- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

What Himax Technologies (HIMX)'s Steep Q3 Revenue and Profit Drop Means For Shareholders

Reviewed by Sasha Jovanovic

- Himax Technologies recently reported its third quarter 2025 financial results, revealing US$199.16 million in revenue and US$1.07 million in net income, both lower than the same quarter last year.

- Profitability fell sharply, with diluted earnings per share from continuing operations dropping to US$0.012, reflecting ongoing pressures on margins for the company.

- We'll explore how the substantial year-over-year decline in revenue and profit could reshape expectations within Himax's investment narrative.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Himax Technologies Investment Narrative Recap

To be a Himax Technologies shareholder, one needs to believe in the company's capacity to leverage its strengths in display IC innovation, automotive, and AI partnerships while navigating a highly cyclical and competitive semiconductor market. The recent quarterly results, which showed a sharp year-over-year fall in both revenue and net income, put immediate focus on persistent weak demand and margin pressures, amplifying short-term concerns. This news is material to the biggest short-term catalyst, which is a turnaround in customer demand, and heightens the largest risk around earnings volatility due to sluggish end-market activity.

Among recent announcements, Himax's expansion of its WiseEye technology into Acer’s Swift Edge 14 AI notebook stands out for its relevance. This move demonstrates the company’s continued push into AI-powered consumer devices, an area expected to be a future revenue driver if adoption broadens. However, the scale and timing of contributions from these design wins remain uncertain in the context of current sluggish demand trends.

In contrast, what often gets overlooked is the ongoing risk that weak visibility and delayed customer orders pose for...

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies' narrative projects $1.1 billion revenue and $139.3 million earnings by 2028. This requires 7.4% yearly revenue growth and a $65.1 million earnings increase from $74.2 million today.

Uncover how Himax Technologies' forecasts yield a $8.74 fair value, a 4% downside to its current price.

Exploring Other Perspectives

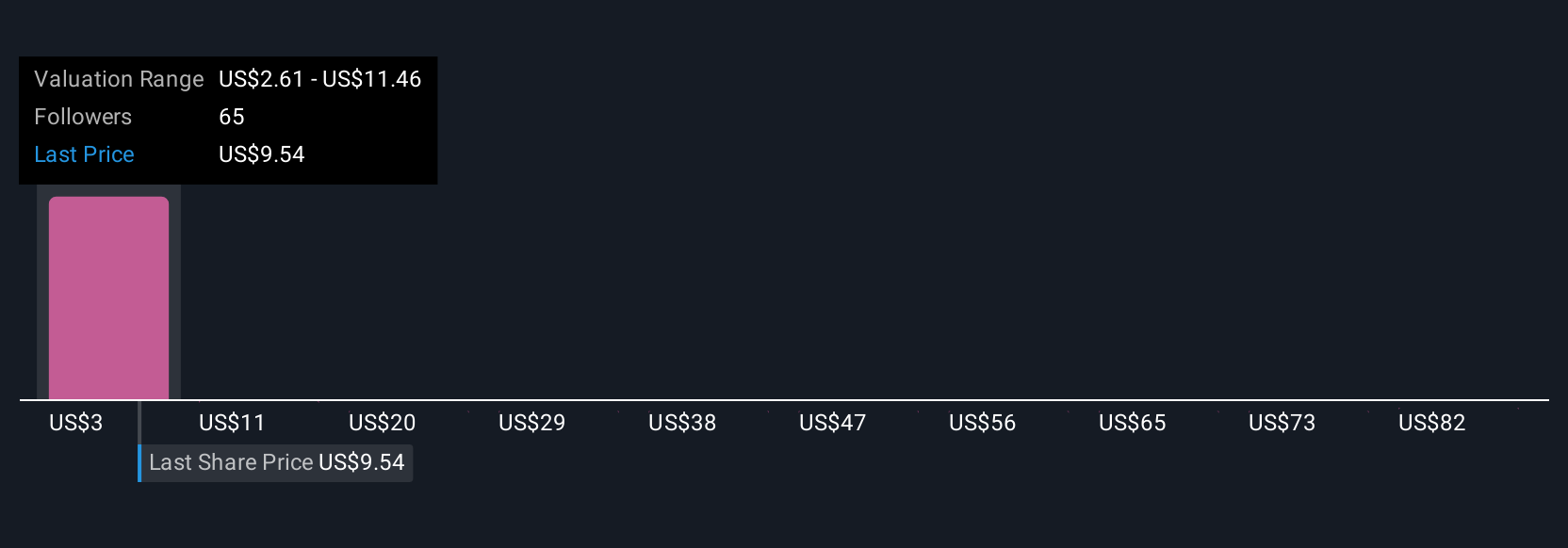

Eight fair value estimates from the Simply Wall St Community span US$1.82 to US$91.18, highlighting extremely broad views on Himax’s potential. With such differing opinions, it’s vital to consider the overlooked risk from customer order delays and weak visibility as you assess the company's prospects.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth over 10x more than the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives