- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (ENPH) Is Down 6.1% After Announcing $68M Safe Harbor Solar Financing Agreement—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 20, 2025, Enphase Energy announced a new safe harbor agreement with a leading third-party solar and battery financing provider, projected to generate nearly US$68 million in revenue over 12–24 months beginning in 2026 with U.S.-manufactured IQ9 microinverters.

- This move highlights Enphase's increasing presence in the fast-growing third-party ownership segment and its alignment with evolving U.S. tax incentive qualification rules and domestic content requirements.

- We'll now explore how this significant partnership, which expands Enphase's pipeline of safe harbor agreements, could influence its future investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Enphase Energy Investment Narrative Recap

To be an Enphase Energy shareholder today, you need to believe in the sustained expansion of integrated solar, battery, and EV charging adoption, supported by policy incentives and demand for resilient home energy systems. The newly announced US$68 million safe harbor agreement boosts Enphase's exposure to third-party ownership and reinforces policy-driven demand, but the most important short-term catalyst, new product launches, remains the key driver, while the biggest immediate risk is a potential contraction in the U.S. residential solar market; this deal does not appear to materially alter those factors.

Among recent news, Enphase’s expanded utility approvals for the IQ Meter Collar stand out, as these broaden installation opportunities for its home backup systems. Together with the new financing partnership, these developments support the outlook for enhanced adoption of next-generation products, which is central to near-term growth prospects.

Yet, in contrast, investors must remain alert to signals of oversupply and elevated channel inventory, as these may...

Read the full narrative on Enphase Energy (it's free!)

Enphase Energy's outlook forecasts $1.6 billion in revenue and $232.0 million in earnings by 2028. This is based on a 3.0% annual revenue growth rate and a $57.3 million increase in earnings from the current $174.7 million level.

Uncover how Enphase Energy's forecasts yield a $39.38 fair value, a 46% upside to its current price.

Exploring Other Perspectives

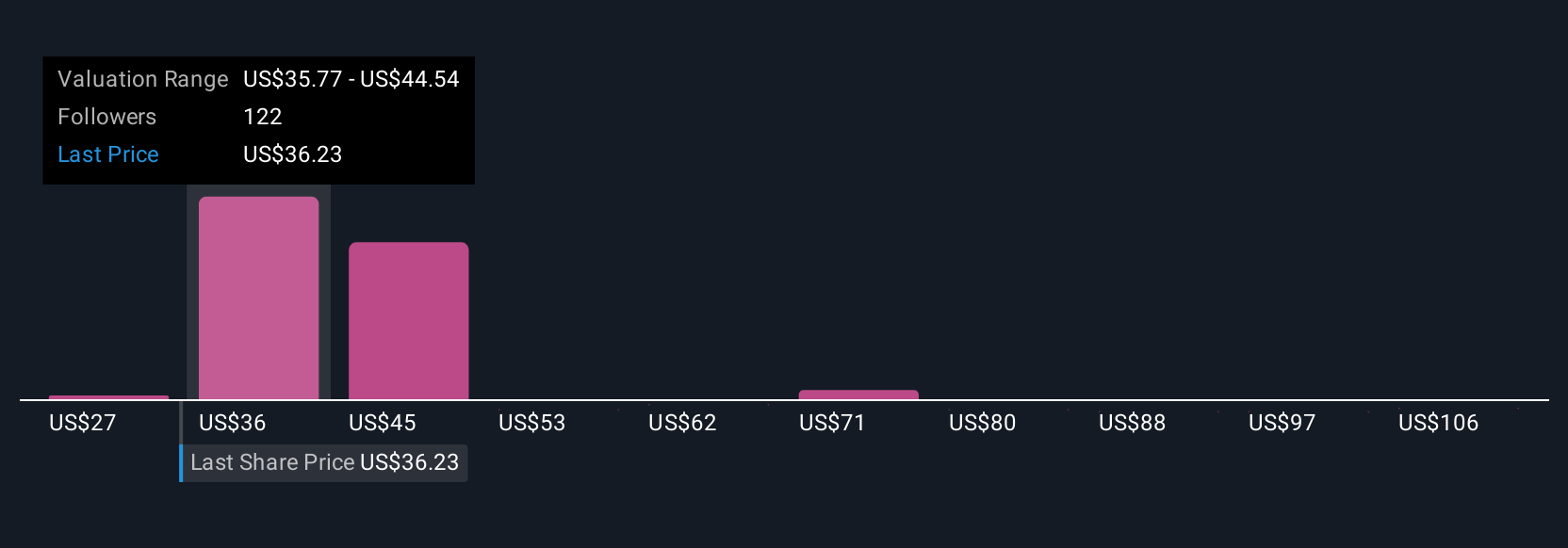

Fifteen members of the Simply Wall St Community estimate Enphase’s fair value between US$28.32 and US$70.42 per share, highlighting a broad spectrum of expectations. Shifts in U.S. tax credits and demand are top of mind for many, making it critical to consider a variety of viewpoints on the company’s resilience.

Explore 15 other fair value estimates on Enphase Energy - why the stock might be worth just $28.32!

Build Your Own Enphase Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enphase Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enphase Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enphase Energy's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives