- United States

- /

- Semiconductors

- /

- NasdaqCM:LAES

SEALSQ (LAES) Is Up 5.1% After Quantum Chip Launch and NASDAQ Uplisting Approval Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- SEALSQ Corp has been approved to uplist to the NASDAQ Global Select Market effective October 27, 2025, while unveiling its NIST-standardized post-quantum secure chip and expanding U.S.-based operations and partnerships.

- This marks a significant operational milestone, underpinned by the announcement of nearly US$450 million in cash reserves and the company's growing leadership in quantum-safe cybersecurity and semiconductor innovation.

- We'll examine how SEALSQ's launch of the Quantum Shield QS7001 chip shapes its investment narrative around post-quantum technology leadership.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is SEALSQ's Investment Narrative?

Being a shareholder in SEALSQ right now means buying into the thesis that quantum-safe security is set to become a core requirement for critical infrastructure and global industries, and trusting that SEALSQ’s latest NASDAQ Global Select Market uplisting and product launch will drive meaningful momentum. The unveiling of the Quantum Shield QS7001 chip, a NIST-standardized, post-quantum secure solution, adds weight to near-term catalysts like sector leadership and regulatory tailwinds, especially as new U.S. and EU mandates push for PQC adoption. With a strong cash position and active U.S. expansion, the business appears positioned to accelerate, but the scale of recent share price moves, ongoing unprofitability, high board turnover, and a rapid pace of fundraising also sharpen near-term risks, particularly around volatility and further dilution. While the recent news provides a clear push for optimism, heightened volatility and fresh capital raises could remain front of mind for investors as SEALSQ’s execution is tested.

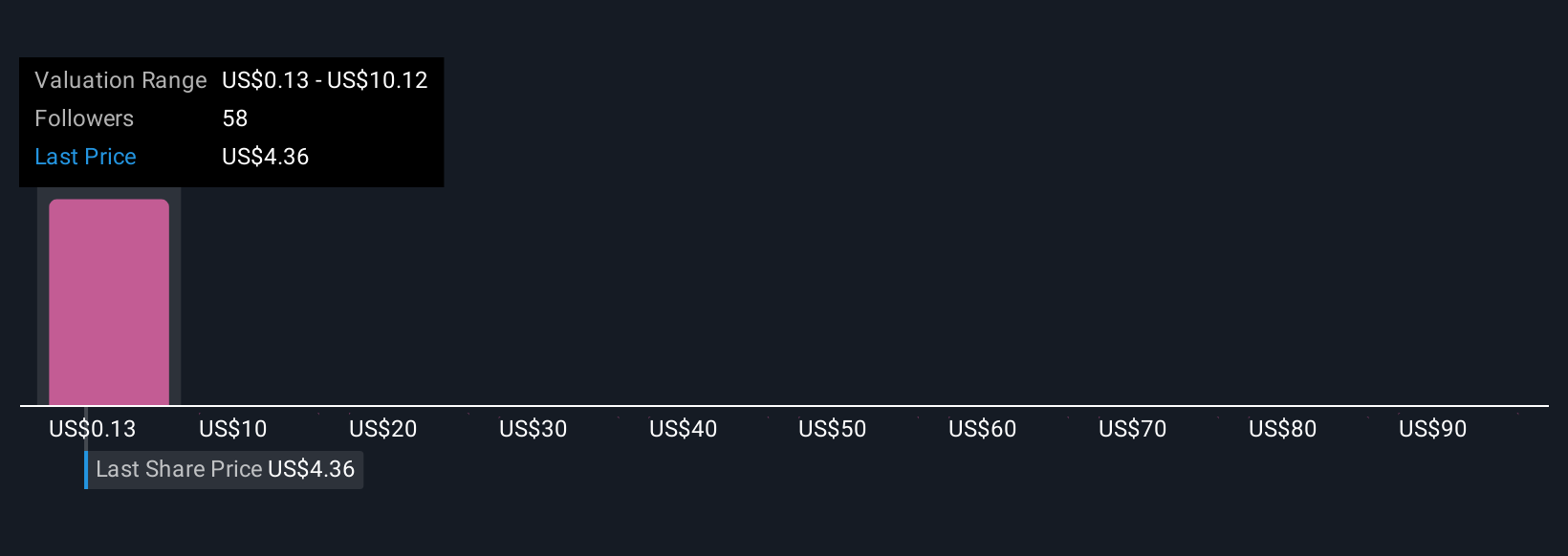

But with this much momentum, the risk of further dilution is a real concern for investors. Our valuation report here indicates SEALSQ may be overvalued.Exploring Other Perspectives

Explore 23 other fair value estimates on SEALSQ - why the stock might be worth less than half the current price!

Build Your Own SEALSQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEALSQ research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SEALSQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEALSQ's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LAES

SEALSQ

Designs, develops, and markets semiconductors in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives