- United States

- /

- Semiconductors

- /

- NasdaqCM:KOPN

Kopin Corporation's (NASDAQ:KOPN) Share Price Is Still Matching Investor Opinion Despite 35% Slump

Kopin Corporation (NASDAQ:KOPN) shares have retraced a considerable 35% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 188%.

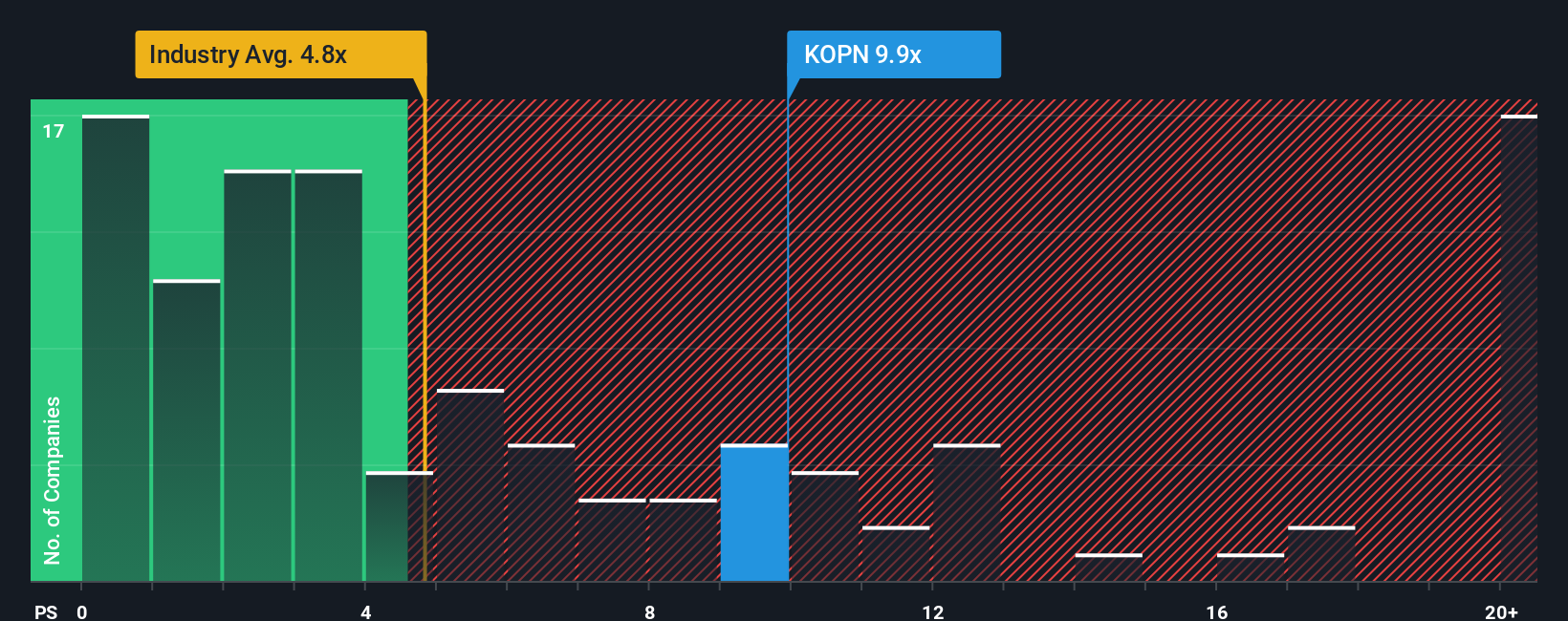

In spite of the heavy fall in price, Kopin may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.9x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4.8x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Kopin

How Has Kopin Performed Recently?

Kopin could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Kopin's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Kopin?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Kopin's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.1%. Still, lamentably revenue has fallen 5.8% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 31% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 27% per year, which is noticeably less attractive.

In light of this, it's understandable that Kopin's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

A significant share price dive has done very little to deflate Kopin's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Kopin's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Kopin is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Kopin's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kopin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KOPN

Kopin

Develops, manufactures, and sells microdisplays, subassemblies, and related components for defense, enterprise, industrial, and consumer products in the United States, the Asia-Pacific, Europe, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives