- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy, Inc. (NASDAQ:ENPH) May Have Run Too Fast Too Soon With Recent 30% Price Plummet

The Enphase Energy, Inc. (NASDAQ:ENPH) share price has fared very poorly over the last month, falling by a substantial 30%. Longer-term shareholders would now have taken a real hit with the stock declining 2.7% in the last year.

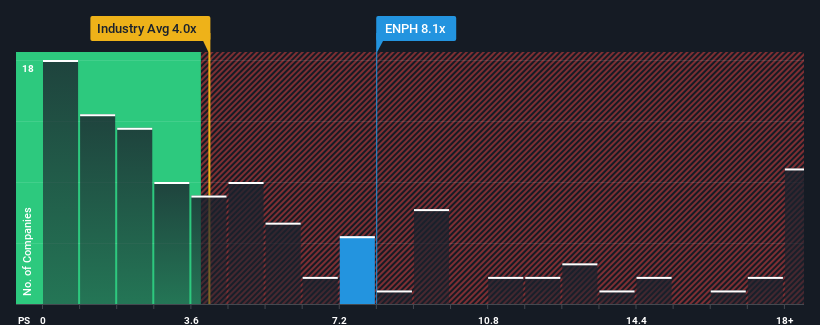

In spite of the heavy fall in price, Enphase Energy may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.1x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4.1x and even P/S lower than 1.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Enphase Energy

How Enphase Energy Has Been Performing

Enphase Energy hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Enphase Energy will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Enphase Energy?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Enphase Energy's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 54%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 25% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 25% per annum, which is not materially different.

In light of this, it's curious that Enphase Energy's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Enphase Energy's P/S?

Even after such a strong price drop, Enphase Energy's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting Enphase Energy's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Enphase Energy you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives