- United States

- /

- Semiconductors

- /

- NasdaqGS:FORM

Did FormFactor's (FORM) $140 Million Texas Facility Just Shift Its Manufacturing and Margin Narrative?

Reviewed by Sasha Jovanovic

- The City of Farmers Branch, Texas and FormFactor, Inc. recently announced that FormFactor has begun site work and equipment installation for its new advanced manufacturing facility in Farmers Branch, representing a major economic milestone for the area.

- This expansion underscores FormFactor's intent to invest over US$140 million in capital for 2026 and highlights its role in supplying critical semiconductor testing equipment globally.

- We'll examine how FormFactor's US$140 million Texas manufacturing ramp could reshape its growth and margin outlook going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

FormFactor Investment Narrative Recap

Shareholders in FormFactor need to believe in the company's ability to capitalize on accelerated demand for advanced semiconductor testing fueled by AI and high-bandwidth memory (HBM) innovations. The recent launch of the Farmers Branch facility supports capacity expansion and potential cost efficiencies, but higher operating expenses and ramp-up investments may weigh on short-term margins, so the biggest near-term catalyst is execution at this new site, while the most critical risk remains gross margin pressure from an evolving product mix and elevated costs.

Among recent company announcements, the expansion of the Taiwan Service Center stands out as highly relevant, given its focus on advanced packaging technologies and faster repair turnaround, complementing the Texas manufacturing push. Both efforts are crucial as FormFactor aims to meet more complex customer testing needs and broaden its reach across fast-growing semiconductor end markets.

However, against the optimism for improved growth, investors should also consider the impact of higher operational costs and margin compression in the interim…

Read the full narrative on FormFactor (it's free!)

FormFactor's outlook anticipates $984.3 million in revenue and $97.0 million in earnings by 2028. This projection assumes an annual revenue growth rate of 8.8% and a $53.1 million increase in earnings from the current $43.9 million.

Uncover how FormFactor's forecasts yield a $54.29 fair value, a 8% upside to its current price.

Exploring Other Perspectives

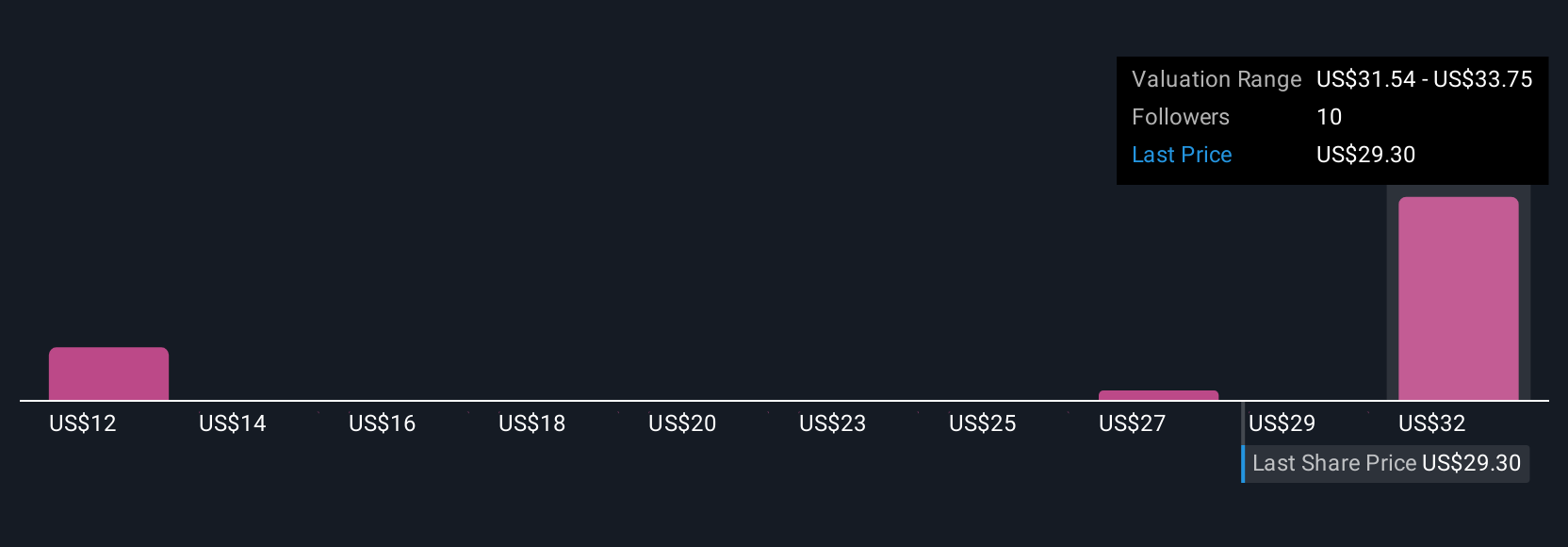

Six individual fair value estimates from the Simply Wall St Community range from US$13.40 to US$56.88 per share, showing a broad spread of opinion. Differing perspectives reflect how persistent margin pressure and changing product mix could affect FormFactor’s future earnings, encouraging you to review a variety of outlooks.

Explore 6 other fair value estimates on FormFactor - why the stock might be worth as much as 13% more than the current price!

Build Your Own FormFactor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FormFactor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free FormFactor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FormFactor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FORM

FormFactor

Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives