- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Subdued Growth No Barrier To Himax Technologies, Inc. (NASDAQ:HIMX) With Shares Advancing 77%

Himax Technologies, Inc. (NASDAQ:HIMX) shareholders have had their patience rewarded with a 77% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 65%.

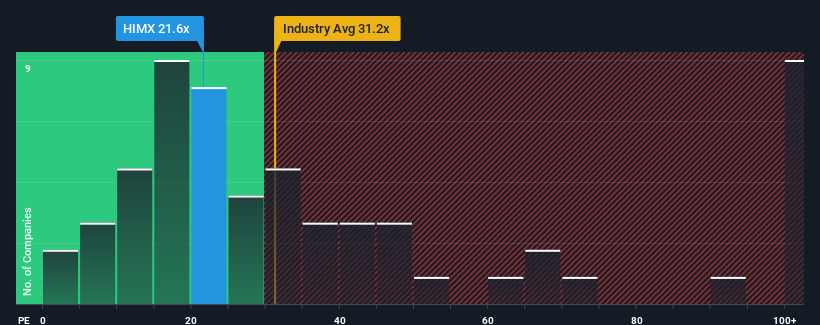

After such a large jump in price, Himax Technologies may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 21.6x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's superior to most other companies of late, Himax Technologies has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Himax Technologies

How Is Himax Technologies' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Himax Technologies' to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen an unpleasant 76% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 4.2% over the next year. With the market predicted to deliver 15% growth , that's a disappointing outcome.

In light of this, it's alarming that Himax Technologies' P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Himax Technologies shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Himax Technologies currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Himax Technologies that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives