- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Canadian Solar (CSIQ) Returns to Profit in Q3 — What Does This Mean for Future Growth?

Reviewed by Sasha Jovanovic

- In November 2025, Canadian Solar Inc. reported third quarter earnings, returning to net profitability with net income of US$8.99 million and revenue of US$1.49 billion, and issued revenue guidance for fourth quarter 2025 in the range of US$1.3 billion to US$1.5 billion.

- The shift to net profitability this quarter, following a net loss the previous year, marks a noteworthy turnaround and provides new insight into the company’s operational performance.

- We’ll examine how Canadian Solar’s updated revenue guidance and return to profit impact the company’s future investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Canadian Solar Investment Narrative Recap

Canadian Solar appeals to those who see long-term opportunities in the global move toward renewable energy, underpinned by advances in module and battery storage technology. The company’s return to net profit in the third quarter, alongside its Q4 revenue guidance, is a positive signal, but doesn’t immediately resolve the critical short-term challenge of margin pressure from cost increases outpacing module price gains.

Of the recent announcements, the launch of FlexBank 1.0, Canadian Solar’s modular battery storage product, stands out. This ties directly into the company’s growth ambitions in energy storage, which has been highlighted as a primary catalyst for improving future margins and diversifying revenue as policy and price risks persist.

Yet, investors should be especially mindful that despite recent profitability, margin recovery can remain vulnerable if costs continue rising faster than selling prices, especially in…

Read the full narrative on Canadian Solar (it's free!)

Canadian Solar's outlook predicts $8.0 billion in revenue and $201.9 million in earnings by 2028. Achieving this would require 10.4% annual revenue growth and an increase in earnings of $208.8 million from the current $-6.9 million.

Uncover how Canadian Solar's forecasts yield a $21.76 fair value, a 4% downside to its current price.

Exploring Other Perspectives

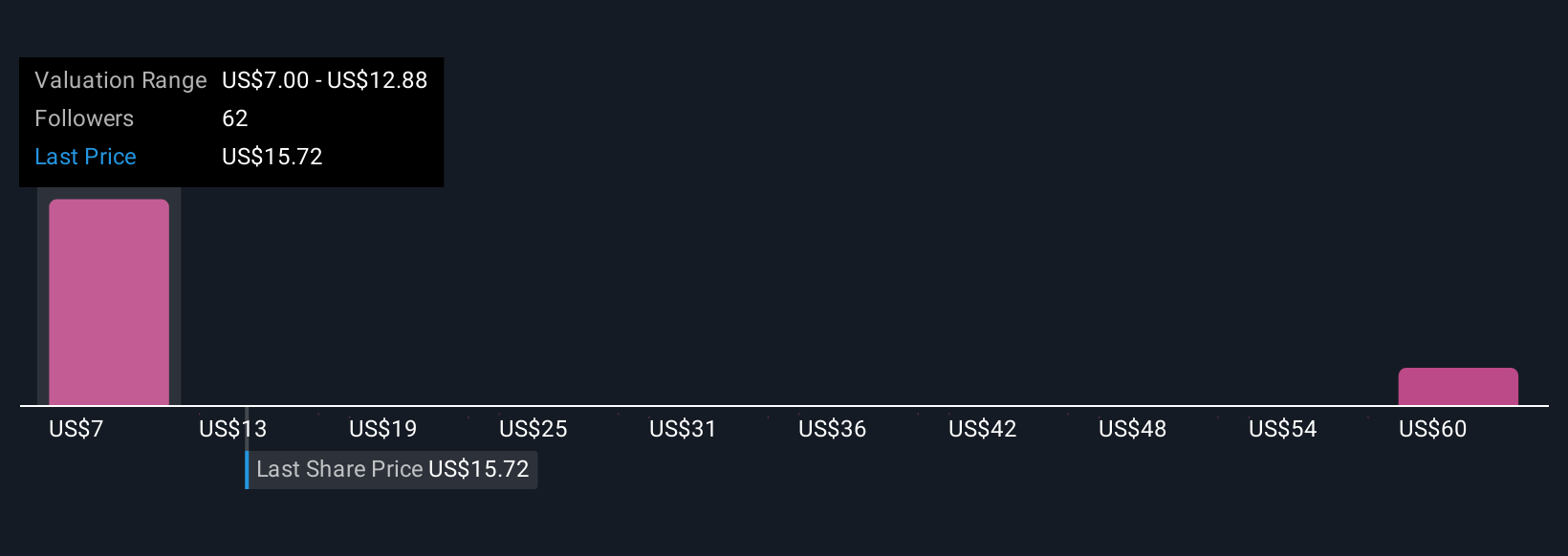

Fair value estimates from 5 Simply Wall St Community members range from US$7 to US$58.42, emphasizing diverse views on Canadian Solar. Given the ongoing risk of supply chain cost increases outpacing module pricing, these perspectives offer a valuable counterbalance when forming your own outlook.

Explore 5 other fair value estimates on Canadian Solar - why the stock might be worth less than half the current price!

Build Your Own Canadian Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Canadian Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Solar's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives