- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

A Look at Canadian Solar (NasdaqGS:CSIQ) Valuation Following Q3 Profit Return and Updated Revenue Guidance

Reviewed by Simply Wall St

Canadian Solar (NasdaqGS:CSIQ) just posted third quarter earnings, moving from a loss last year to net income this quarter, and paired the report with new revenue guidance for the coming quarter.

See our latest analysis for Canadian Solar.

Canadian Solar’s return to profitability and upbeat guidance seemed to ignite new optimism, as reflected in its 66.2% 1-month share price return and a remarkable 118.9% gain over the last 90 days. Even so, the one-year total shareholder return stands at 90.7%, a strong turnaround following three- and five-year total shareholder returns that remained in the red. Momentum appears to be building, which suggests that investors are viewing the company’s latest results as a turning point.

If this surge has you thinking about other high-momentum opportunities, now’s your chance to broaden your search and discover fast growing stocks with high insider ownership

But with shares roaring back and trading at a premium to analyst targets, the key question is whether Canadian Solar is undervalued after its turnaround, or if the market is already pricing in all the good news.

Most Popular Narrative: 14.5% Overvalued

Canadian Solar’s most popular narrative sets a fair value of $21.76, which is 14.5% below the last close price of $24.93. This gap is drawing attention as investors debate whether recent momentum is outpacing the company’s improving fundamentals.

Strong global demand, expanded energy storage, and innovation position Canadian Solar for sustained growth and improved margins. Geographic and policy diversification enhance resilience, revenue stability, and the ability to withstand regulatory or regional shocks.

Curious why this narrative calls for a value lower than the current share price? The calculation relies on some big projections for future margins and a key earnings milestone that could transform expectations. But just how aggressive are those assumptions? What industry benchmarks are they measured against? Click through to uncover the financial logic powering this valuation.

Result: Fair Value of $21.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent policy uncertainty in the U.S. and intensifying global competition could quickly undermine confidence in Canadian Solar’s improved earnings outlook.

Find out about the key risks to this Canadian Solar narrative.

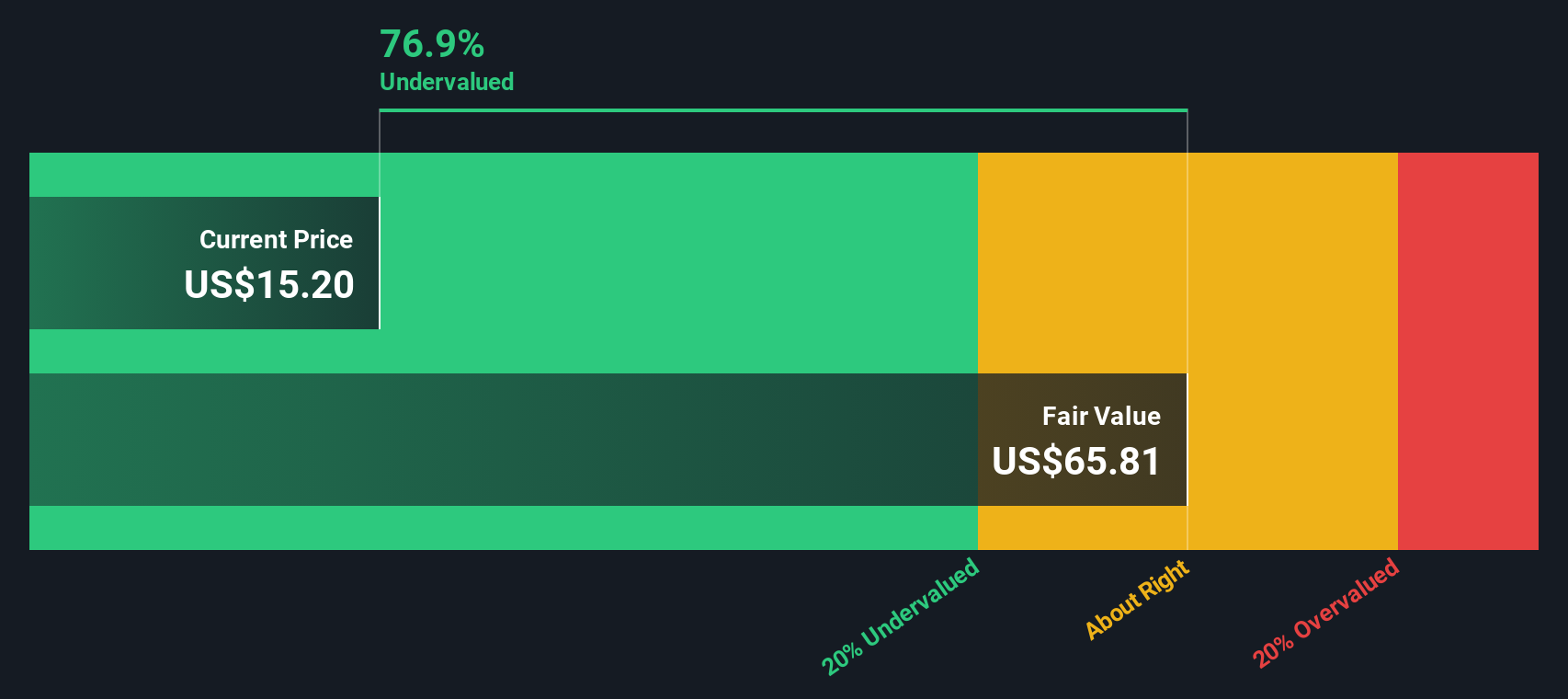

Another View: Deep Discount According to SWS DCF Model

While the popular narrative points to Canadian Solar being overvalued, the SWS DCF model presents a much different picture. By focusing on future cash flows, our DCF suggests the shares are trading at a steep 57.3% discount to fair value. Could this gap be an opportunity for long-term investors, or is the market seeing something the models miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canadian Solar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Canadian Solar Narrative

If you want to run the numbers your way or dig deeper into the story, it takes less than three minutes to assemble a personalized view. Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best stock isn’t the only stock. Seize today’s momentum and expand your watchlist with exciting new opportunities that align with your goals.

- Unlock unique income potential by zeroing in on these 14 dividend stocks with yields > 3% offering market-beating yields and steady cash flow.

- Tap into the future of intelligent technology with these 26 AI penny stocks that are revolutionizing industries and redefining what’s possible in automation.

- Capitalize on undervalued gems and seek out these 924 undervalued stocks based on cash flows before the broader market catches on and prices rise.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success