- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

Here's Why We Think First Solar (NASDAQ:FSLR) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like First Solar (NASDAQ:FSLR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide First Solar with the means to add long-term value to shareholders.

View our latest analysis for First Solar

How Fast Is First Solar Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. It certainly is nice to see that First Solar has managed to grow EPS by 25% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

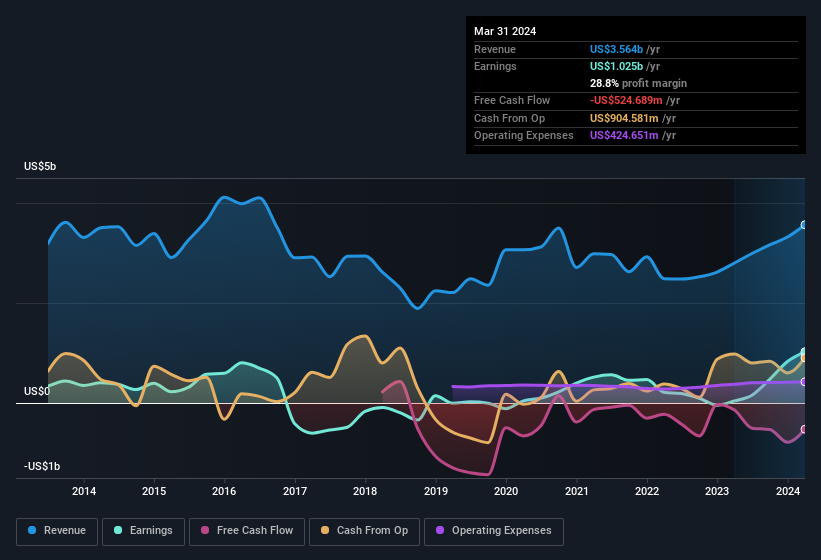

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. First Solar shareholders can take confidence from the fact that EBIT margins are up from -5.2% to 31%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for First Solar's future EPS 100% free.

Are First Solar Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While there was some insider selling, that pales in comparison to the US$74m that the company insider, Farhad Ebrahimi spent acquiring shares. We should note the average purchase price was around US$148. It's not often you see purchases like this and so it should be on the radar of everyone who follows First Solar.

Along with the insider buying, another encouraging sign for First Solar is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$1.3b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Mark Widmar, is paid less than the median for similar sized companies. For companies with market capitalisations over US$8.0b, like First Solar, the median CEO pay is around US$14m.

First Solar's CEO took home a total compensation package worth US$7.7m in the year leading up to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add First Solar To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into First Solar's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. Still, you should learn about the 2 warning signs we've spotted with First Solar (including 1 which shouldn't be ignored).

The good news is that First Solar is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives