- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

How Investors May Respond To Kulicke and Soffa (KLIC) AI Partnership With Lavorro for Smart Manufacturing

Reviewed by Simply Wall St

- Kulicke and Soffa Industries recently announced a partnership with Lavorro Inc. to deliver advanced smart manufacturing solutions across the semiconductor sector, utilizing AI-driven virtual assistants like "Lucy" for diagnostic, optimization, and maintenance support.

- This collaboration aims to formalize expert knowledge and automate workflows, potentially accelerating onboarding, improving yield, and enhancing operational efficiency for semiconductor manufacturers.

- We'll explore how the integration of Lavorro's AI-powered virtual assistants could influence Kulicke and Soffa's position in digital manufacturing innovation.

What Is Kulicke and Soffa Industries' Investment Narrative?

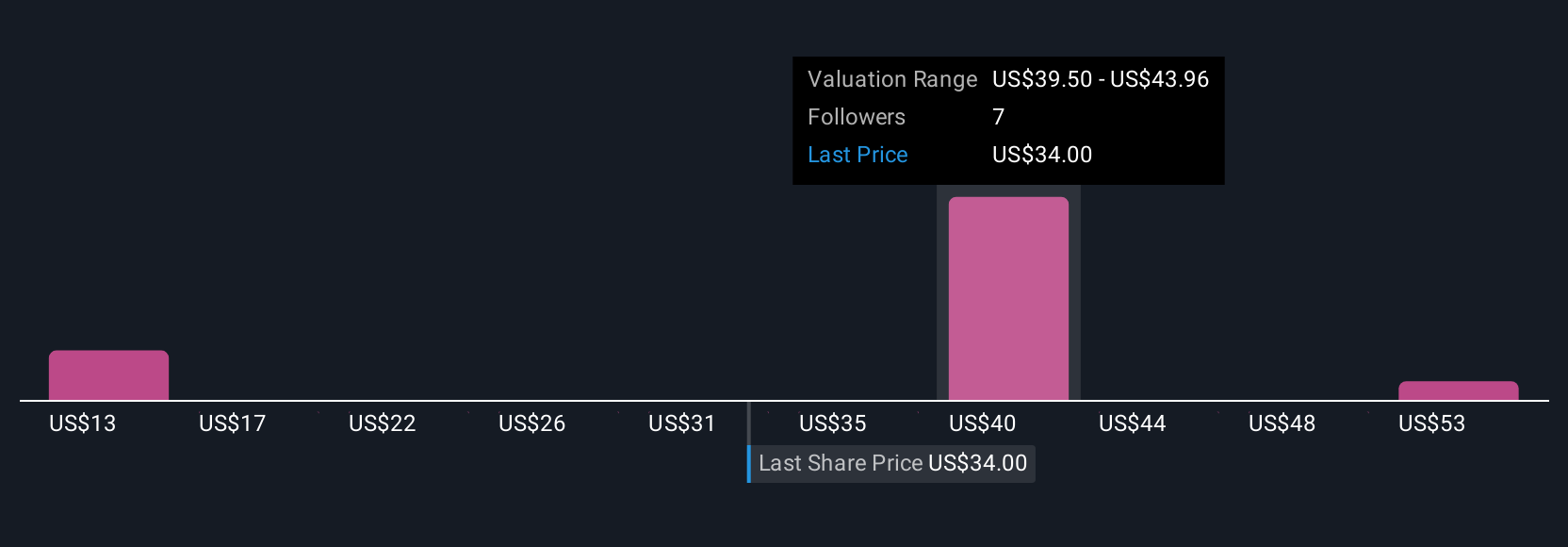

To be a shareholder in Kulicke and Soffa Industries (KLIC), you typically want to have conviction in the company's ability to adapt to shifts in semiconductor manufacturing, especially as automation and AI begin reshaping the sector. Recent financials showed KLIC just returned to profitability, but several quarters of losses and a substantial one-off item have weighed on results. The new partnership with Lavorro Inc. brings a timely catalyst; it positions KLIC at the forefront of AI-powered manufacturing and could sharpen their competitive edge in both operational and workforce efficiency. Yet, the initial market response has been muted, suggesting investors see this as a long-term rather than immediate inflection. Meanwhile, key risks such as thin dividend coverage and expensive valuations against peers remain. Whether this AI alliance will meaningfully reduce KLIC's earnings and margin volatility is an open question, but it does hint at evolving catalysts and possibly a more resilient business model ahead. On the other hand, pricing remains high compared to peers and is something investors should be aware of.

Kulicke and Soffa Industries' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Engages in the design, manufacture, and sale of capital equipment and tools used to assemble semiconductor devices.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives