- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Credo Technology Group Holding And 2 More Top Growth Stocks With Insider Stake

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a recent tech rout, with major indexes closing higher amid ongoing economic uncertainties, investors are increasingly attentive to growth companies that demonstrate resilience and potential for long-term success. In this context, stocks like Credo Technology Group Holding stand out not only for their growth prospects but also for their high insider ownership, which can be an indicator of strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Enovix (ENVX) | 12% | 42.7% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.1% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 27.1% |

| AppLovin (APP) | 27.5% | 25.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

Let's explore several standout options from the results in the screener.

Credo Technology Group Holding (CRDO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Credo Technology Group Holding Ltd offers high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications across the United States, Taiwan, Mainland China, Hong Kong, and internationally with a market cap of approximately $28.41 billion.

Operations: The company generates revenue primarily from its Semiconductors segment, which accounted for $600.14 million.

Insider Ownership: 10.9%

Credo Technology Group Holding is experiencing strong growth, with earnings projected to rise significantly at 30.4% annually, outpacing the US market. Despite recent volatility in its share price and notable insider selling, the company remains focused on innovation. Recent product launches like Weaver and ZeroFlap optical transceivers aim to address AI infrastructure challenges, enhancing memory bandwidth and network stability. Credo's strategic initiatives position it well for future growth in high-demand sectors like AI and data centers.

- Take a closer look at Credo Technology Group Holding's potential here in our earnings growth report.

- According our valuation report, there's an indication that Credo Technology Group Holding's share price might be on the expensive side.

Sea (SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates as a consumer internet company with operations in Southeast Asia, Latin America, the rest of Asia, and internationally, and has a market cap of approximately $92.66 billion.

Operations: Sea Limited's revenue segments include digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets.

Insider Ownership: 15.3%

Sea Limited has shown impressive growth, with half-year revenues reaching US$10.1 billion, up from US$7.54 billion a year ago. Net income surged to US$809 million from US$58.2 million, reflecting strong profitability gains. The company's earnings are forecast to grow significantly at 29.8% annually, outpacing the broader market's 15.8%. Despite trading below fair value estimates and analyst targets suggesting potential upside, insider ownership remains stable with no recent substantial insider trading activity noted.

- Click here and access our complete growth analysis report to understand the dynamics of Sea.

- The valuation report we've compiled suggests that Sea's current price could be quite moderate.

Toast (TOST)

Simply Wall St Growth Rating: ★★★★★☆

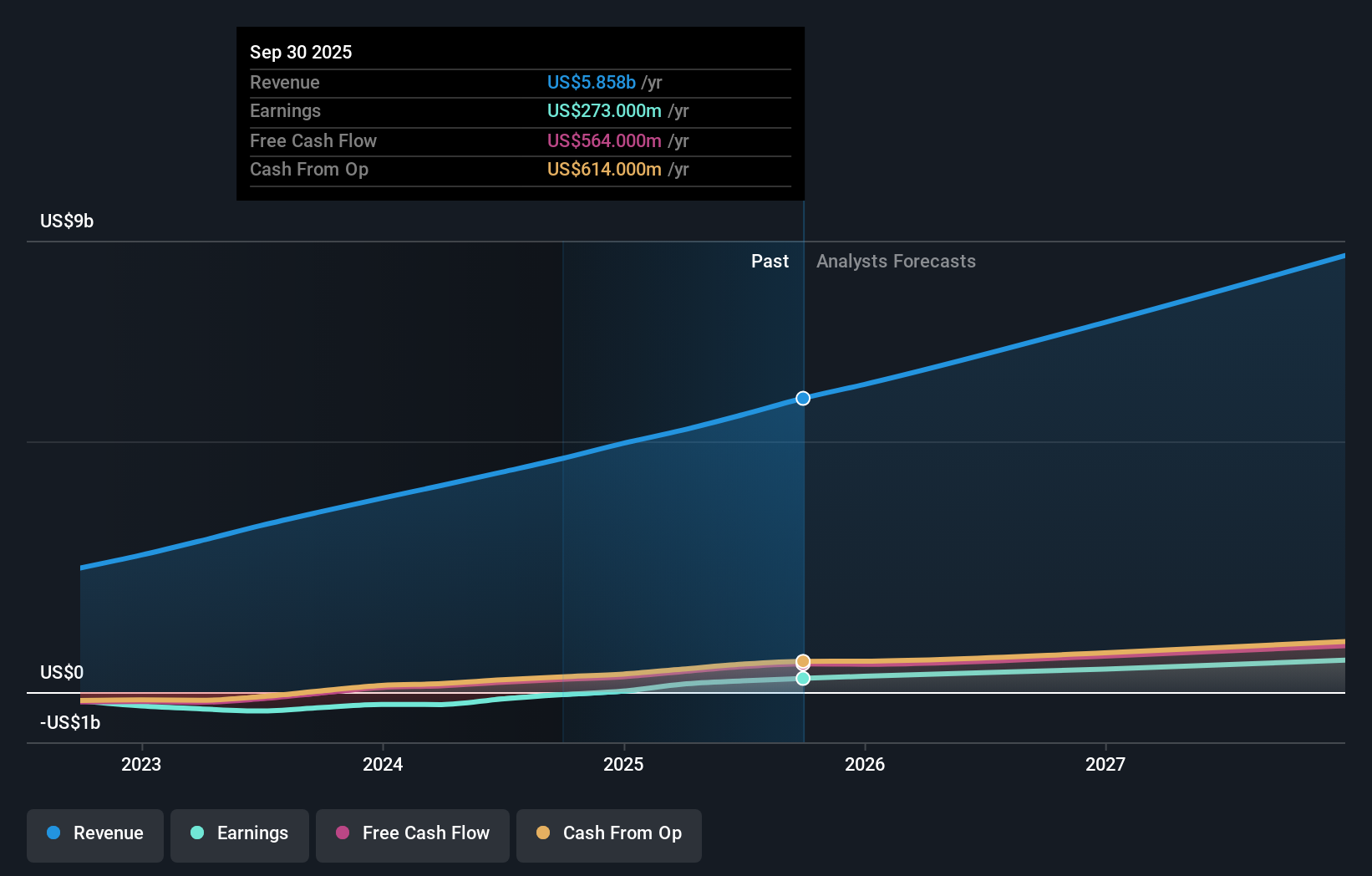

Overview: Toast, Inc. provides a cloud-based digital technology platform for the restaurant industry across multiple countries, with a market cap of approximately $20.78 billion.

Operations: Toast, Inc.'s revenue segments include a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and other international markets.

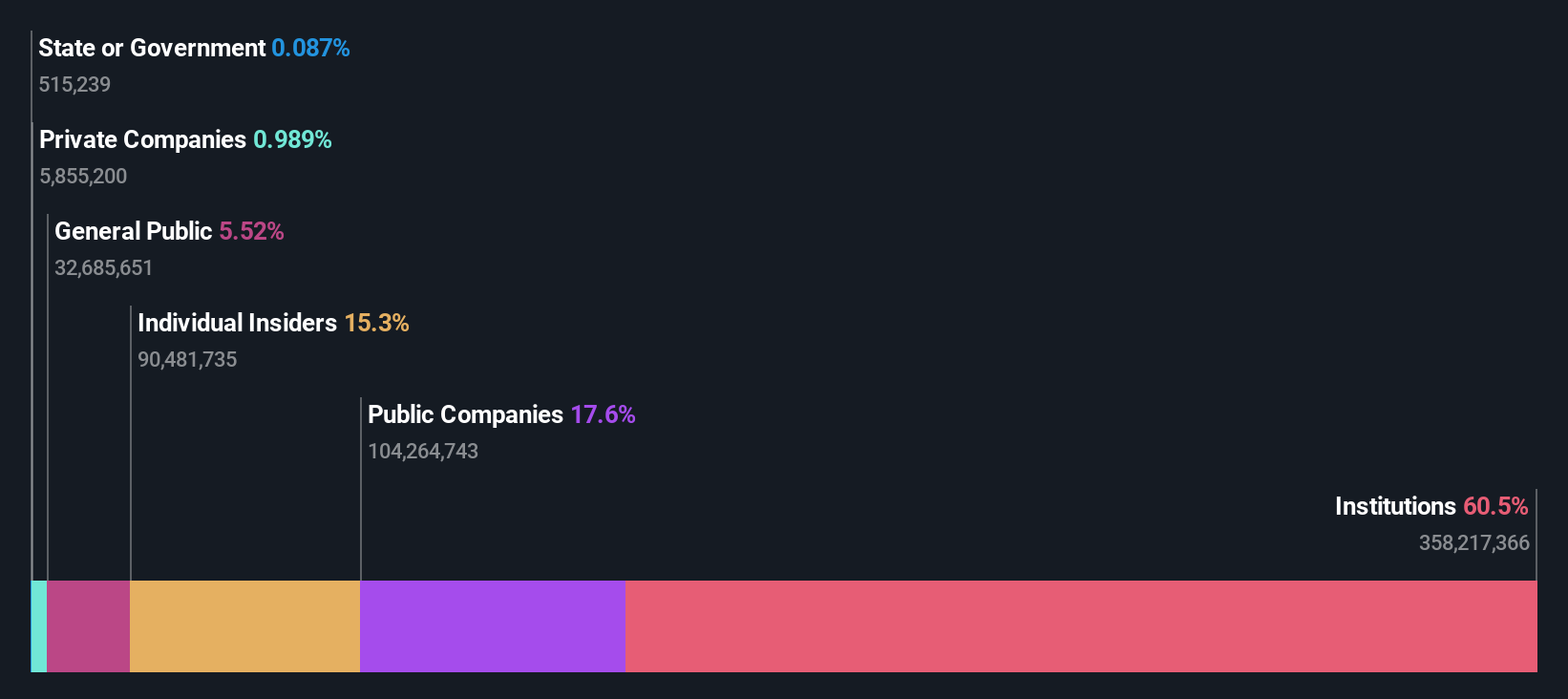

Insider Ownership: 18.8%

Toast has demonstrated significant growth, with recent quarterly revenue reaching US$1.63 billion, up from US$1.31 billion a year prior, and net income increasing to US$105 million from US$56 million. Earnings are forecast to grow at 26.4% annually, surpassing market expectations of 15.8%. The strategic partnership with Uber aims to enhance restaurant operations and expand their customer base globally. Insider buying has been modest recently, indicating cautious optimism among stakeholders despite the positive outlook.

- Unlock comprehensive insights into our analysis of Toast stock in this growth report.

- Our comprehensive valuation report raises the possibility that Toast is priced higher than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 198 companies by clicking here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives