- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

How Do Recent AR VR Partnerships Impact Himax Technologies Valuation in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Himax Technologies is undervalued right now? You are not alone as many savvy investors are digging into the numbers to see if there is a bargain to be had.

- Despite a rocky short-term ride with a 9.2% drop over the last week and a 22.0% decrease in the past month, Himax has still returned an impressive 44.3% over the past year.

- Market chatter recently ramped up after announcements related to new product launches in the AR/VR space and strategic partnerships with major display manufacturers. These developments have spotlighted Himax’s positioning in fast-growing tech segments, adding fresh context to its share price volatility.

- On the valuation front, Himax scores 3 out of 6 on our valuation checks, suggesting there is room for both opportunity and caution. In the next sections, we will break down how we measure value. Keep reading, as we will also share a smarter way to get the full valuation picture.

Find out why Himax Technologies's 44.3% return over the last year is lagging behind its peers.

Approach 1: Himax Technologies Discounted Cash Flow (DCF) Analysis

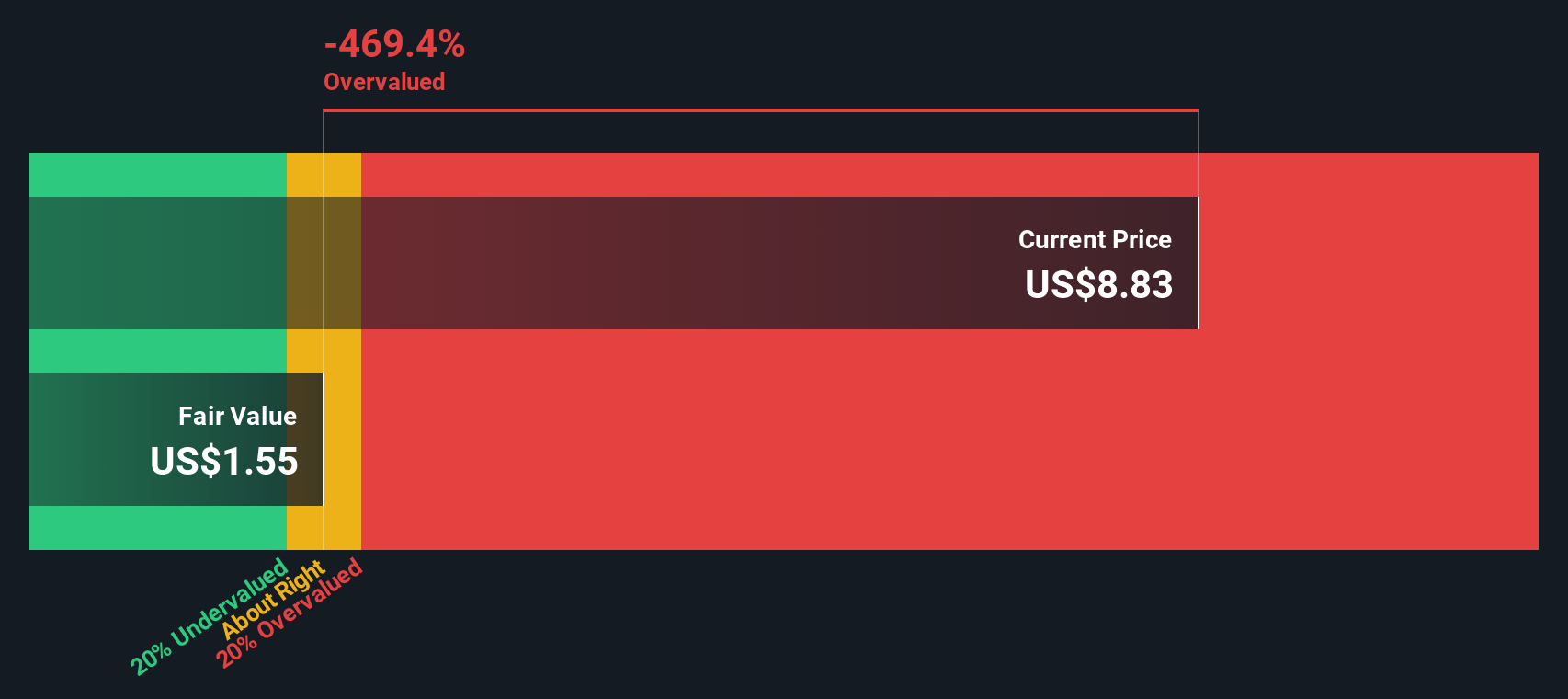

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge whether the current stock price reflects the fundamental cash generation potential of the business.

For Himax Technologies, the DCF method draws on recent results and forward estimates. The company’s last twelve months of free cash flow totaled $141 million. Analysts expect this figure to fluctuate but stabilize around $35 to $58 million per year over the next decade. Notably, projections for 2026 are at $58.65 million, tapering down to around $35.55 million by 2035, as extrapolated by Simply Wall St’s two-stage model.

Based on these cash flows, the DCF model calculates an intrinsic value of $1.85 per share. With Himax currently trading far above this estimate, the DCF analysis suggests the stock is 291.6% overvalued right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Himax Technologies may be overvalued by 291.6%. Discover 894 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Himax Technologies Price vs Earnings

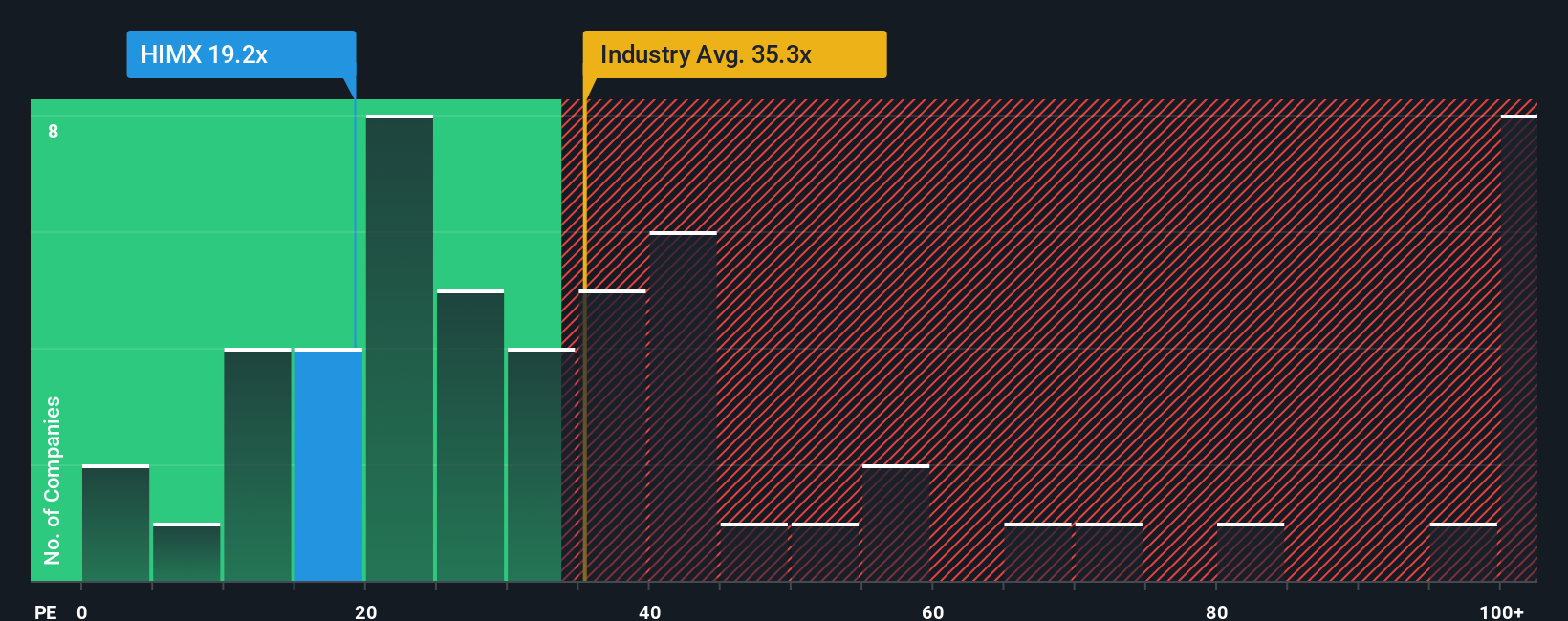

For profitable companies like Himax Technologies, the Price-to-Earnings (PE) ratio is one of the most trusted indicators of valuation. This metric lets investors quickly compare how much they are paying for each dollar of current earnings. A higher PE suggests the market expects stronger growth or lower risk, while a lower PE may mean expectations are muted or there are company-specific concerns.

Currently, Himax Technologies is trading at a PE ratio of 20.33x. To put that into context, the semiconductor industry averages a PE of 34.37x, and the company’s peer group sits even higher at 56.19x. On the surface, Himax appears to be trading at a noticeable discount compared to these basic benchmarks, which might catch the eye of value-focused investors.

However, Simply Wall St’s proprietary Fair Ratio goes a step further. Rather than relying solely on sector or peer comparisons, the Fair Ratio factors in Himax’s unique fundamentals, including its earnings growth, risk profile, profit margins, and market capitalization. This tailored approach means investors get a fair value estimate that truly reflects the business’s strengths and weaknesses.

For Himax, the Fair Ratio is calculated at 34.08x. With the actual PE at 20.33x, there is a significant gap. This suggests the market may be underestimating the company’s true value based on its performance and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Himax Technologies Narrative

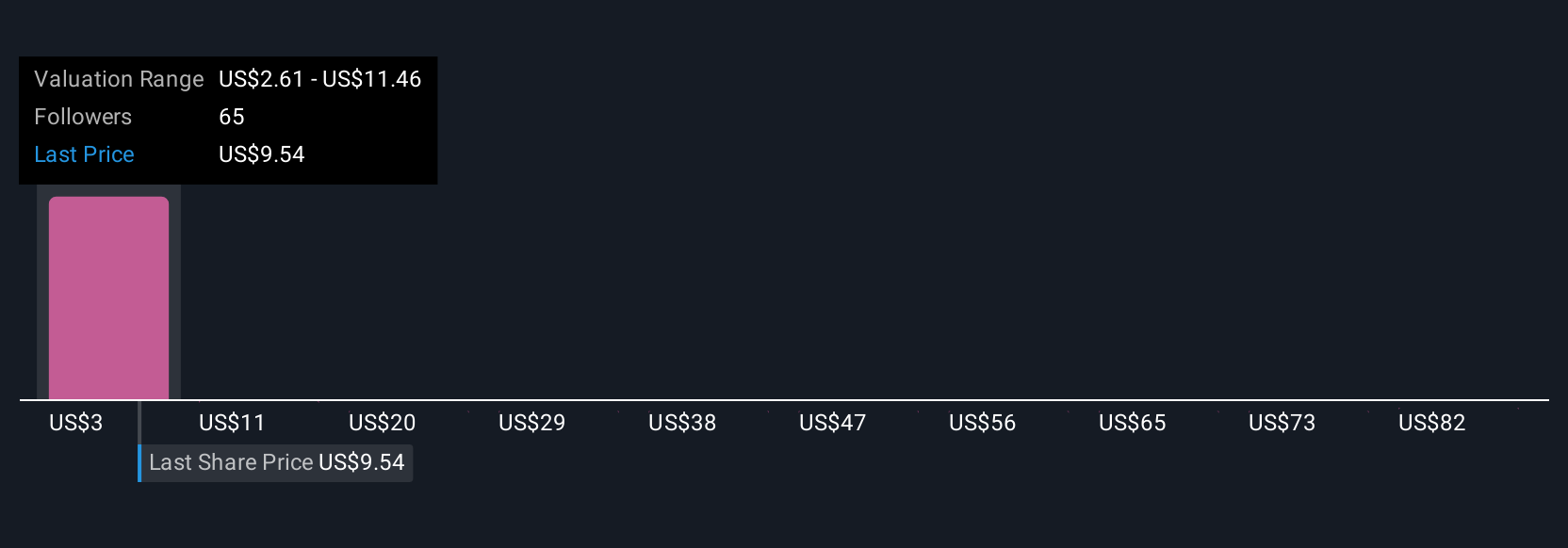

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative gives investors the power to capture their personal view or “story” about a company, connecting what they believe about its future with a set of numbers, like estimated fair value, future revenues, earnings, and margins.

With Narratives, you can link your unique perspective on Himax Technologies directly to a financial forecast and a fair value, transforming research from static numbers into a living, breathing investment case. Narratives are easy to use and accessible on Simply Wall St’s Community page, where millions of investors share and compare their insights.

Narratives help you make smarter buy or sell decisions by showing how your fair value estimate stacks up against today’s share price. Best of all, they update automatically whenever new information such as earnings results or industry news arrives, ensuring your view stays relevant.

For example, in the Himax Technologies Community, one investor’s narrative might forecast major revenue and margin growth from expanding automotive and AI display technologies, resulting in a bullish price target of $11.6. Another investor may focus on margin risks and competition, seeing limited upside and setting a conservative target of $7.0. Whichever “story” you believe, Narratives let you invest accordingly with clarity and confidence.

Do you think there's more to the story for Himax Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives