- United States

- /

- Semiconductors

- /

- NasdaqCM:LAES

SEALSQ Corp (NASDAQ:LAES) May Have Run Too Fast Too Soon With Recent 35% Price Plummet

To the annoyance of some shareholders, SEALSQ Corp (NASDAQ:LAES) shares are down a considerable 35% in the last month, which continues a horrid run for the company. The good news is that in the last year, the stock has shone bright like a diamond, gaining 129%.

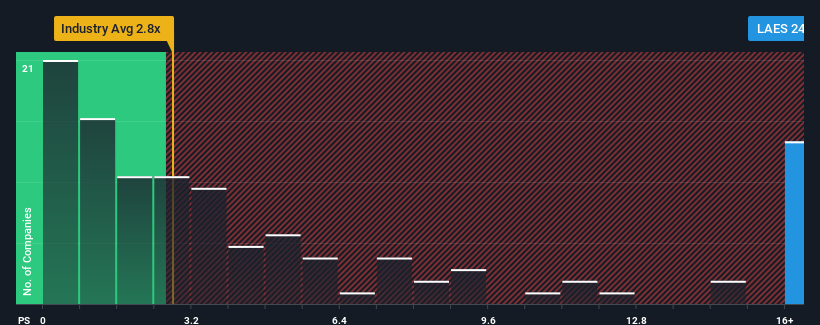

In spite of the heavy fall in price, you could still be forgiven for thinking SEALSQ is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 24.8x, considering almost half the companies in the United States' Semiconductor industry have P/S ratios below 2.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for SEALSQ

What Does SEALSQ's Recent Performance Look Like?

SEALSQ hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think SEALSQ's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For SEALSQ?

In order to justify its P/S ratio, SEALSQ would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 63%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 29% as estimated by the lone analyst watching the company. With the industry predicted to deliver 37% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that SEALSQ's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From SEALSQ's P/S?

A significant share price dive has done very little to deflate SEALSQ's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see SEALSQ trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with SEALSQ.

If you're unsure about the strength of SEALSQ's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LAES

SEALSQ

Designs, develops, and markets semiconductors in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives