- United States

- /

- Semiconductors

- /

- NasdaqGS:DIOD

What Diodes (DIOD)'s Launch of Automotive LED Controller Could Mean for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, Diodes Incorporated launched the AL3069Q, a high-efficiency, automotive-grade 60V boost controller designed for advanced LED backlighting in vehicle displays, featuring robust diagnostic and protection capabilities.

- This new device accommodates larger and more intricate automotive display panels, an area of growing complexity, by supporting flexible input voltages, precise current control, and enhanced safety features.

- We’ll explore how this innovation in automotive LED technology adds a layer of product differentiation to Diodes’ broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Diodes Investment Narrative Recap

To be a shareholder in Diodes today, you need to believe in its ability to diversify beyond consumer-driven cyclicality by capturing sustained demand in automotive and industrial markets, where long-term design wins and steady content per vehicle can help drive stability. The launch of the AL3069Q adds incremental strength to Diodes’ automotive narrative and future product differentiation, but its impact on short-term earnings catalysts is limited, ongoing inventory management remains the more material focal point and risk in the current environment.

The most relevant related announcement is the September release of the AL58818Q and AL58812Q LED drivers, which similarly highlighted Diodes' deepening presence in automotive systems and display technology. While these launches reinforce the growth catalyst in automotive semiconductors, the pace at which they translate to higher margins and reduce reliance on cyclical consumer segments continues to face timing uncertainty and depends on execution across several fronts.

However, investors should be aware that, despite these innovations, persistent high inventory levels could still pose significant headwinds if...

Read the full narrative on Diodes (it's free!)

Diodes’ narrative projects $1.8 billion in revenue and $124.0 million in earnings by 2028. This requires 8.7% yearly revenue growth and a $60.4 million increase in earnings from the current $63.6 million.

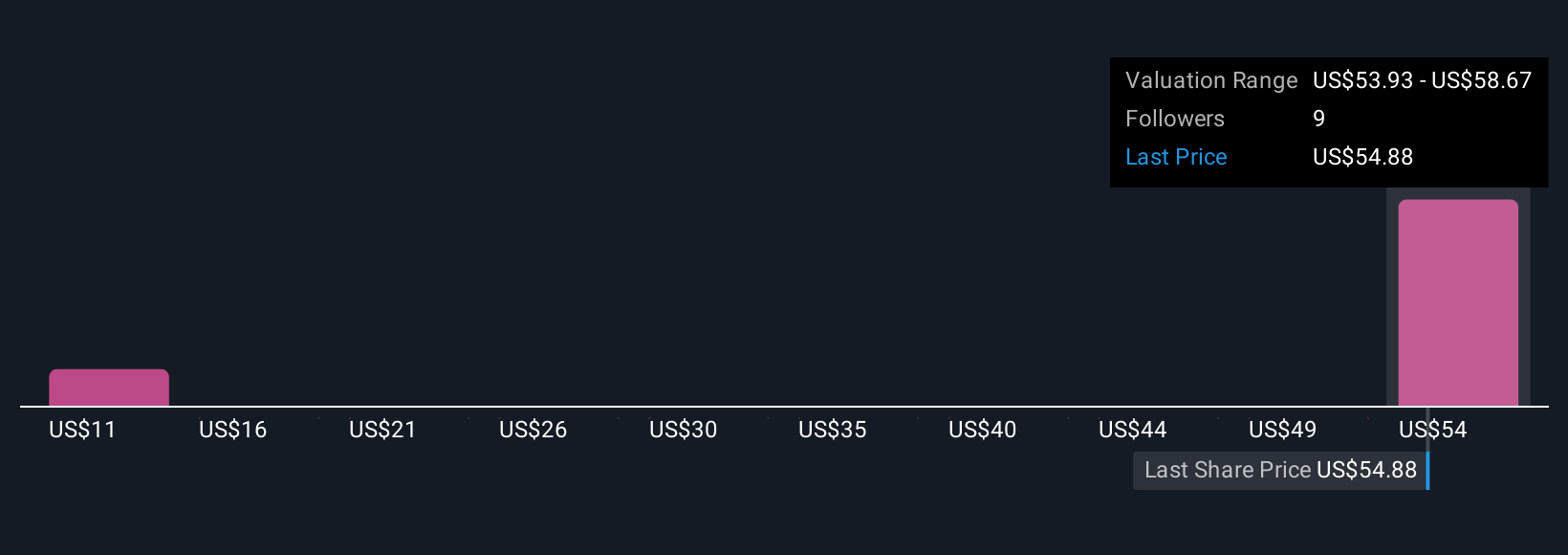

Uncover how Diodes' forecasts yield a $58.67 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Diodes shares, ranging from US$27.82 to US$58.67. Although product momentum in automotive semiconductors remains a highlight, opinions still diverge widely on how quickly this will offset exposure to cyclical risks; consider reviewing several independent viewpoints before forming your own judgment.

Explore 2 other fair value estimates on Diodes - why the stock might be worth 40% less than the current price!

Build Your Own Diodes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diodes research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Diodes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diodes' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DIOD

Diodes

Manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets in Asia, Europe, and the Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026