- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

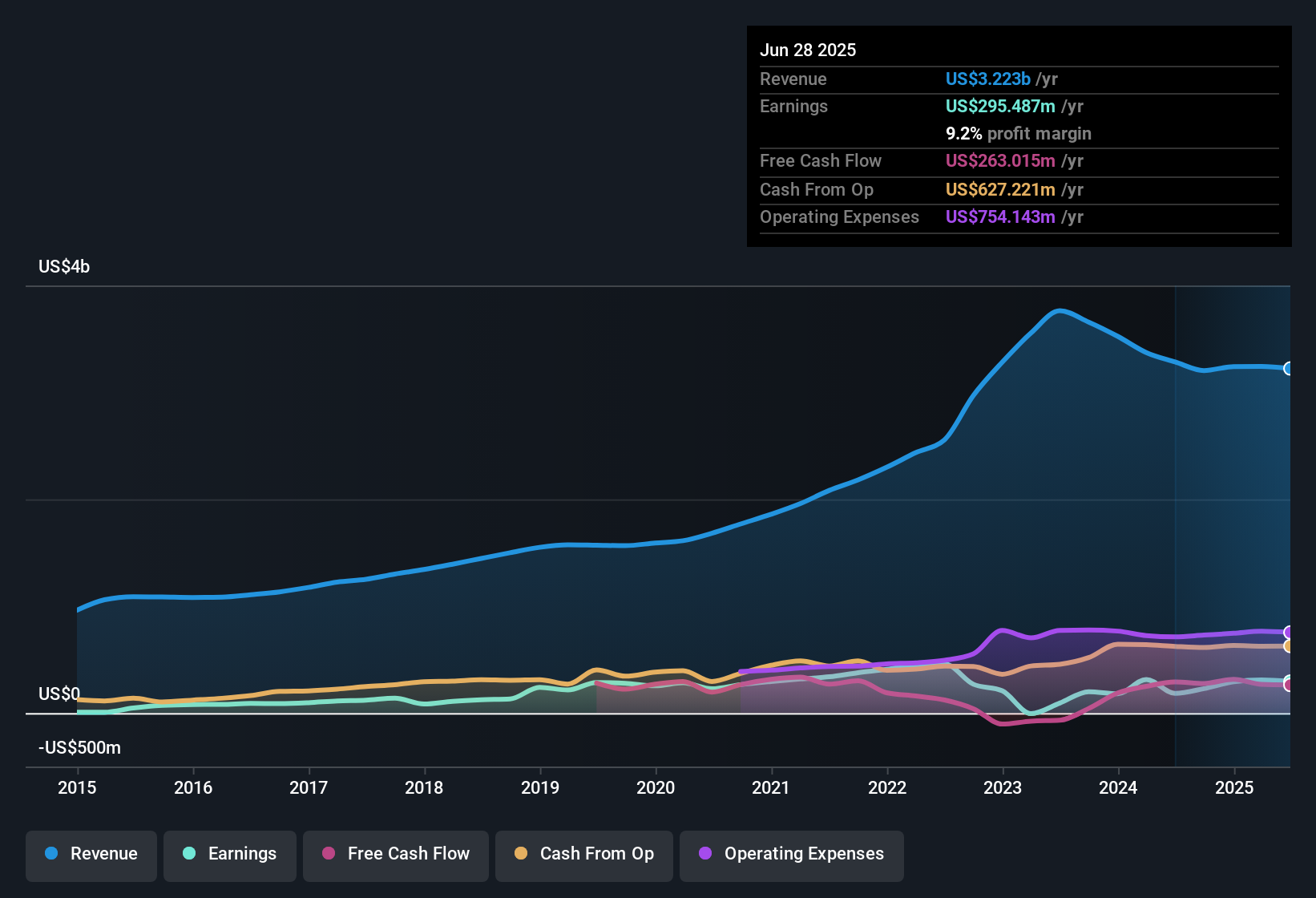

Entegris (ENTG) Profit Margin Jumps to 9.2%, Challenging Bearish Earnings Narratives

Reviewed by Simply Wall St

Entegris (ENTG) reported a robust net profit margin of 9.2%, a clear improvement over last year’s 5.7%, alongside 59.2% earnings growth for the year. Looking forward, the company expects annual earnings to rise 23.19%, well above its five-year trend of declining by 8.7% each year and outpacing the broader US market’s projected 15.7% growth. Investors are taking notice of the momentum, but with shares trading at $87.5 and a Price-to-Earnings ratio of 44.9x, surpassing both the industry and peers, the market’s optimism already reflects high expectations for future gains.

See our full analysis for Entegris.Next up, we’ll see how these headline results compare to the big-picture narratives that investors follow most closely. Some expectations may hold up, while others could face a reality check.

See what the community is saying about Entegris

Margins Poised to Widen

- Analysts anticipate Entegris' profit margins climbing from 9.2% currently to 12.9% over the next three years, signifying expected operational improvements and greater efficiency.

- According to analysts' consensus view, advanced materials leadership and cost-cutting initiatives are set to push margins higher, even as ongoing facility ramp-up creates short-term inefficiencies.

- Expansion in Asia, especially localization of manufacturing, aims to dampen revenue swings and support steadier margins as more business is insulated from global supply chain disruptions.

- However, near-term profit margins remain vulnerable if ramp delays or lingering operational setbacks prevent Entegris from reaching targeted utilization rates as new manufacturing clusters scale up.

- Results show margin expansion is projected to outpace historical patterns, reinforcing the view that renewed operational discipline and innovation could underpin stronger profitability going forward.

See what drove analysts’ margin optimism in the full consensus narrative: 📊 Read the full Entegris Consensus Narrative.

Manufacturing Investments Stir Growth and Risks

- With significant new production ramping up in Taiwan and Colorado, Entegris is shifting its supply chain towards regionalization, positioning itself for more secure and speedy delivery in key Asian markets.

- Analysts' consensus view underscores that while these investments should help secure long-term revenue, especially by shortening lead times and enabling quick recovery from trade/tariff shocks, the company faces substantial execution risk:

- If new plants in Asia and the US face technical delays or fail to gain customer requalification quickly, growth could lag the expected 7.4% annual revenue increase and revenue volatility might persist.

- Geopolitical exposure remains high, as roughly 70% of revenue comes from Asia, meaning any disruption or shifting trade policies could still sway future performance despite efforts to localize supply chains.

Valuation Premium Implies High Bar for Delivery

- The current share price of $87.50 puts Entegris at a 57% premium to its $55.62 DCF fair value estimate and a Price-to-Earnings ratio of 44.9x, well above both industry (39.9x) and peer (41.9x) averages.

- Analysts' consensus view highlights tensions in valuation. A consensus analyst target of $100.83 is 15% above the current share price, but sustaining this valuation premium demands Entegris not only deliver forecasted earnings growth and margin gains, but also overcome industry softness, cyclical swings in demand, and high leverage.

- High debt levels (gross leverage ~4.3x) and interest costs (~$48 million/quarter) weigh on earnings flexibility, while heavy expectations embedded in the stock price mean any slip-up could trigger outsized downside.

- If sector growth accelerates and margin improvement keeps pace, the valuation gap to DCF fair value may narrow. But if execution stumbles or demand falters, shares look fully valued or even stretched relative to fundamentals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Entegris on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the earnings results? Share your perspective and craft your own company narrative in just a few minutes. Do it your way

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Entegris faces significant risks from high leverage and interest costs. This makes its future growth vulnerable to even minor financial setbacks or missed targets.

If you want companies with stronger fundamentals that can better weather uncertainty, discover solid balance sheet and fundamentals stocks screener (1984 results) tailored to highlight resilient balance sheets and lower debt exposure right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success