- United States

- /

- Semiconductors

- /

- NasdaqGS:GSIT

GSI Technology, Inc. (NASDAQ:GSIT) Stock Rockets 201% As Investors Are Less Pessimistic Than Expected

The GSI Technology, Inc. (NASDAQ:GSIT) share price has done very well over the last month, posting an excellent gain of 201%. The annual gain comes to 248% following the latest surge, making investors sit up and take notice.

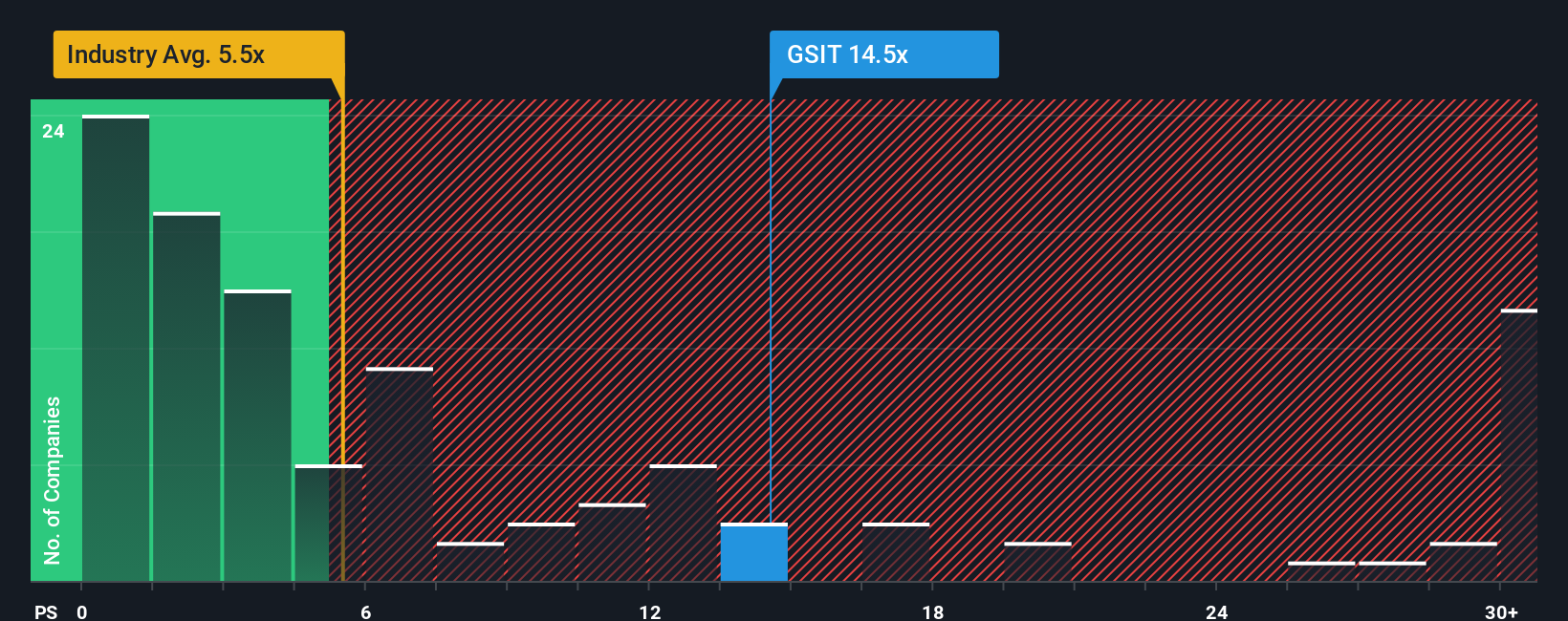

Following the firm bounce in price, GSI Technology may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 14.5x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 5.5x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for GSI Technology

How Has GSI Technology Performed Recently?

The recent revenue growth at GSI Technology would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for GSI Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, GSI Technology would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 6.1% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 34% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 37% shows it's an unpleasant look.

In light of this, it's alarming that GSI Technology's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

GSI Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that GSI Technology currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

It is also worth noting that we have found 1 warning sign for GSI Technology that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GSIT

GSI Technology

Designs, develops, and markets semiconductor memory solutions for networking, industrial, test equipment, medical, aerospace, and military customers in the United States, China, Singapore, Germany, the Netherlands, and internationally.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives