- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

FormFactor (FORM) Is Up 27.3% After Beating Q3 Estimates and Issuing Strong Revenue Outlook – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- FormFactor, Inc. recently reported third-quarter results that exceeded analyst expectations, with revenue of US$202.68 million surpassing guidance and net income per diluted share also ahead of estimates. The company issued a strong outlook for the fourth quarter, projecting revenue of US$210 million plus or minus US$5 million and non-GAAP net income per share of US$0.19 plus or minus US$0.04, highlighting ongoing operational improvements and robust demand in advanced semiconductor testing markets.

- An interesting takeaway is that FormFactor's ongoing margin improvement initiatives and cost reductions are positioning it to capture a greater share of growth driven by advanced packaging and high bandwidth memory segments.

- We'll now explore how FormFactor's upbeat revenue guidance amid strengthening demand in advanced chip markets shapes its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

FormFactor Investment Narrative Recap

To believe in FormFactor as a shareholder, you need confidence in its ability to build on advanced semiconductor testing demand and deliver gross margin improvements while managing margin risks from product mix and cost pressures. The recent upbeat quarterly results and raised fourth-quarter guidance reinforce FormFactor’s status as a key player in the advanced packaging and high bandwidth memory markets, but the most important short-term catalyst remains sustained demand in these segments, while gross margin pressure due to higher costs and product mix still stands as the biggest risk. While the news validates robust demand and margin progress, it does not eliminate the ongoing vulnerability to margin compression from unfavorable mix and rising expenses.

Among recent announcements, the ramp-up of FormFactor’s new Farmers Branch, Texas manufacturing facility stands out. This development directly ties to the catalysts of improving operational efficiency and expanding capacity to serve growth areas like high bandwidth memory and AI applications, aligned with management's strategy to address cost and margin headwinds.

However, in contrast to revenue momentum, investors should be aware of risks if gross margin improvements stall or are offset by rising costs and unfavorable product mix...

Read the full narrative on FormFactor (it's free!)

FormFactor's narrative projects $984.3 million revenue and $97.0 million earnings by 2028. This requires 8.8% yearly revenue growth and a $53.1 million earnings increase from $43.9 million currently.

Uncover how FormFactor's forecasts yield a $35.25 fair value, a 36% downside to its current price.

Exploring Other Perspectives

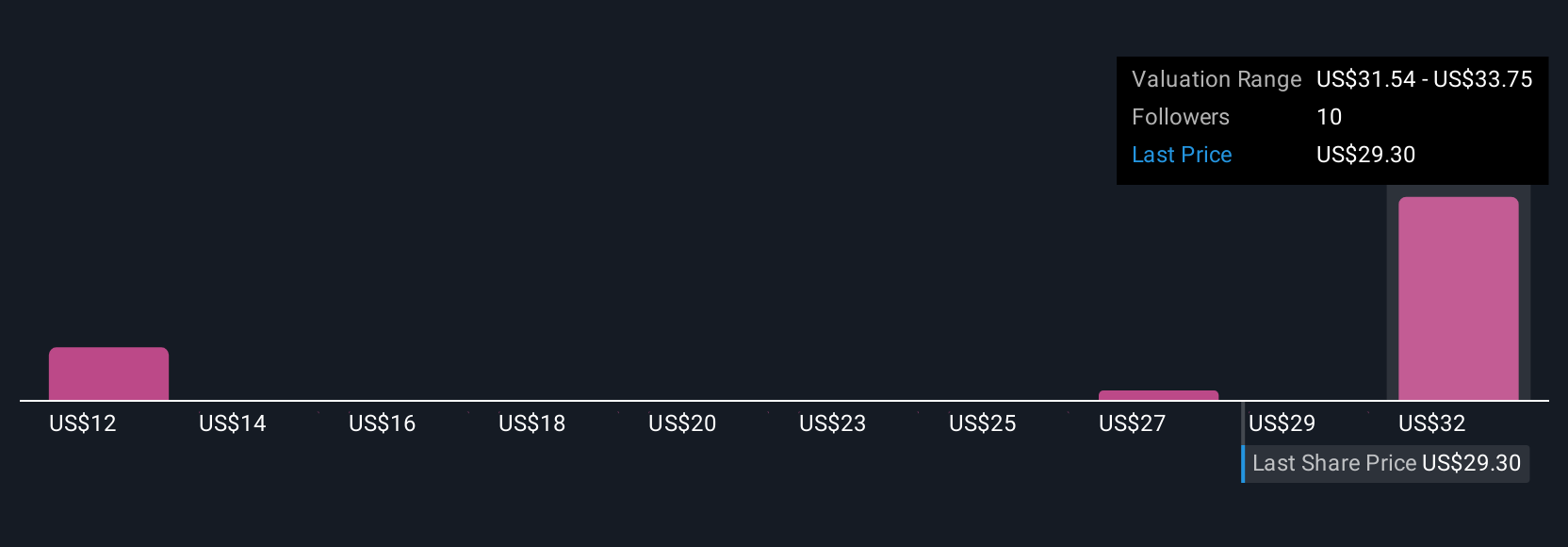

Six fair value estimates from the Simply Wall St Community range widely from just US$5.93 to US$49.14 per share. With FormFactor’s margin outlook hinging on both operational improvements and market demand, you can see how interpretations of its potential can sharply diverge.

Explore 6 other fair value estimates on FormFactor - why the stock might be worth as much as $49.14!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives