- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

FormFactor (FORM): Evaluating Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

FormFactor (FORM) shares have attracted attention recently, as investors analyze the company’s performance trends and what they could mean for the stock going forward. While there are no headline events, a look at returns reveals some movement.

See our latest analysis for FormFactor.

FormFactor’s 30-day share price return of 10.26% has caught notice, coming on the heels of a surge that pushed the stock up nearly 75% over the past quarter. Over the longer term, the company’s total shareholder return of 22.74% for the past year and 113.51% over three years signals enduring investor confidence. At the same time, recent price momentum shows some cooling after rapid gains.

If you’re watching how growth plays out in tech hardware, now is a good time to look beyond the usual suspects and discover fast growing stocks with high insider ownership

This raises a key question for investors. Given recent gains and continued growth in fundamentals, is FormFactor’s current price a bargain, or are optimistic expectations already built into the share price?

Most Popular Narrative: 10% Undervalued

With FormFactor closing at $48.68 and the narrative fair value at $54.29, market optimism has pushed the price higher. The stage is set for competing growth assumptions.

Accelerating adoption of generative AI, high-performance computing, and HBM DRAM in data centers is driving substantial increases in test complexity and intensity. FormFactor's differentiated probe cards and early leadership in HBM4 chiplet testing position the company to benefit from higher ASPs and revenue growth as these markets scale. (Impacts: Revenue, potential margin improvement)

Ever wondered what powers this bullish re-rating? The secret is a growth story tied to big tech trends, future margins, and aggressive profit forecasts. Want to see which numbers have everyone talking and how much future upside the narrative is banking on? Dive into the details that make this fair value projection stand out from the crowd.

Result: Fair Value of $54.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including margin pressure from product mix and the potential for sudden changes in customer demand that could impact future results.

Find out about the key risks to this FormFactor narrative.

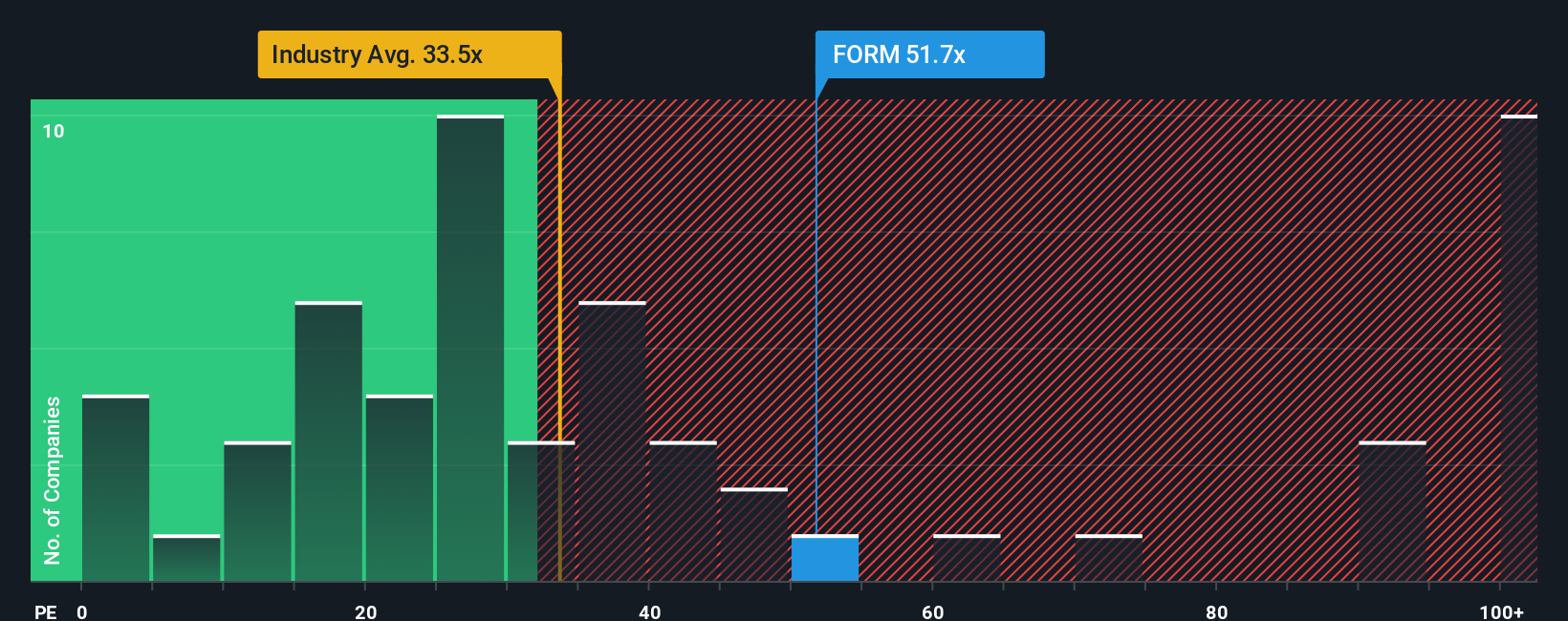

Another View: Market Multiples Tell a Different Story

A different lens is the price-to-earnings ratio, where FormFactor stands out for its high valuation. Currently, the company trades at 92.4 times earnings, which is well above both the U.S. semiconductor industry average of 34.4 and its peer average of 40.4. In comparison, its fair ratio is just 41.3. This significant gap means investors are paying a steep premium, increasing the risk if future growth does not meet expectations. Is the market too optimistic, or is there a reason for such lofty pricing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FormFactor Narrative

If you see the numbers differently, or want to shape your unique perspective, it takes less than three minutes to develop your own personal view. Do it your way

A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t let today’s hottest stocks pass you by. Give yourself an edge with hand-picked ideas that could put you ahead of the pack.

- Jump in on the AI movement with these 27 AI penny stocks to see which companies are setting the pace in machine learning innovation.

- Boost your portfolio’s steady income by tracking down high-yielders using these 18 dividend stocks with yields > 3%, and spot stocks with strong yields above 3%.

- Spot overlooked value gems that others might miss by evaluating these 907 undervalued stocks based on cash flows, where strong cash flow signals meet attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives