- United States

- /

- Semiconductors

- /

- NasdaqGS:ICHR

Revenues Working Against Ichor Holdings, Ltd.'s (NASDAQ:ICHR) Share Price

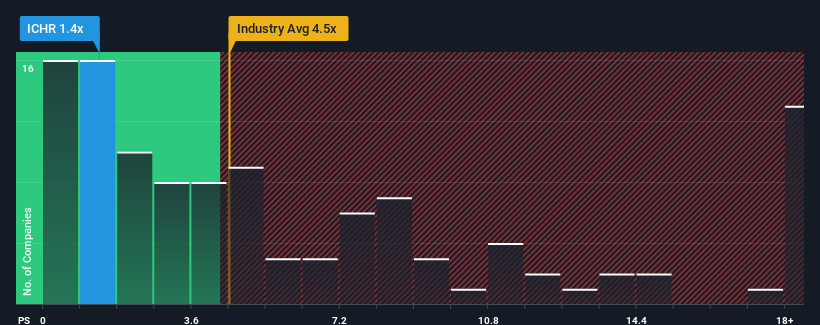

With a price-to-sales (or "P/S") ratio of 1.4x Ichor Holdings, Ltd. (NASDAQ:ICHR) may be sending very bullish signals at the moment, given that almost half of all the Semiconductor companies in the United States have P/S ratios greater than 4.5x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Ichor Holdings

How Ichor Holdings Has Been Performing

Ichor Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Ichor Holdings will help you uncover what's on the horizon.How Is Ichor Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Ichor Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. As a result, revenue from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 8.0% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 25% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Ichor Holdings' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Ichor Holdings' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Ichor Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ichor Holdings you should know about.

If these risks are making you reconsider your opinion on Ichor Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ICHR

Ichor Holdings

Engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives