- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (FSLR) Is Up 10.6% After Record Shipments but Lowers Outlook—What’s Next?

Reviewed by Sasha Jovanovic

- First Solar reported its third-quarter 2025 earnings in the past week, achieving record module shipments of 5.3 GW and increasing quarterly sales to US$1.59 billion and net income to US$455.94 million, while revising full-year guidance downward due to contract cancellations and supply chain issues.

- The company announced plans to expand U.S. manufacturing capacity with a new 3.7 GW factory, highlighted a robust order backlog, and reiterated strong demand despite operational hurdles.

- We'll explore how First Solar's manufacturing expansion and resilience amid operational disruptions now shape the company's investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

First Solar Investment Narrative Recap

Being a First Solar shareholder typically means believing in the resilience of U.S.-centric solar manufacturing and the ongoing benefits of renewable energy policy support. The latest earnings results, while showing strong shipment growth and robust sales, do not materially alter the most important near-term catalyst: growing U.S. capacity to meet demand under supportive policy, even as the biggest risk remains potential contract terminations and overdue payments impacting short-term earnings stability.

Among recent announcements, the revised full-year guidance, reflecting lower anticipated sales after significant contract cancellations, stands out as it directly relates to the short-term risks highlighted by the Q3 results. This context intensifies the company's challenge of balancing expanding production capacity with ensuring customer commitments, reinforcing the importance of closely watching contract enforcement and payment trends.

On the flip side, keep in mind that contract defaults, especially among large utility customers, may be a warning sign investors should not ignore since...

Read the full narrative on First Solar (it's free!)

First Solar's outlook anticipates $7.0 billion in revenue and $3.2 billion in earnings by 2028. This scenario relies on a 17.4% annual revenue growth rate and a $1.9 billion increase in earnings from the current $1.3 billion level.

Uncover how First Solar's forecasts yield a $259.11 fair value, a 3% downside to its current price.

Exploring Other Perspectives

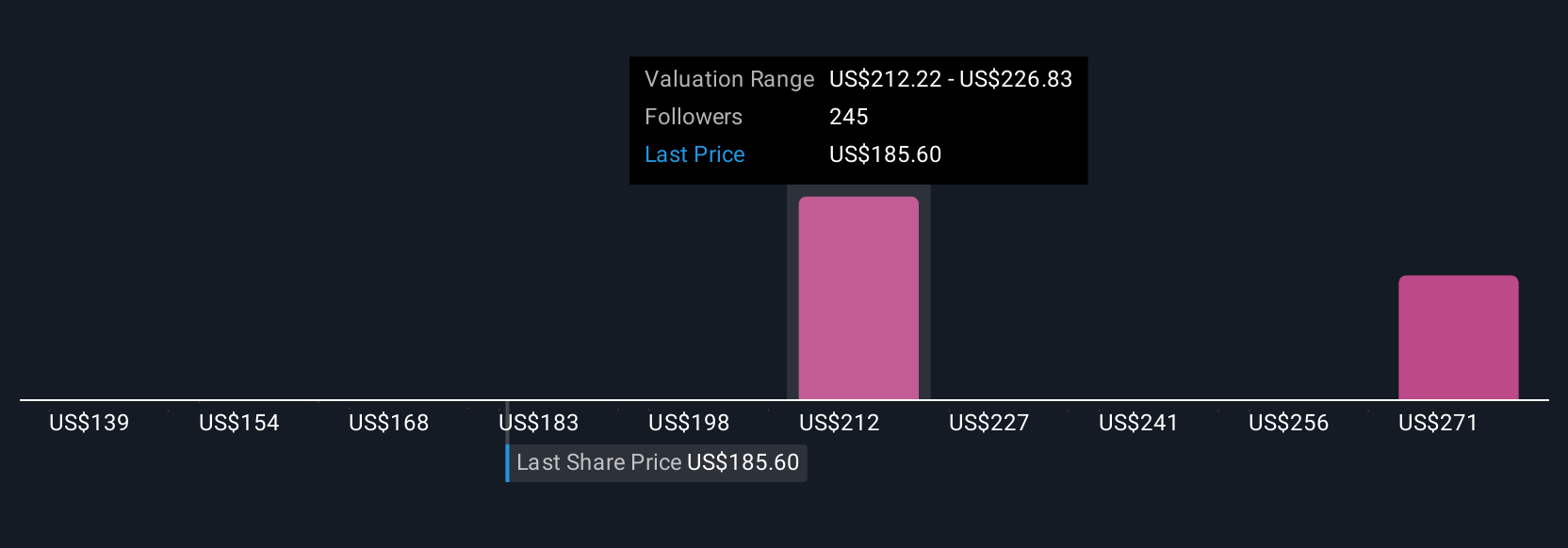

Twenty-eight members of the Simply Wall St Community value First Solar anywhere from US$142 to nearly US$500 per share. With contract terminations now shaping earnings expectations, this range invites you to explore why opinions on First Solar’s future differ so widely.

Explore 28 other fair value estimates on First Solar - why the stock might be worth as much as 87% more than the current price!

Build Your Own First Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Solar research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free First Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Solar's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives