- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Earnings Update: KLA Corporation (NASDAQ:KLAC) Just Reported Its First-Quarter Results And Analysts Are Updating Their Forecasts

KLA Corporation (NASDAQ:KLAC) just released its latest quarterly results and things are looking bullish. Results were good overall, with revenues beating analyst predictions by 3.4% to hit US$1.5b. Statutory earnings per share (EPS) came in at US$2.69, some 4.3% above whatthe analysts had expected. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on KLA after the latest results.

Check out our latest analysis for KLA

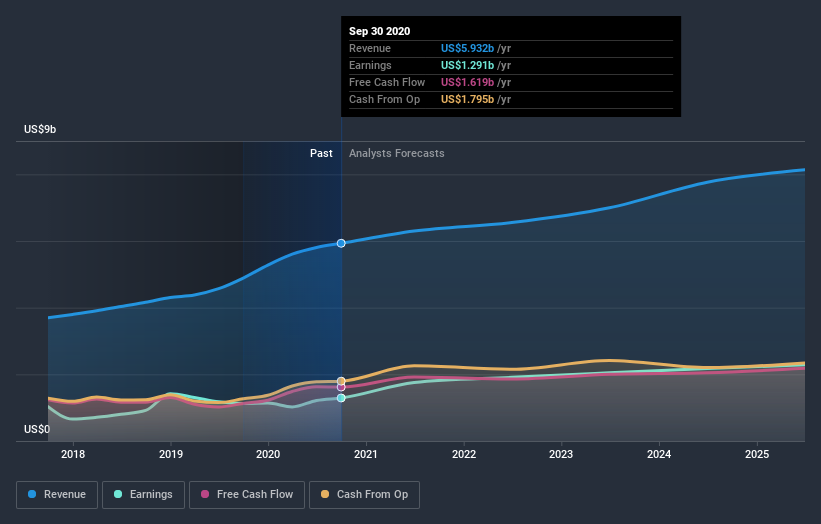

Taking into account the latest results, the most recent consensus for KLA from 14 analysts is for revenues of US$6.30b in 2021 which, if met, would be a reasonable 6.2% increase on its sales over the past 12 months. Statutory earnings per share are predicted to leap 34% to US$11.13. In the lead-up to this report, the analysts had been modelling revenues of US$6.03b and earnings per share (EPS) of US$10.52 in 2021. It looks like there's been a modest increase in sentiment following the latest results, withthe analysts becoming a bit more optimistic in their predictions for both revenues and earnings.

Despite these upgrades,the analysts have not made any major changes to their price target of US$221, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic KLA analyst has a price target of US$278 per share, while the most pessimistic values it at US$170. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the KLA's past performance and to peers in the same industry. We would highlight that KLA's revenue growth is expected to slow, with forecast 6.2% increase next year well below the historical 15%p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 9.7% next year. Factoring in the forecast slowdown in growth, it seems obvious that KLA is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards KLA following these results. Fortunately, they also upgraded their revenue estimates, although our data indicates sales are expected to perform worse than the wider industry. The consensus price target held steady at US$221, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple KLA analysts - going out to 2025, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 2 warning signs for KLA you should know about.

When trading KLA or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026