- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

Assessing Kulicke and Soffa Industries (KLIC) Valuation After Recent Share Price Recovery

Reviewed by Simply Wall St

Kulicke and Soffa Industries (KLIC) shares have shown steady movement over the past month, catching the attention of investors interested in semiconductor sector trends. Let us break down some recent performance data and what it could mean for shareholders.

See our latest analysis for Kulicke and Soffa Industries.

Zooming out, Kulicke and Soffa’s share price has rebounded by more than 20% over the past 90 days, regaining some ground after a challenging start to the year. While the 1-year total shareholder return stands at -11.8%, the five-year figure is still an impressive 65% gain. This highlights the stock’s long-term growth potential and resilience as investor sentiment recovers.

If you want to see what’s possible beyond semiconductors, this could be the moment to broaden your search and discover fast growing stocks with high insider ownership

With gains in recent months but a muted long-term return, the big question for Kulicke and Soffa Industries is clear: Is there genuine value left for new investors, or has the market already priced in future growth?

Price-to-Sales of 3.2x: Is it justified?

Kulicke and Soffa Industries currently trades at a price-to-sales (P/S) ratio of 3.2x, lower than the US Semiconductor industry average of 5.3x. This suggests that the market is assigning a more conservative valuation to KLIC’s revenue stream compared to industry peers, even as the share price has recently recovered.

The price-to-sales ratio measures how much investors are willing to pay for each dollar of a company’s sales. For semiconductor companies, this multiple is particularly relevant because earnings often fluctuate with industry cycles, so sales provide a more stable measure of value.

For KLIC, the P/S of 3.2x appears attractive in comparison to the sector, which could mean the market anticipates slower growth ahead or is cautious after the company’s return to profitability. However, when compared with an estimated fair P/S ratio of 3.9x, there is room for the market’s view to adjust if forecasts prove to be correct.

With the current discount to both industry peers and the fair ratio, investors should monitor future results to determine whether there is potential for a re-rating.

Explore the SWS fair ratio for Kulicke and Soffa Industries

Result: Price-to-Sales of 3.2x (UNDERVALUED)

However, slower revenue momentum or weaker-than-expected earnings growth could quickly challenge the view that Kulicke and Soffa remains undervalued at current levels.

Find out about the key risks to this Kulicke and Soffa Industries narrative.

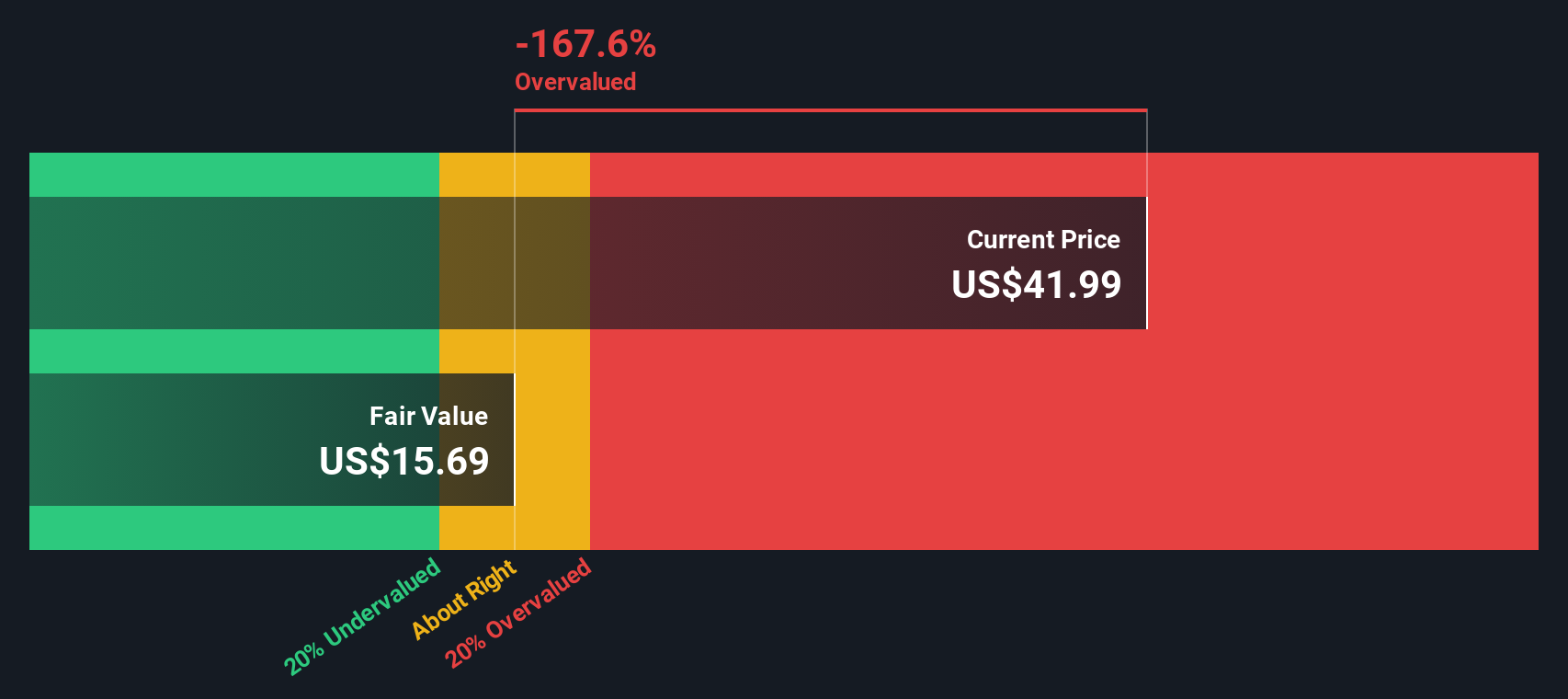

Another View: DCF Model Points to Overvaluation

Looking at Kulicke and Soffa Industries through the lens of the SWS DCF model, a very different picture emerges. The DCF model currently estimates a fair value of just $15.47 per share, which is well below the recent trading price of $40.99. This method suggests the stock may actually be overvalued right now. Could market optimism be running hot, or does the model miss something fundamental?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kulicke and Soffa Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kulicke and Soffa Industries Narrative

If you want to dive into the numbers and chart your own course, you can quickly build your own perspective with just a few clicks. Do it your way.

A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh opportunities on their radar. Give yourself an edge by looking beyond the headlines and catching trends before the crowd reacts.

- Capitalize on tiny companies making big moves. Check out these 3575 penny stocks with strong financials before these breakout stocks gain wider attention.

- Position for the future of medicine with these 34 healthcare AI stocks and find healthcare leaders harnessing AI for innovation and growth.

- Boost your income potential with these 21 dividend stocks with yields > 3% to spot solid businesses paying attractive yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Engages in the design, manufacture, and sale of capital equipment and tools used to assemble semiconductor devices.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives