniqueness of Lam’s business prospects or risks.

To address this, Simply Wall St calculates a proprietary "Fair Ratio" for Lam Research, which in this case is 34.0x. The Fair Ratio is more reliable than a straight comparison to peers or industry averages because it builds in expected growth, risk profile, profit margins, market cap, and industry dynamics, offering a truer picture of intrinsic value.

With Lam Research’s current multiple matching its Fair Ratio almost exactly, the stock appears to be priced just about right using this valuation method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

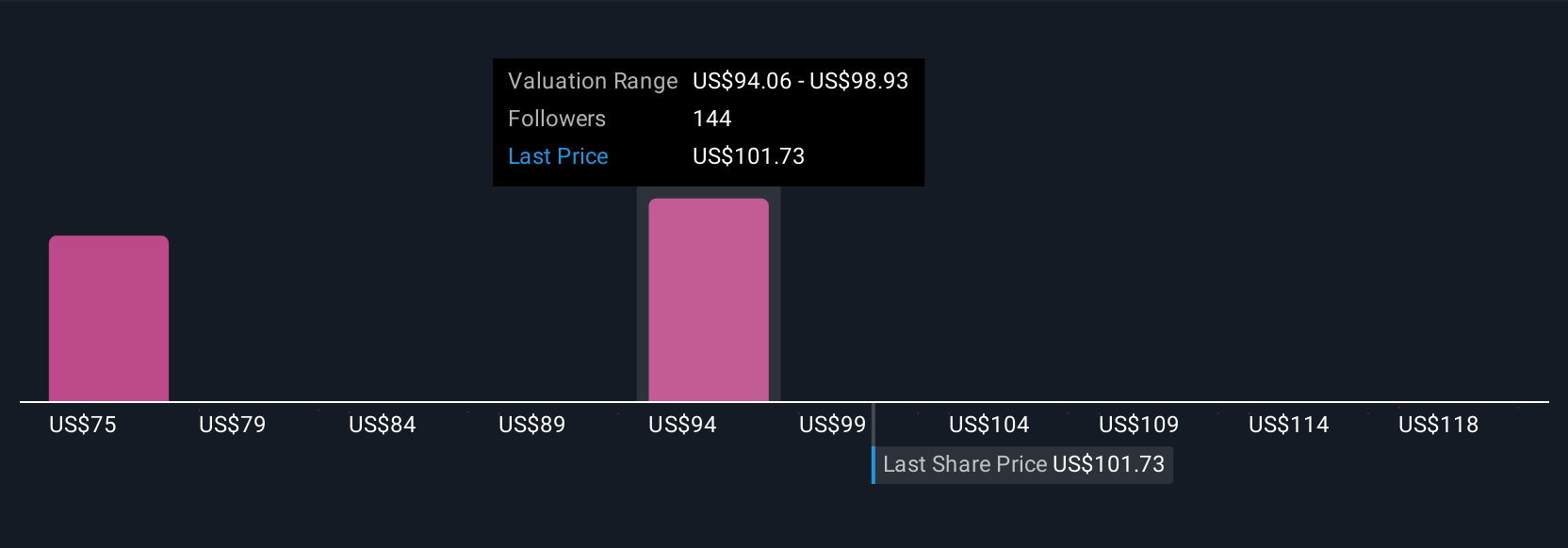

Upgrade Your Decision Making: Choose your Lam Research Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative connects your view of Lam Research’s story—how you see its business model, industry trends, and prospects—to your own financial forecast and fair value estimate. Rather than just looking at numbers in isolation, Narratives allow you to map out the “why” behind your assumptions about future revenue, profit margins, and growth rates, and see how they drive a target share price.

Narratives make it easy for anyone to turn their perspective into a practical investing plan. Within Simply Wall St’s Community page, you can choose or create a Narrative, compare your fair value against the current price, and see when your view suggests it may be time to buy or sell. Narratives are constantly updated when news or earnings are released, keeping your outlook current with the evolving reality.

For Lam Research, for example, one investor might see AI-driven chip demand and government incentives supporting earnings acceleration, justifying a fair value as high as $135. Another, focused on industry cyclicality or competition, sees value closer to $80. Narratives let you clearly anchor your investment rationale and check if the stock price lines up with your expectations.

Do you think there's more to the story for Lam Research? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives