- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

Why You Should Leave Kulicke and Soffa Industries, Inc.'s (NASDAQ:KLIC) Upcoming Dividend On The Shelf

Readers hoping to buy Kulicke and Soffa Industries, Inc. (NASDAQ:KLIC) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 25th of June in order to be eligible for this dividend, which will be paid on the 13th of July.

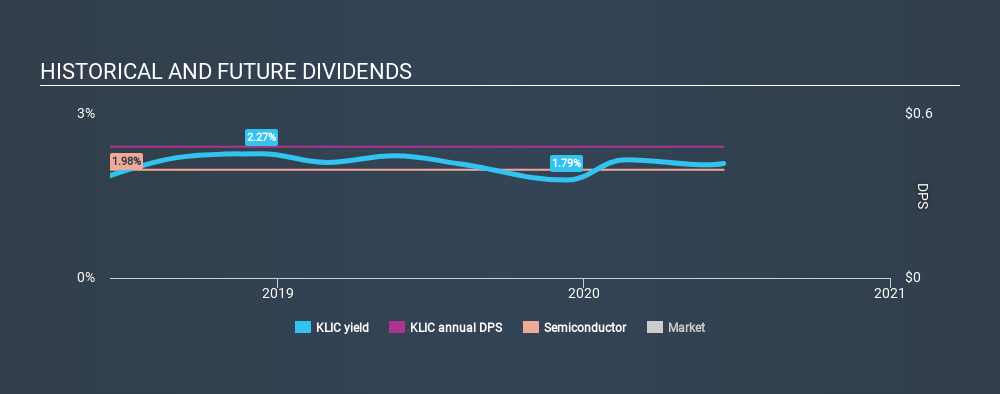

Kulicke and Soffa Industries's upcoming dividend is US$0.12 a share, following on from the last 12 months, when the company distributed a total of US$0.48 per share to shareholders. Looking at the last 12 months of distributions, Kulicke and Soffa Industries has a trailing yield of approximately 2.1% on its current stock price of $22.95. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Kulicke and Soffa Industries has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Kulicke and Soffa Industries

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Last year Kulicke and Soffa Industries paid out 93% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. A useful secondary check can be to evaluate whether Kulicke and Soffa Industries generated enough free cash flow to afford its dividend. It paid out an unsustainably high 265% of its free cash flow as dividends over the past 12 months, which is worrying. Our definition of free cash flow excludes cash generated from asset sales, so since Kulicke and Soffa Industries is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

Kulicke and Soffa Industries does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

As Kulicke and Soffa Industries's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Kulicke and Soffa Industries's earnings per share have fallen at approximately 8.9% a year over the previous five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. It looks like the Kulicke and Soffa Industries dividends are largely the same as they were two years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

The Bottom Line

From a dividend perspective, should investors buy or avoid Kulicke and Soffa Industries? Not only are earnings per share declining, but Kulicke and Soffa Industries is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. This is a clearly suboptimal combination that usually suggests the dividend is at risk of being cut. If not now, then perhaps in the future. It's not that we think Kulicke and Soffa Industries is a bad company, but these characteristics don't generally lead to outstanding dividend performance.

With that in mind though, if the poor dividend characteristics of Kulicke and Soffa Industries don't faze you, it's worth being mindful of the risks involved with this business. In terms of investment risks, we've identified 2 warning signs with Kulicke and Soffa Industries and understanding them should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Engages in the design, manufacture, and sale of capital equipment and tools used to assemble semiconductor devices.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives