- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Does Lam Research’s (LRCX) Dividend Move Reflect Growing Confidence in Its AI-Driven Strategy?

Reviewed by Sasha Jovanovic

- Lam Research Corporation recently announced its Board of Directors approved a quarterly dividend of $0.26 per share, to be paid on January 7, 2026, to shareholders of record as of December 3, 2025, and reported the results of its annual shareholder meeting, including a bylaw amendment and the outcome of a special meeting proposal vote.

- The announcement comes as Lam Research continues to experience strong demand for AI-driven semiconductor manufacturing equipment, which has shaped the company's outlook and heightened industry interest.

- We'll explore how Lam Research's continued innovation and recent shareholder actions could strengthen its long-term investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Lam Research Investment Narrative Recap

To believe in Lam Research as a shareholder, you need confidence in sustained demand for advanced semiconductor manufacturing equipment, spurred by AI, and trust in Lam's ability to maintain its technological edge amid shifting global spending and fierce competition. The recent dividend affirmation and bylaw amendment highlight strong governance and a focus on returning value, but these updates do not materially impact the primary near-term catalyst, which remains customer investment in AI-centric chipmaking tools, nor do they alter the key risk tied to exposure in China and customer concentration.

Among Lam Research’s recent announcements, the quarterly dividend increase to US$0.26 per share stands out. This highlights management’s commitment to regular cash returns as the company capitalizes on heightened AI-driven tool demand, yet it does little to affect visibility around future shifts in customer technology investment or the cyclical nature of wafer fab equipment spending.

In contrast, investors should be aware of how normalization in China demand or changes in major customer capital spending could...

Read the full narrative on Lam Research (it's free!)

Lam Research is projected to reach $23.6 billion in revenue and $6.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 8.5% and an earnings increase of $1.3 billion from the current earnings of $5.4 billion.

Uncover how Lam Research's forecasts yield a $158.02 fair value, a 6% upside to its current price.

Exploring Other Perspectives

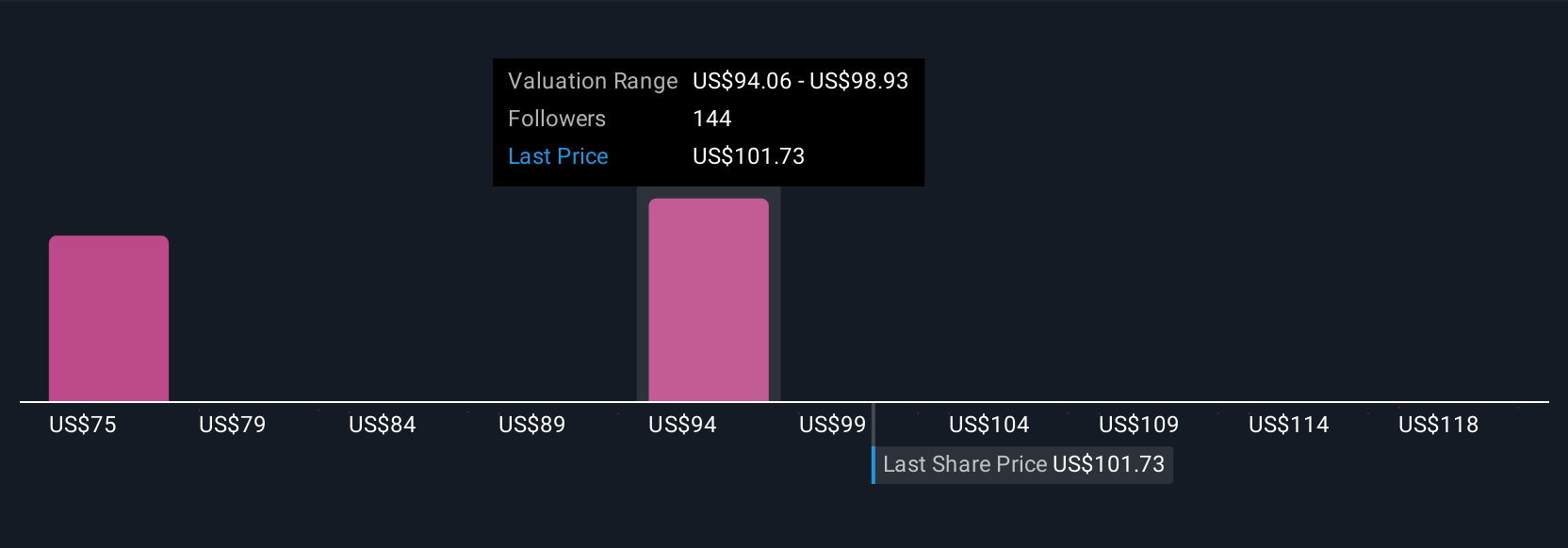

Seventeen fair value estimates from the Simply Wall St Community span a wide range, from US$63.53 to US$158.02 per share. Against this backdrop of differing views, the accelerating pace of AI-related equipment adoption remains a significant catalyst that could influence Lam Research’s performance. Explore these varied perspectives to inform your own outlook.

Explore 17 other fair value estimates on Lam Research - why the stock might be worth as much as 6% more than the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives