- United States

- /

- Semiconductors

- /

- NasdaqGM:CAMT

How Camtek’s (CAMT) Record 2025 Revenue Forecast Could Shift Analyst Expectations and Investor Sentiment

Reviewed by Sasha Jovanovic

- Camtek Ltd. recently reported its third quarter 2025 earnings, highlighting sales of US$125.99 million and a net loss compared to last year's net profit, while simultaneously issuing forward guidance that projects record annual revenues of US$495 million for 2025, with growth accelerating later in the year.

- An interesting aspect of this update is the company’s expectation that revenue will be weighted toward the second half of 2025, suggesting management anticipates a strong demand rebound after an early-year slowdown.

- We’ll now examine how Camtek’s record-setting 2025 revenue forecast could shape its investment narrative and impact analyst expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Camtek Investment Narrative Recap

To be a shareholder in Camtek, you need to be confident in the ongoing demand for advanced semiconductor inspection driven by AI and high-performance computing trends, factors that management still sees boosting growth, as evidenced by their record US$495 million 2025 revenue forecast. Despite strong top-line guidance, the near-term investment story hinges on the timing of the anticipated order ramp and the risk that concentrated exposure to key Asian customers could add unpredictability; the latest results do not materially change this main risk. Among the latest announcements, Camtek’s Q3 2025 results showed significant one-off losses despite higher year-over-year sales, highlighting ongoing earnings volatility at a time when competition and customer CapEx cycles remain as key catalysts. These financial swings reinforce why future product adoption in key areas like advanced packaging and metrology, supported by customer wins in the Hawk and Eagle G5 platforms, will be closely monitored amid management’s prediction for a second-half revenue surge. Yet, even as growth is back-weighted, investors should be aware that if demand from major chiplet and HBM customers softens unexpectedly, the impact could be...

Read the full narrative on Camtek (it's free!)

Camtek's outlook anticipates $679.8 million in revenue and $183.6 million in earnings by 2028. This projection relies on a 13.0% annual revenue growth rate and a $49.8 million increase in earnings from the current $133.8 million.

Uncover how Camtek's forecasts yield a $125.60 fair value, a 26% upside to its current price.

Exploring Other Perspectives

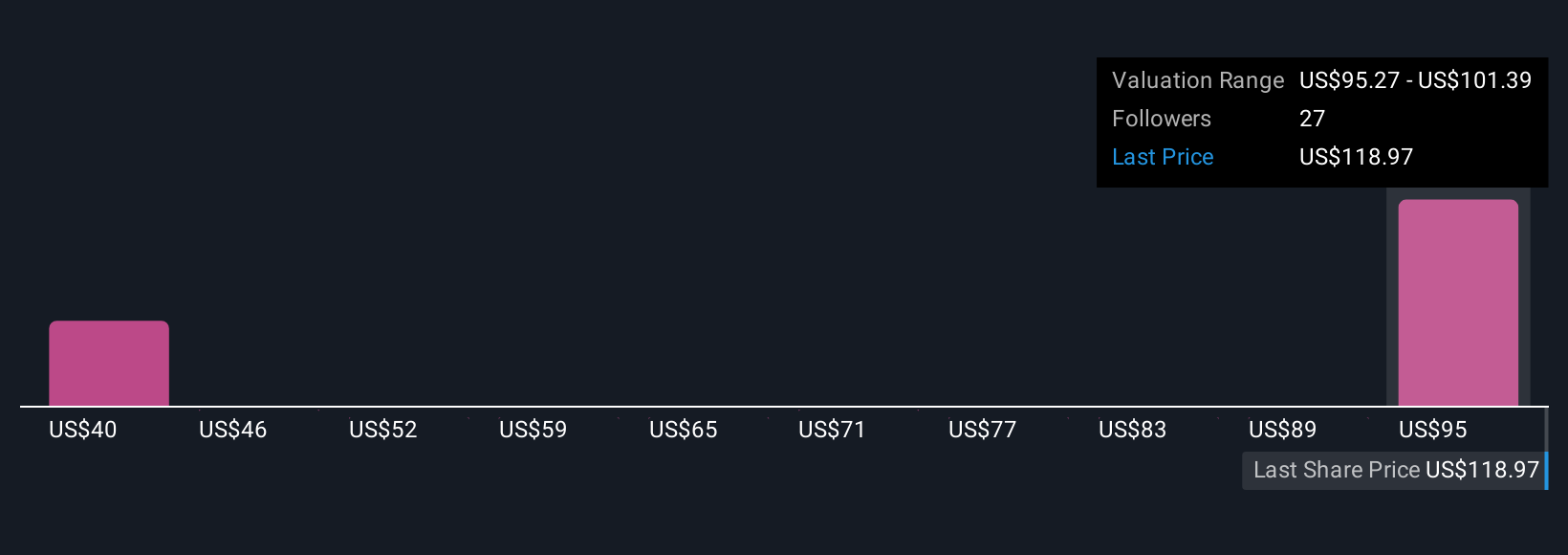

Fair value opinions from five members of the Simply Wall St Community range from US$36.82 to US$125.60 per share. With Camtek’s revenue still highly concentrated in Asia, outcomes may depend heavily on stability and demand from that region, so it pays to compare many viewpoints before making decisions.

Explore 5 other fair value estimates on Camtek - why the stock might be worth less than half the current price!

Build Your Own Camtek Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Camtek research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Camtek research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Camtek's overall financial health at a glance.

No Opportunity In Camtek?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CAMT

Camtek

Develops, manufactures, and sells inspection and metrology equipment for semiconductor industry in the United States, China, Korea, Europe, and the Asia Pacific.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives