- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

How Investors May Respond To First Solar (FSLR) Expanding US Capacity With New Louisiana Mega-Plant

Reviewed by Sasha Jovanovic

- First Solar has inaugurated its US$1.1 billion, 2.4 million square foot fully integrated solar manufacturing facility in Iberia Parish, Louisiana, expected to employ over 800 people and add 3.5 GW of annual capacity, further expanding its American manufacturing footprint alongside a planned new plant in South Carolina.

- This expansion solidifies First Solar's position as the largest solar technology manufacturer in the Western Hemisphere and reflects a cumulative investment of approximately US$4.5 billion in American manufacturing and R&D since 2019.

- We'll explore how the substantial capacity increase from First Solar's new Louisiana plant could shape the outlook for its US manufacturing growth.

Find companies with promising cash flow potential yet trading below their fair value.

First Solar Investment Narrative Recap

To be a First Solar shareholder, you need to believe in the continued expansion of US-based solar manufacturing and the supportive policy environment that underpins demand for domestic modules. While the new Louisiana facility meaningfully boosts production capacity, its impact on the near-term outlook appears modest, with US policy stability still the primary catalyst, and the biggest risk, given First Solar's reliance on government incentives for margin protection.

Of the recent announcements, the planned Gaffney, South Carolina facility is especially relevant as it further localizes production, offering greater compliance with expected FEOC rules and bolstering First Solar’s ability to meet domestic content requirements, one key factor supporting forward demand and pricing power.

By contrast, investors should be aware of how any changes to US policy support or incentives could quickly shift...

Read the full narrative on First Solar (it's free!)

First Solar's outlook anticipates $7.0 billion in revenue and $3.2 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 17.4% and a $1.9 billion increase in earnings from current levels of $1.3 billion.

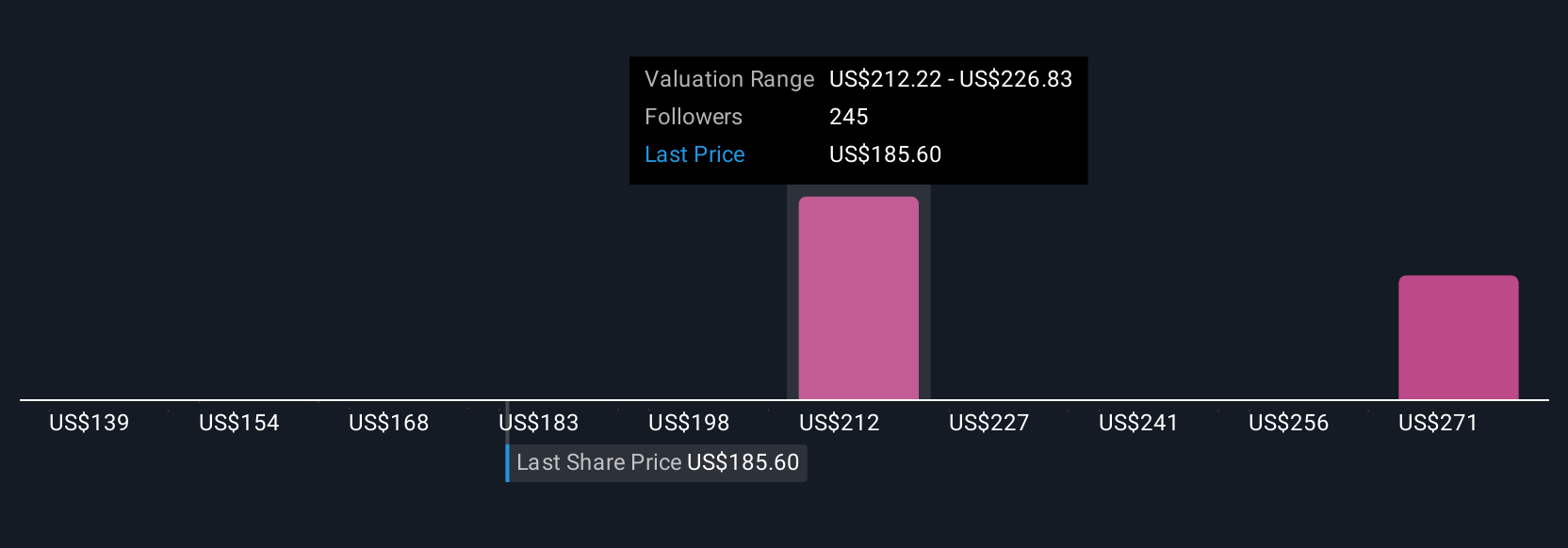

Uncover how First Solar's forecasts yield a $269.64 fair value, a 8% upside to its current price.

Exploring Other Perspectives

You’ll find 28 unique fair value estimates from Simply Wall St Community members, spanning US$142 to US$481 per share. With US policy and manufacturing catalysts in play, explore how different outlooks reflect the risks and opportunities facing First Solar’s performance.

Explore 28 other fair value estimates on First Solar - why the stock might be worth as much as 93% more than the current price!

Build Your Own First Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free First Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Solar's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives